Region:Middle East

Author(s):Shubham

Product Code:KRAD3464

Pages:89

Published On:November 2025

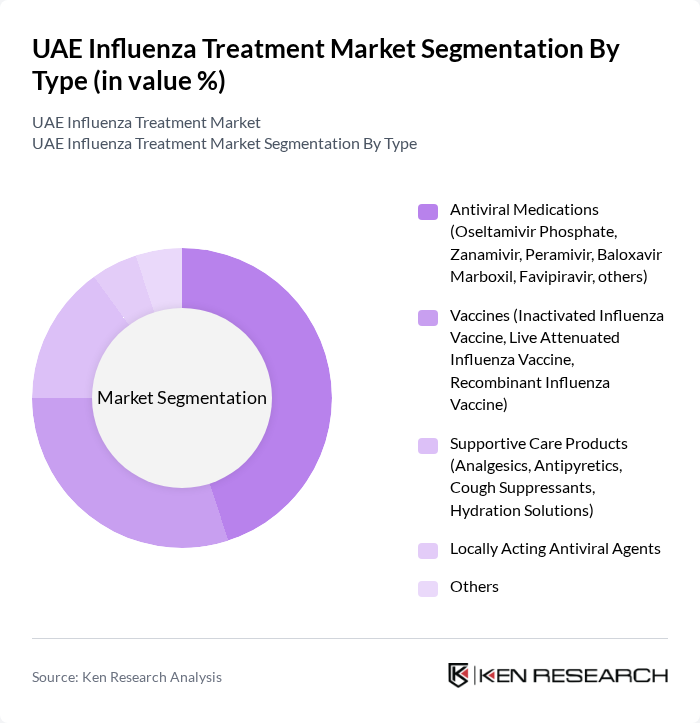

By Type:The market is segmented into antiviral medications, vaccines, supportive care products, locally acting antiviral agents, and others. Among these, antiviral medications—especially Oseltamivir Phosphate and Zanamivir—lead the market due to their proven effectiveness in treating influenza and the growing awareness of their benefits among healthcare providers and patients. Locally acting antiviral agents are gaining traction for their targeted action and reduced side-effect profile, reflecting a shift toward innovative drug solutions tailored to local healthcare needs.

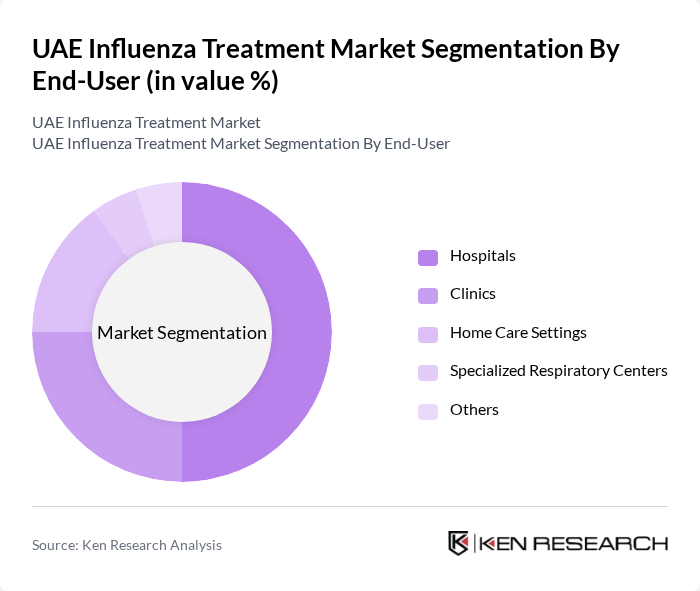

By End-User:The end-user segmentation includes hospitals, clinics, home care settings, specialized respiratory centers, and others. Hospitals remain the dominant end-user segment, driven by the high volume of influenza cases treated in these facilities and the availability of advanced medical technologies that facilitate effective treatment. The UAE government’s investments in expanding hospital infrastructure and specialized respiratory centers further reinforce hospital-based treatment as the primary mode of care for influenza.

The UAE Influenza Treatment Market is characterized by a dynamic mix of regional and international players. Leading participants such as GlaxoSmithKline (GSK), Sanofi, F. Hoffmann-La Roche Ltd. (Roche), Pfizer Inc., Merck & Co., Inc., AstraZeneca, Novartis AG, AbbVie Inc., Takeda Pharmaceutical Company Limited, Johnson & Johnson, Bayer AG, Boehringer Ingelheim, Eli Lilly and Company, Amgen Inc., Astellas Pharma Inc., Gilead Sciences, Inc., BioCryst Pharmaceuticals, Inc., Cipla Ltd., Julphar (Gulf Pharmaceutical Industries), Hikma Pharmaceuticals PLC contribute to innovation, geographic expansion, and service delivery in this space.

The UAE influenza treatment market is poised for significant evolution, driven by technological advancements and changing healthcare dynamics. The integration of telemedicine is expected to enhance patient access to consultations, while the rise of home healthcare services will facilitate treatment delivery. Furthermore, the focus on personalized medicine will likely lead to tailored treatment protocols, improving patient outcomes. These trends indicate a shift towards more efficient and accessible healthcare solutions in the UAE, enhancing the overall treatment landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Antiviral Medications (Oseltamivir Phosphate, Zanamivir, Peramivir, Baloxavir Marboxil, Favipiravir, others) Vaccines (Inactivated Influenza Vaccine, Live Attenuated Influenza Vaccine, Recombinant Influenza Vaccine) Supportive Care Products (Analgesics, Antipyretics, Cough Suppressants, Hydration Solutions) Locally Acting Antiviral Agents Others |

| By End-User | Hospitals Clinics Home Care Settings Specialized Respiratory Centers Others |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Others |

| By Patient Demographics | Pediatric Patients Adult Patients Geriatric Patients Patients with Chronic Conditions Others |

| By Treatment Setting | Inpatient Treatment Outpatient Treatment Emergency Care Telemedicine/Remote Consultation Others |

| By Treatment Duration | Short-term Treatment Long-term Treatment Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Practitioners | 100 | Family Physicians, General Practitioners |

| Pharmacists | 75 | Community Pharmacists, Hospital Pharmacists |

| Infectious Disease Specialists | 50 | Infectious Disease Physicians, Epidemiologists |

| Healthcare Administrators | 60 | Hospital Administrators, Health Policy Makers |

| Patients with Influenza | 90 | Patients who have received treatment for influenza |

The UAE Influenza Treatment Market is valued at approximately USD 19 million, reflecting a five-year historical analysis. This valuation is influenced by advancements in healthcare infrastructure and rising respiratory disease prevalence.