Region:Global

Author(s):Shubham

Product Code:KRAA2652

Pages:94

Published On:August 2025

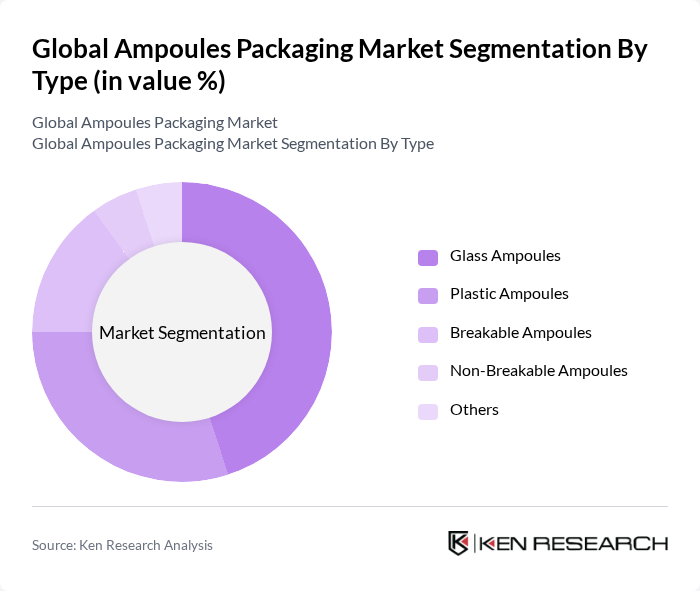

By Type:The ampoules packaging market is segmented into various types, including glass ampoules, plastic ampoules, breakable ampoules, non-breakable ampoules, and others. Among these, glass ampoules are the most widely used due to their excellent barrier properties, chemical resistance, and compatibility with a wide range of pharmaceutical products. Plastic ampoules are gaining traction owing to their lightweight, shatterproof nature, and suitability for diverse applications. The demand for breakable and non-breakable ampoules is also significant, driven by specific user requirements in pharmaceutical, biotechnology, and personal care sectors .

By End-User:The end-user segmentation includes the pharmaceutical industry, biotechnology sector, personal care & cosmetics, research laboratories, food & beverage industry, veterinary applications, and others. The pharmaceutical industry is the largest segment, driven by the increasing demand for injectable drugs, vaccines, and biologics. The biotechnology sector is witnessing significant growth due to advancements in biologics and personalized medicine. Personal care and cosmetics are emerging as important users of ampoules, particularly for serums and concentrated formulations, while research laboratories and veterinary applications continue to contribute to overall market demand .

The Global Ampoules Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Schott AG, Gerresheimer AG, Nipro Corporation, AptarGroup, Inc., Ompi (Stevanato Group), Bormioli Pharma S.p.A., SGD Pharma, West Pharmaceutical Services, Inc., Vetter Pharma-Fertigung GmbH & Co. KG, Catalent, Inc., ACG Worldwide, H&T Presspart, Stölzle-Oberglas GmbH, Shandong Pharmaceutical Glass Co., Ltd., T.O. Plastics, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ampoules packaging market appears promising, driven by ongoing innovations and a heightened focus on sustainability. As the pharmaceutical industry continues to expand, the demand for secure and efficient packaging solutions will likely increase. Furthermore, the integration of smart packaging technologies is expected to enhance product tracking and safety. Companies that invest in eco-friendly materials and automation will be well-positioned to capitalize on emerging trends, ensuring their competitiveness in a rapidly evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Glass Ampoules Plastic Ampoules Breakable Ampoules Non-Breakable Ampoules Others |

| By End-User | Pharmaceutical Industry Biotechnology Sector Personal Care & Cosmetics Research Laboratories Food & Beverage Industry Veterinary Applications Others |

| By Material | Glass Plastic Composite Materials Others |

| By Capacity | Less than 1 ml ml to 5 ml ml to 10 ml More than 10 ml |

| By Application | Injectable Drugs Vaccines Diagnostic Solutions Cosmetics & Skincare Food & Beverage Packaging Veterinary Medicines Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturing | 100 | Production Managers, Quality Control Supervisors |

| Healthcare Providers | 60 | Pharmacists, Hospital Supply Chain Managers |

| Regulatory Bodies | 40 | Compliance Officers, Regulatory Affairs Specialists |

| Research Institutions | 50 | Research Scientists, Lab Managers |

| Packaging Suppliers | 40 | Sales Directors, Product Development Managers |

The Global Ampoules Packaging Market is valued at approximately USD 5.1 billion, reflecting a significant growth trend driven by the increasing demand for safe and sterile packaging solutions in the pharmaceutical and biotechnology sectors.