Region:Global

Author(s):Dev

Product Code:KRAD1581

Pages:100

Published On:November 2025

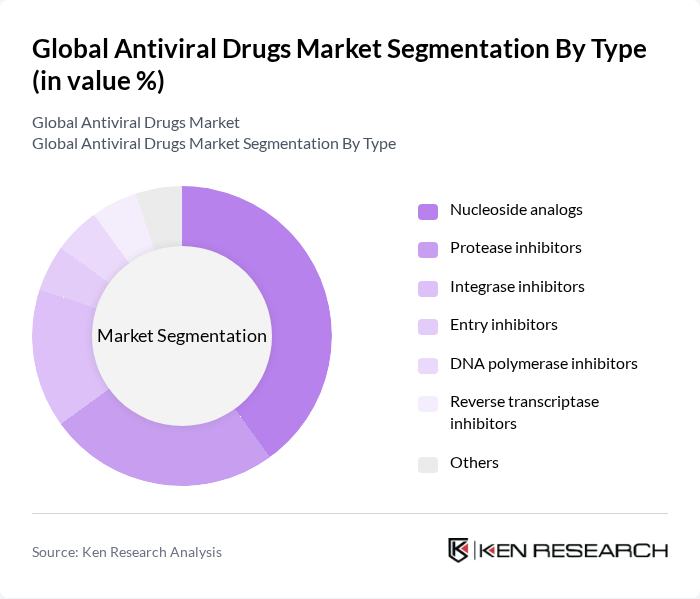

By Type:The antiviral drugs market can be segmented into various types, including Nucleoside analogs, Protease inhibitors, Integrase inhibitors, Entry inhibitors, DNA polymerase inhibitors, Reverse transcriptase inhibitors, and Others. Among these, Nucleoside analogs are currently dominating the market due to their widespread use in treating chronic viral infections such as HIV and hepatitis. The increasing incidence of these infections, coupled with the proven efficacy and safety profiles of nucleoside analogs, continues to drive their adoption as first-line therapies in both developed and emerging markets.

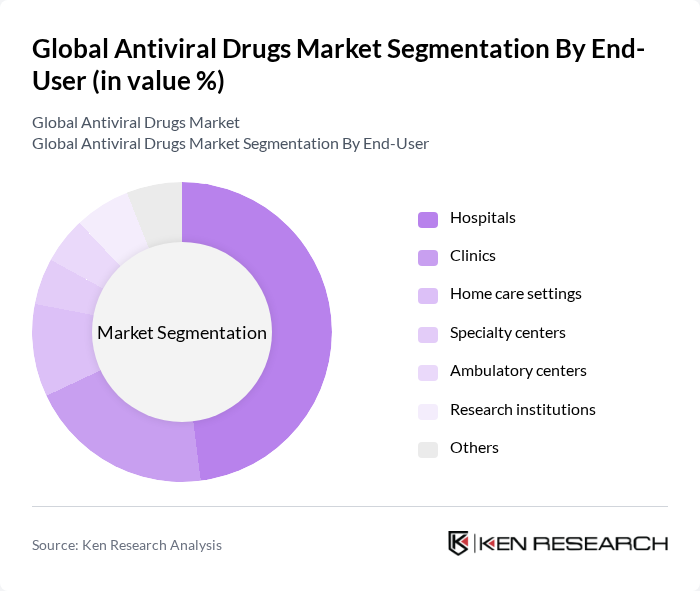

By End-User:The market can also be segmented based on end-users, which include Hospitals, Clinics, Home care settings, Specialty centers, Ambulatory centers, Research institutions, and Others. Hospitals remain the leading end-user segment, accounting for nearly half of the market share. This is primarily due to their capacity to provide comprehensive care, access to advanced antiviral therapies, and the increasing number of hospital admissions for viral infections. The trend is further reinforced by the expansion of hospital-based specialty centers and the integration of antiviral stewardship programs.

The Global Antiviral Drugs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gilead Sciences, Inc., GlaxoSmithKline plc, Merck & Co., Inc., AbbVie Inc., Bristol-Myers Squibb Company, Johnson & Johnson (Janssen Pharmaceuticals), Roche Holding AG, Pfizer Inc., Astellas Pharma Inc., Novartis AG, Sanofi S.A., Teva Pharmaceutical Industries Ltd., Eli Lilly and Company, Bayer AG, Takeda Pharmaceutical Company Limited, Cipla Ltd., Dr. Reddy’s Laboratories Ltd., Aurobindo Pharma Ltd., Sun Pharmaceutical Industries Ltd., Mylan N.V. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the antiviral drugs market is poised for significant transformation, driven by technological advancements and evolving healthcare needs. The integration of artificial intelligence in drug discovery is expected to streamline the development process, reducing time and costs. Additionally, the increasing focus on preventive therapies, such as vaccines and pre-exposure prophylaxis, will reshape treatment paradigms. As healthcare systems adapt to these changes, the demand for innovative antiviral solutions will likely rise, fostering a dynamic market environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Nucleoside analogs Protease inhibitors Integrase inhibitors Entry inhibitors DNA polymerase inhibitors Reverse transcriptase inhibitors Others |

| By End-User | Hospitals Clinics Home care settings Specialty centers Ambulatory centers Research institutions Others |

| By Distribution Channel | Retail pharmacies Online pharmacies Hospital pharmacies Wholesalers Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Drug Class | Antiretrovirals (HIV) Antivirals for Hepatitis (HBV, HCV) Antivirals for Influenza Antivirals for Herpes (HSV, HCMV, VZV) Antivirals for Respiratory Syncytial Virus (RSV) Antivirals for Coronavirus Infection Others |

| By Route of Administration | Oral Injectable (Parenteral) Topical Others |

| By Patient Demographics | Pediatric Adult Geriatric Others |

| By Drug Type | Branded Generic |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 100 | R&D Directors, Product Managers |

| Healthcare Providers | 80 | Infectious Disease Specialists, Pharmacists |

| Regulatory Bodies | 40 | Regulatory Affairs Managers, Compliance Officers |

| Market Research Analysts | 60 | Market Analysts, Business Development Managers |

| Public Health Organizations | 50 | Public Health Officials, Epidemiologists |

The Global Antiviral Drugs Market is valued at approximately USD 66 billion, driven by the rising prevalence of chronic viral infections, advancements in drug development technologies, and increased healthcare expenditure worldwide.