Region:Asia

Author(s):Dev

Product Code:KRAA8328

Pages:97

Published On:November 2025

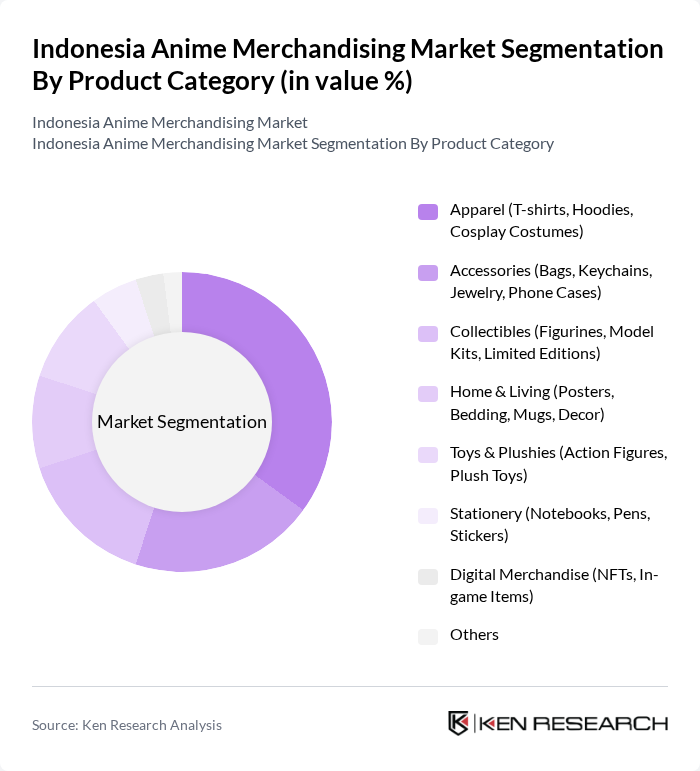

By Product Category:The product category segmentation of the Indonesia Anime Merchandising Market includes various subsegments such as Apparel, Accessories, Collectibles, Home & Living, Toys & Plushies, Stationery, Digital Merchandise, and Others. Among these,Apparel, which includes T-shirts, hoodies, and cosplay costumes, is the leading subsegment. The growing trend of wearing anime-themed clothing in everyday life, coupled with the rise of cosplay culture and collaborations between anime brands and local fashion designers, has significantly boosted the demand for apparel. Consumers are increasingly seeking unique and stylish clothing that reflects their favorite anime characters, making this subsegment a dominant force in the market.

By End-User:The end-user segmentation of the Indonesia Anime Merchandising Market includes Individual Consumers, Retailers, Online Marketplaces, Event Organizers, and Others.Individual Consumersrepresent the largest segment, driven by the increasing number of anime fans who actively seek out merchandise to express their fandom. The rise of online shopping and mobile commerce platforms has also made it easier for consumers to access a wide range of products, further boosting this segment's growth. Retailers and online marketplaces are also significant contributors, as they provide platforms for fans to purchase their favorite items.

The Indonesia Anime Merchandising Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tokopedia, Bukalapak, Shopee Indonesia, Blibli, Lazada Indonesia, Kaskus, Anime Merchandise Indonesia, Otaku Store Indonesia, Coswalk Indonesia, Mizuho Anime Store, Anime House Indonesia, J-Store Indonesia, Anime Corner Indonesia, Kawaii Shop Indonesia, Manga Station Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia anime merchandising market appears promising, driven by the increasing integration of technology and fan engagement strategies. As the market evolves, businesses are likely to adopt innovative approaches, such as augmented reality experiences and interactive merchandise. Additionally, the growing trend of sustainability will push companies to develop eco-friendly products, aligning with consumer preferences. The combination of these trends is expected to create a dynamic environment for growth and expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Apparel (T-shirts, Hoodies, Cosplay Costumes) Accessories (Bags, Keychains, Jewelry, Phone Cases) Collectibles (Figurines, Model Kits, Limited Editions) Home & Living (Posters, Bedding, Mugs, Decor) Toys & Plushies (Action Figures, Plush Toys) Stationery (Notebooks, Pens, Stickers) Digital Merchandise (NFTs, In-game Items) Others |

| By End-User | Individual Consumers Retailers (Anime Shops, Comic Stores) Online Marketplaces Event Organizers (Conventions, Pop-up Events) Others |

| By Distribution Channel | Online Retail (E-commerce Platforms, Brand Websites) Physical Stores (Specialty Anime Shops, Department Stores) Pop-up Shops & Temporary Stalls Events and Conventions Others |

| By Price Range | Low-End (Mass Market, Entry-Level) Mid-Range (Branded, Licensed Products) Premium (Limited Editions, Imported Goods) Others |

| By Consumer Age Group | Children (Below 13) Teenagers (13-19) Young Adults (20-35) Adults (36+) Others |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers Trend-Following Customers Others |

| By Product Origin | Domestic Brands Imported Brands (Japanese, International) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Anime Merchandise Retailers | 60 | Store Owners, Retail Managers |

| Online Anime Merchants | 50 | E-commerce Managers, Digital Marketing Specialists |

| Anime Convention Organizers | 40 | Event Coordinators, Marketing Directors |

| Anime Collectors and Enthusiasts | 100 | Active Community Members, Social Media Influencers |

| Manufacturers of Anime Merchandise | 45 | Production Managers, Supply Chain Analysts |

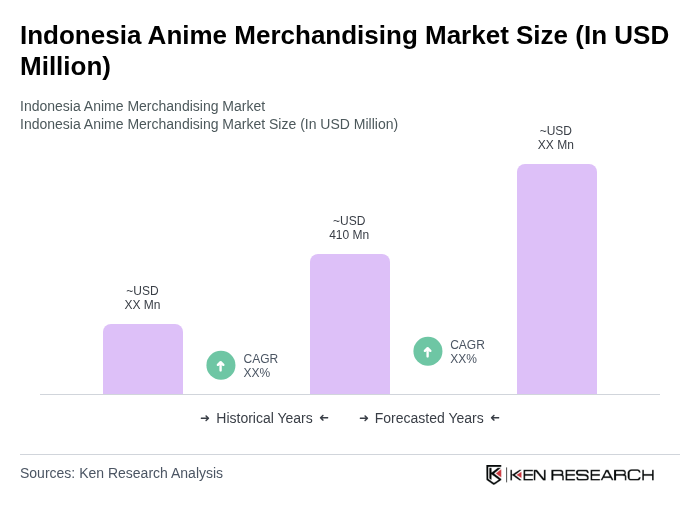

The Indonesia Anime Merchandising Market is valued at approximately USD 410 million, reflecting significant growth driven by the rising popularity of anime culture, streaming platforms, and social media engagement among fans.