Region:Middle East

Author(s):Dev

Product Code:KRAD0436

Pages:86

Published On:August 2025

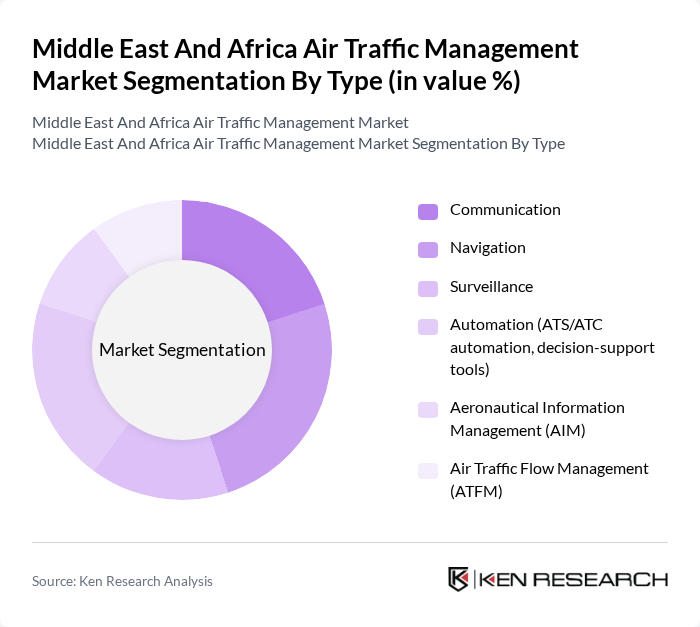

By Type:The market is segmented into various types, including Communication, Navigation, Surveillance, Automation (ATS/ATC automation, decision-support tools), Aeronautical Information Management (AIM), and Air Traffic Flow Management (ATFM). Each of these subsegments plays a crucial role in ensuring the safety and efficiency of air traffic operations.

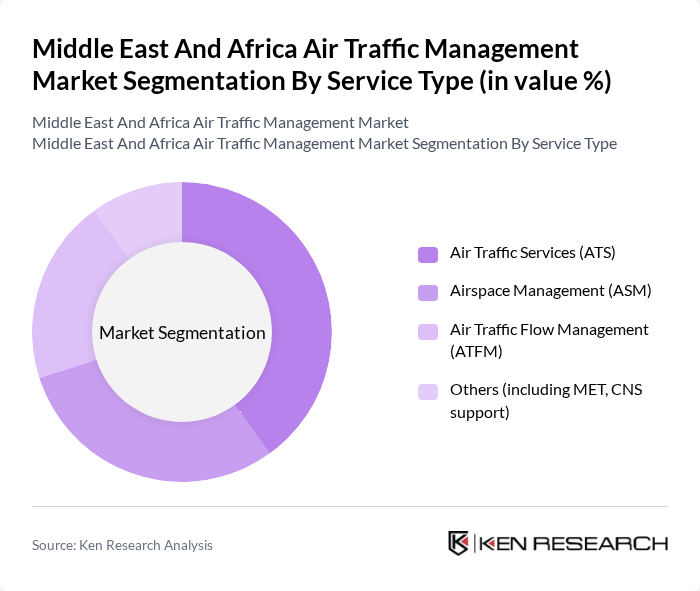

By Service Type:The service type segmentation includes Air Traffic Services (ATS), Airspace Management (ASM), Air Traffic Flow Management (ATFM), and Others (including MET, CNS support). These services are essential for maintaining safe and efficient air traffic operations across the region.

The Middle East And Africa Air Traffic Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thales Group, Raytheon Technologies (RTX), Indra Sistemas S.A., Leonardo S.p.A., Northrop Grumman Corporation, Frequentis AG, L3Harris Technologies, Inc., ADB SAFEGATE, SITA, Saab AB, BAE Systems plc, Honeywell International Inc., Collins Aerospace, Elbit Systems Ltd., Bayanat (formerly Bayanat AI, UAE) contribute to innovation, geographic expansion, and service delivery in this space.

The future of air traffic management in the Middle East and Africa is poised for transformation, driven by technological advancements and increased air traffic. The integration of artificial intelligence and machine learning into air traffic systems is expected to enhance operational efficiency and safety. Additionally, a growing emphasis on sustainability will likely lead to the adoption of greener technologies, aligning with global environmental goals. These trends will shape the region's aviation landscape, fostering innovation and improved service delivery.

| Segment | Sub-Segments |

|---|---|

| By Type | Communication Navigation Surveillance Automation (ATS/ATC automation, decision-support tools) Aeronautical Information Management (AIM) Air Traffic Flow Management (ATFM) |

| By Service Type | Air Traffic Services (ATS) Airspace Management (ASM) Air Traffic Flow Management (ATFM) Others (including MET, CNS support) |

| By Component | Hardware Software Services |

| By Application | Air Traffic Control (En?route, TMA/Approach, Tower) Flight Planning & Aeronautical Information Airport Operations Management Airspace Design & Capacity Management |

| By Airport Class | Class I Class II Class III Class IV |

| By End-User | Civil ANSPs and Airport Authorities Military Aviation Commercial Airlines Cargo Operators General Aviation |

| By Country | Saudi Arabia United Arab Emirates South Africa Egypt Turkey Israel Rest of Middle East and Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Air Traffic Control Operations | 120 | Air Traffic Controllers, Operations Managers |

| Airport Management Systems | 100 | Airport Directors, IT Managers |

| Airline Operations and Scheduling | 110 | Flight Operations Managers, Scheduling Coordinators |

| Air Traffic Management Technology Providers | 90 | Product Managers, Technical Directors |

| Regulatory and Compliance Bodies | 80 | Regulatory Affairs Managers, Policy Analysts |

The Middle East and Africa Air Traffic Management market is valued at approximately USD 530 million, reflecting significant growth driven by increasing air traffic, technological advancements, and government investments in airport infrastructure.