Region:Global

Author(s):Rebecca

Product Code:KRAC8447

Pages:85

Published On:November 2025

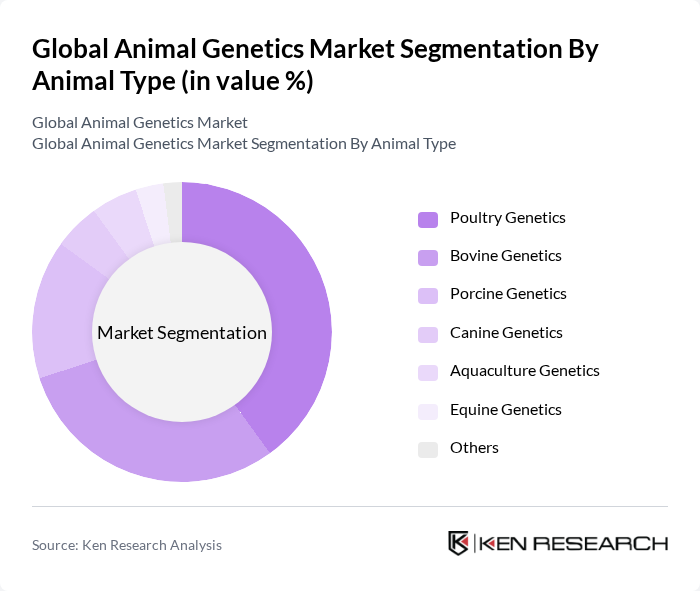

By Animal Type:The animal type segmentation includes various categories such as poultry, bovine, porcine, canine, aquaculture, equine, and others. Among these, poultry genetics is currently the leading sub-segment due to the high demand for poultry products globally. The increasing consumption of chicken and eggs, coupled with advancements in breeding technologies, has driven the growth of this segment. Bovine genetics follows closely, supported by the rising need for dairy and beef production to meet the growing population's dietary needs.

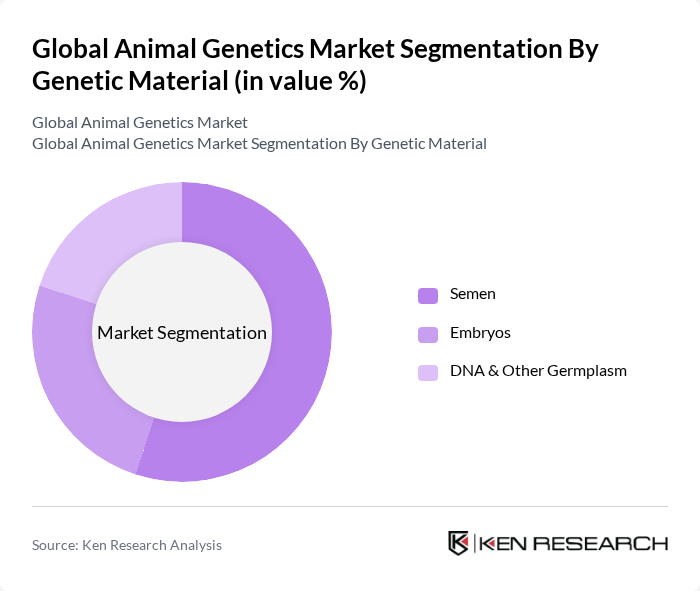

By Genetic Material:This segmentation includes semen, embryos, and DNA & other germplasm. The semen sub-segment is the most significant contributor to the market, driven by its essential role in artificial insemination and breeding programs. The increasing adoption of artificial reproductive technologies in livestock management has led to a surge in demand for high-quality semen. Embryos and DNA & other germplasm are also gaining traction, particularly in advanced breeding techniques and genetic research, including gene editing and genomic selection .

The Global Animal Genetics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Genus plc, Neogen Corporation, Zoetis Inc., Merck Animal Health, Allflex Livestock Intelligence, CRV Holding B.V., Hendrix Genetics, Topigs Norsvin, Urus Group, Evonik Industries AG, VetGen, Genomic Vision, Leachman Cattle Company, Semex Alliance, and Cogent contribute to innovation, geographic expansion, and service delivery in this space.

The future of the animal genetics market is poised for significant transformation, driven by technological advancements and changing consumer preferences. As the demand for sustainable and traceable food sources grows, the integration of artificial intelligence in genetic analysis will enhance breeding efficiency. Additionally, the expansion into emerging markets, particularly in Asia and Africa, presents opportunities for growth, as these regions increasingly adopt modern genetic practices to improve livestock productivity and health.

| Segment | Sub-Segments |

|---|---|

| By Animal Type | Poultry Genetics Bovine Genetics Porcine Genetics Canine Genetics Aquaculture Genetics Equine Genetics Others |

| By Genetic Material | Semen Embryos DNA & Other Germplasm |

| By Service Type | DNA Typing Animal Genetic Testing Services Other Services |

| By End-User | Veterinary Hospitals & Clinics Research Centers & Institutes Commercial Breeders Government Agencies Others |

| By Application | Breeding Programs Disease Resistance Enhancement Productivity Improvement Animal Health Management Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Investment Source | Private Investments Public Funding Venture Capital Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cattle Genetic Improvement Programs | 120 | Livestock Breeders, Geneticists |

| Poultry Genetics and Breeding | 90 | Poultry Farmers, Veterinary Consultants |

| Swine Genetic Research Initiatives | 60 | Swine Producers, Animal Genetic Researchers |

| Genetic Testing Services for Pets | 50 | Pet Owners, Veterinary Practitioners |

| Biotechnology in Animal Genetics | 70 | Biotech Researchers, Industry Analysts |

The Global Animal Genetics Market is valued at approximately USD 7.4 billion, driven by advancements in genetic technologies, increasing demand for high-quality livestock, and a focus on animal health and productivity.