Region:Middle East

Author(s):Dev

Product Code:KRAA3931

Pages:99

Published On:January 2026

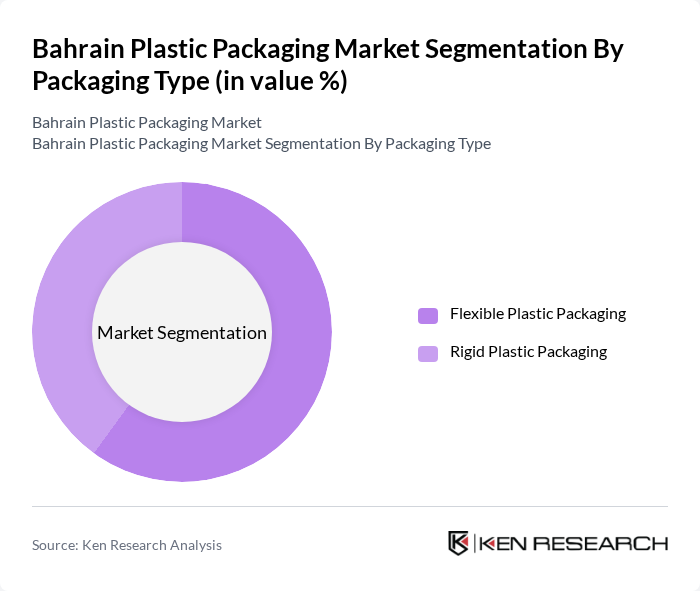

By Packaging Type:The market is segmented into flexible and rigid plastic packaging, in line with broader GCC packaging market classifications where plastic remains the dominant material across both formats. Flexible plastic packaging is gaining traction due to its lightweight nature, printability, and versatility in formats such as pouches, films, and wraps, making it suitable for snacks, dairy, frozen foods, and personal care applications. Rigid plastic packaging, on the other hand, is preferred for its durability, barrier properties, and protective qualities, especially in beverages, edible oils, household chemicals, and pharmaceuticals. The demand for flexible packaging is particularly strong, driven by consumer preferences for convenience, smaller pack sizes, and cost-effective logistics, as well as by retailers’ focus on shelf appeal and source-reduction of material use.

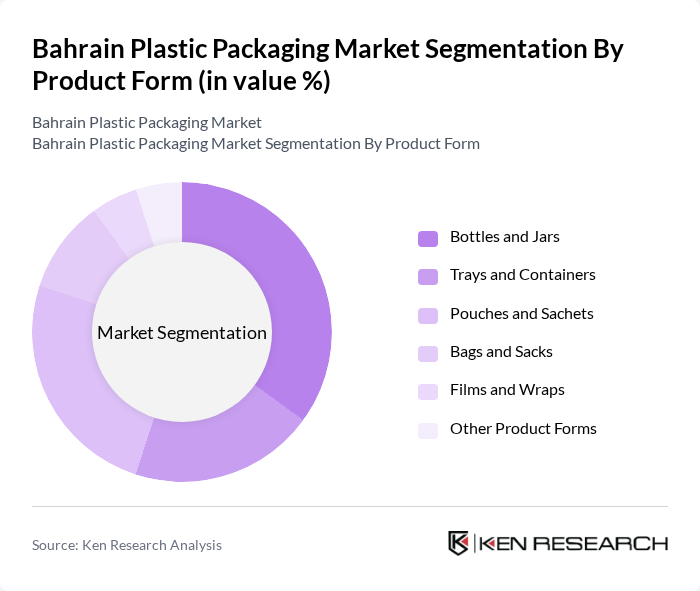

By Product Form:The product forms in the market include bottles and jars, trays and containers, pouches and sachets, bags and sacks, films and wraps, and other product forms, aligning with typical plastic packaging product taxonomies used in GCC and global packaging market studies. Bottles and jars dominate the market due to their extensive use in the beverage, edible oil, dairy, and food condiment industries, where rigid PET and HDPE containers remain standard. Pouches and sachets are also witnessing significant growth, driven by the demand for single-serve and on-the-go packaging solutions across snacks, instant beverages, sauces, and personal care products. The trend towards convenience, portability, and reduced material usage is influencing consumer and brand-owner preferences, leading to increased adoption of flexible packaging formats such as stand-up pouches, multilayer films, and resealable sachets.

The Bahrain Plastic Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Plastics Company (BAPCO), Bahrain Packaging Industries B.S.C., Trafco Group B.S.C. – Packaging Division, Al Wefaq Packaging & Plastic W.L.L., United Paper Industries (Bahrain Pack), Hotpack Packaging Industries – Bahrain, International Plastics Company W.L.L., Middle East Mold & Plastic Factory, Bahrain National Plastic Company W.L.L., Delmon Plastics Industries, Al Jazeera Factory for Plastic W.L.L., Gulf Plastic Industries W.L.L., Al Khaleej Plastics W.L.L., Al Taawon Plastic Factory, First Plastics W.L.L. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain plastic packaging market appears promising, driven by ongoing innovations in sustainable materials and technology. As consumer preferences shift towards eco-friendly options, companies are likely to invest in research and development to create biodegradable and recyclable packaging solutions. Additionally, the expansion of e-commerce and retail sectors will further fuel demand for innovative packaging that enhances product safety and convenience, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Packaging Type | Flexible Plastic Packaging Rigid Plastic Packaging |

| By Product Form | Bottles and Jars Trays and Containers Pouches and Sachets Bags and Sacks Films and Wraps Other Product Forms |

| By Material | Polyethylene (PE) Polypropylene (PP) Polyethylene Terephthalate (PET) Polystyrene and EPS Polyvinyl Chloride (PVC) Other Material Types |

| By End-User Industry | Food Beverage Pharmaceuticals and Healthcare Cosmetics and Personal Care Industrial and Household Care Other End-User Industries |

| By Application | Primary Packaging Secondary Packaging Tertiary / Transport Packaging |

| By Sustainability Profile | Recyclable Packaging Reusable / Refillable Packaging Biobased / Compostable Plastics Lightweighted / Reduced Plastic Usage Use of Recycled Content (rPE, rPET, etc.) |

| By Manufacturing Process | Extrusion Injection Molding Blow Molding Thermoforming Other Processes |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Packaging | 120 | Packaging Managers, Product Development Heads |

| Pharmaceutical Packaging Solutions | 90 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Consumer Goods Packaging | 100 | Brand Managers, Supply Chain Coordinators |

| Industrial Packaging Applications | 80 | Operations Managers, Procurement Officers |

| Sustainable Packaging Initiatives | 70 | Sustainability Managers, Environmental Compliance Officers |

The Bahrain Plastic Packaging Market is valued at approximately USD 150 million, reflecting its position within the broader GCC packaging industry, where it holds a smaller share compared to larger markets like Saudi Arabia and the UAE.