Region:Global

Author(s):Dev

Product Code:KRAE0033

Pages:94

Published On:December 2025

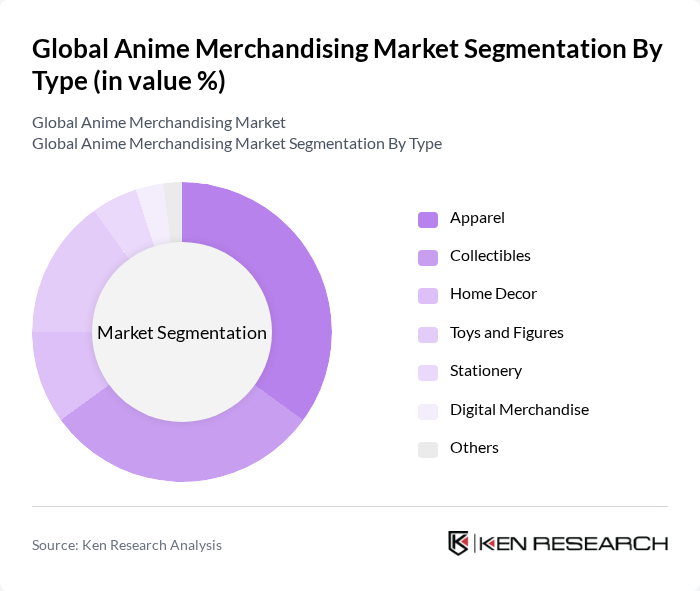

By Type:The anime merchandising market is segmented into various types, including apparel, collectibles, home decor, toys and figures, stationery, digital merchandise, and others. Among these, apparel and collectibles are the most prominent segments, driven by consumer demand for fashion items and unique collectibles that resonate with anime fandom. The trend of wearing anime-themed clothing and owning exclusive collectibles has significantly influenced purchasing behavior, making these segments crucial for market growth.

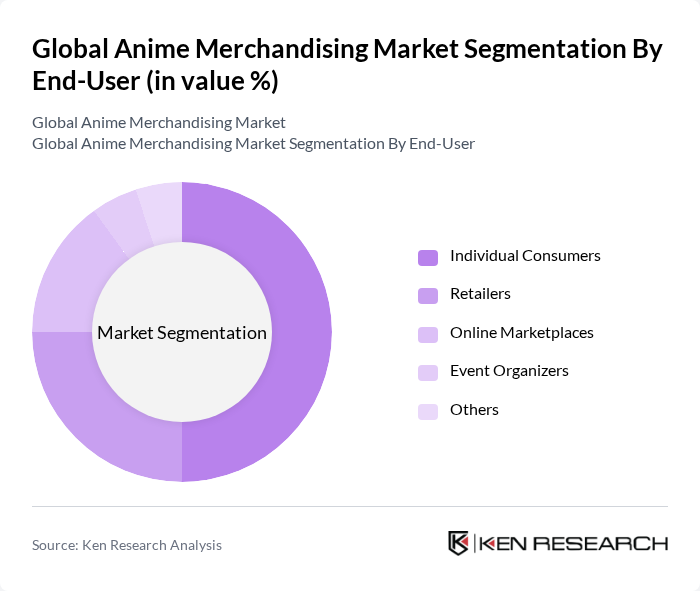

By End-User:The end-user segmentation includes individual consumers, retailers, online marketplaces, event organizers, and others. Individual consumers represent the largest segment, as they are the primary purchasers of anime merchandise for personal use. Retailers and online marketplaces also play significant roles, providing platforms for consumers to access a wide range of products. The growing trend of online shopping has further enhanced the market's reach, making it easier for fans to acquire their favorite merchandise.

The Global Anime Merchandising Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bandai Namco Holdings Inc., Funimation Global Group, LLC, Crunchyroll, LLC, Good Smile Company, Inc., Kotobukiya Co., Ltd., Aniplex Inc., Square Enix Holdings Co., Ltd., Viz Media LLC, Tokyo Otaku Mode Inc., NIS America, Inc., Capcom Co., Ltd., Sega Sammy Holdings Inc., Bandai Spirits Co., Ltd., Alter Co., Ltd., MegaHouse Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the anime merchandising market appears promising, driven by the continued growth of digital platforms and the increasing global reach of anime culture. As more fans engage with anime through streaming services and social media, the demand for unique and high-quality merchandise is expected to rise. Additionally, the integration of technology, such as augmented reality, will likely enhance consumer experiences, further stimulating market growth and innovation in product offerings.

| Segment | Sub-Segments |

|---|---|

| By Type | Apparel Collectibles Home Decor Toys and Figures Stationery Digital Merchandise Others |

| By End-User | Individual Consumers Retailers Online Marketplaces Event Organizers Others |

| By Distribution Channel | Online Retail Brick-and-Mortar Stores Pop-Up Shops Events and Conventions Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Product Category | Licensed Merchandise Unlicensed Merchandise Limited Edition Merchandise Others |

| By Consumer Demographics | Age Groups Gender Income Levels Others |

| By Marketing Strategy | Influencer Marketing Social Media Campaigns Traditional Advertising Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Anime Merchandise Retailers | 150 | Store Owners, Retail Managers |

| Anime Convention Attendees | 100 | Event Organizers, Attendees |

| Online Anime Merchants | 80 | E-commerce Managers, Marketing Directors |

| Anime Collectors | 70 | Collectors, Community Leaders |

| Anime Content Creators | 60 | Influencers, YouTubers, Bloggers |

The global anime merchandising market is valued at approximately USD 9,785 million, reflecting significant growth driven by the increasing popularity of anime culture, streaming platforms, and consumer demand for collectibles and apparel.