Region:Asia

Author(s):Dev

Product Code:KRAB1942

Pages:91

Published On:January 2026

By Product Type:The product type segmentation includes various categories that cater to the diverse preferences of anime fans. The most popular subsegments are apparel and fashion, which includes T-shirts, hoodies, and streetwear, as fans often wear clothing that reflects their favorite characters or series; this aligns with regional trends where clothing and figurines are among the top revenue?generating categories in anime merchandising. Collectibles and figurines also dominate the market, as many fans enjoy displaying their favorite characters in their homes or workspaces, mirroring the strong figurine share seen in broader Asia Pacific and Japan anime merchandising markets. Accessories, such as bags and keychains, are also popular due to their practicality, relatively lower price points, and ability to showcase fandom in everyday life, while emerging categories like home décor and digital items (codes, in?game items) are gradually gaining traction alongside the global shift toward lifestyle and digital collectibles.

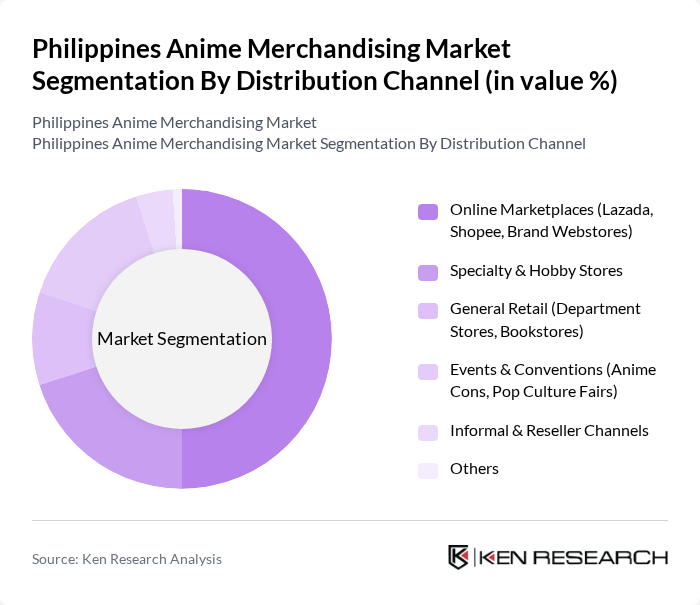

By Distribution Channel:The distribution channels for anime merchandise are diverse, with online marketplaces being the most significant due to the convenience they offer and the rapid expansion of e?commerce across Asia Pacific. Platforms like Lazada and Shopee have become popular among consumers, allowing easy access to a wide range of products from both international brands and local resellers. Specialty and hobby stores also play a crucial role, as they provide a physical space for fans to explore high?quality licensed merchandise, participate in community activities, and access limited or exclusive items. Events and conventions are vital for direct sales and community engagement, allowing fans to connect with each other and the brands they love, and often serving as launchpads for limited?run merchandise, collaborations, and creator signings in line with broader anime industry trends.

The Philippines Anime Merchandising Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bandai Namco Holdings Inc., Good Smile Company, Inc., Aniplus Asia, Cosplay.ph, Otaku Asia Anime Store, Toy Kingdom, Hobby Stock, Game One PH, Anime Alliance Philippines, Kawaii PH Store, Anime Merchandise PH, Manga Manila, Cosplay Central, Anime Hub Philippines, The Otaku Box contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines anime merchandising market appears promising, driven by the increasing integration of technology and consumer engagement strategies. As the youth demographic continues to embrace anime culture, businesses are likely to innovate their product offerings. The rise of digital platforms and social media marketing will further enhance brand visibility, while collaborations with local artists may create unique merchandise that resonates with consumers, fostering loyalty and expanding market reach.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Apparel & Fashion (T-shirts, Hoodies, Streetwear) Accessories (Bags, Keychains, Jewelry, Phone Charms) Collectibles & Figurines Home & Lifestyle (Home Decor, Bedding, Kitchenware) Toys, Plushies & Models Stationery & Printed Materials (Notebooks, Posters, Artbooks) Digital & Interactive Merchandise (In?game items, NFTs, Codes) Others |

| By Distribution Channel | Online Marketplaces (Lazada, Shopee, Brand Webstores) Specialty & Hobby Stores General Retail (Department Stores, Bookstores) Events & Conventions (Anime Cons, Pop Culture Fairs) Informal & Reseller Channels Others |

| By Consumer Demographics | Age Group (Children, Teens, Young Adults, Adults) Gender (Male, Female, Unisex/All?gender) Income Level (Mass, Mid, Premium/High) Otaku/Anime Engagement Level (Casual Fans, Core Fans, Collectors) Others |

| By Price Tier | Budget/Mass Mid?Range Premium & Limited Edition Others |

| By Licensing Status | Officially Licensed Merchandise Fan?Made / Doujin & Indie Products Unlicensed / Grey Market Others |

| By Product Origin | Imported (Japan, Rest of Asia, Rest of World) Locally Manufactured / Printed Others |

| By Use Case / Occasion | Everyday Wear & Use Collecting & Display Gifts & Souvenirs Event?Specific / Limited Drops Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Anime Merchandise | 120 | Store Managers, Retail Buyers |

| Consumer Purchase Behavior | 150 | Anime Fans, Collectors |

| Online Sales Channels | 100 | E-commerce Managers, Digital Marketing Specialists |

| Event Participation and Conventions | 80 | Event Organizers, Attendees |

| Anime Merchandise Production | 70 | Manufacturers, Product Designers |

The Philippines Anime Merchandising Market is valued at approximately USD 140 million, reflecting significant growth driven by the rising popularity of anime culture and increased accessibility through streaming services and social media engagement.