Region:Middle East

Author(s):Shubham

Product Code:KRAA8489

Pages:80

Published On:November 2025

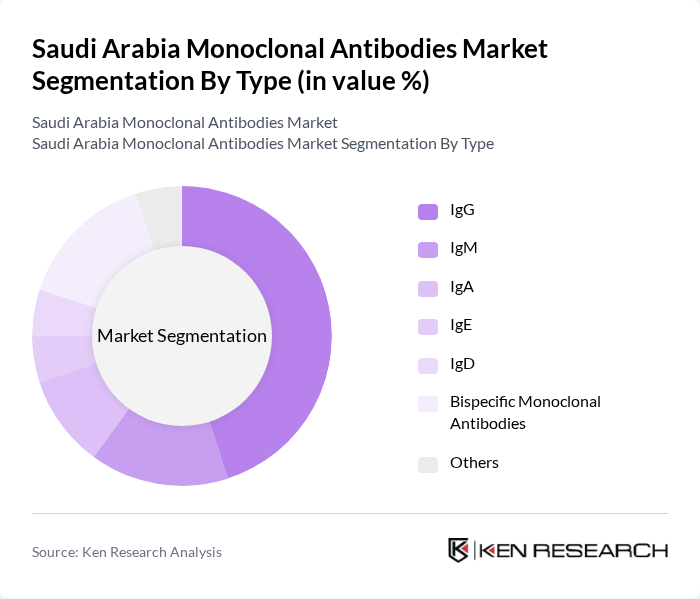

By Type:The market is segmented into various types of monoclonal antibodies, including IgG, IgM, IgA, IgE, IgD, bispecific monoclonal antibodies, and others. Among these, IgG antibodies dominate the market due to their widespread use in therapeutic applications, particularly in oncology and autoimmune disorders. The versatility and established efficacy of IgG make it the preferred choice for healthcare providers, driving its significant market share .

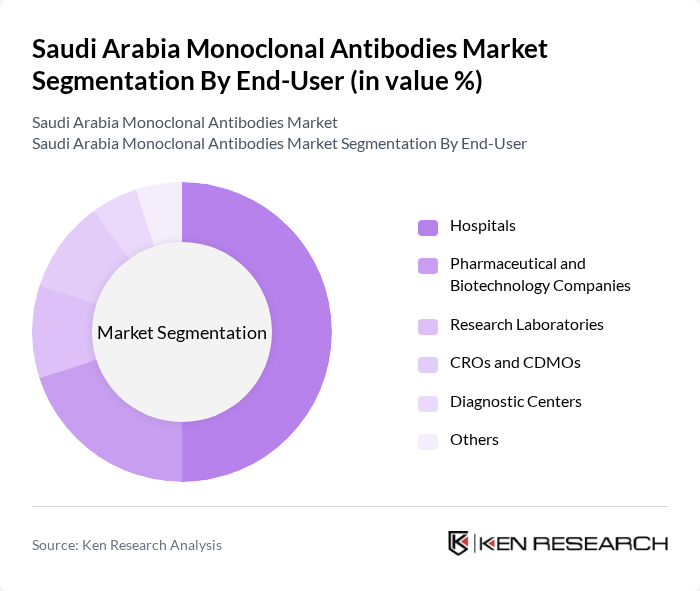

By End-User:The end-user segmentation includes hospitals, pharmaceutical and biotechnology companies, research laboratories, CROs and CDMOs, diagnostic centers, and others. Hospitals are the leading end-users, as they are the primary settings for administering monoclonal antibody therapies. The increasing number of cancer treatment centers and specialized clinics within hospitals contributes to their dominant position in the market .

The Saudi Arabia Monoclonal Antibodies Market is characterized by a dynamic mix of regional and international players. Leading participants such as AbbVie Inc., Amgen Inc., Genentech, a member of the Roche Group, Merck & Co., Inc., Johnson & Johnson, Bristol-Myers Squibb, Novartis AG, Sanofi S.A., GSK (GlaxoSmithKline), Eli Lilly and Company, Takeda Pharmaceutical Company Limited, Regeneron Pharmaceuticals, Inc., Biogen Inc., Astellas Pharma Inc., Sandoz (a Novartis division), SPIMACO (Saudi Pharmaceutical Industries & Medical Appliances Corporation), Tabuk Pharmaceuticals Manufacturing Company, Jamjoom Pharma, Hikma Pharmaceuticals PLC, MabThera (Rituximab) – Roche Product contribute to innovation, geographic expansion, and service delivery in this space.

The future of the monoclonal antibodies market in Saudi Arabia appears promising, driven by ongoing advancements in biotechnology and increasing healthcare investments. As the government continues to prioritize healthcare improvements, the market is likely to witness enhanced access to innovative therapies. Additionally, the growing focus on personalized medicine and combination therapies will further shape treatment paradigms, ensuring that patients receive tailored and effective care in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | IgG IgM IgA IgE IgD Bispecific Monoclonal Antibodies Others |

| By End-User | Hospitals Pharmaceutical and Biotechnology Companies Research Laboratories CROs and CDMOs Diagnostic Centers Others |

| By Application | Cancer Treatment Autoimmune Diseases Infectious Diseases Transplantation Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Hospital Pharmacies Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Manufacturing Process | Hybridoma Technology Recombinant DNA Technology Single-Use Bioreactor Technology Others |

| By Pricing Model | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncology Treatment Centers | 60 | Oncologists, Clinical Pharmacists |

| Rheumatology Clinics | 50 | Rheumatologists, Nurse Practitioners |

| Immunology Research Institutions | 40 | Immunologists, Research Scientists |

| Patient Advocacy Groups | 40 | Patient Representatives, Healthcare Advocates |

| Pharmaceutical Distributors | 45 | Distribution Managers, Sales Representatives |

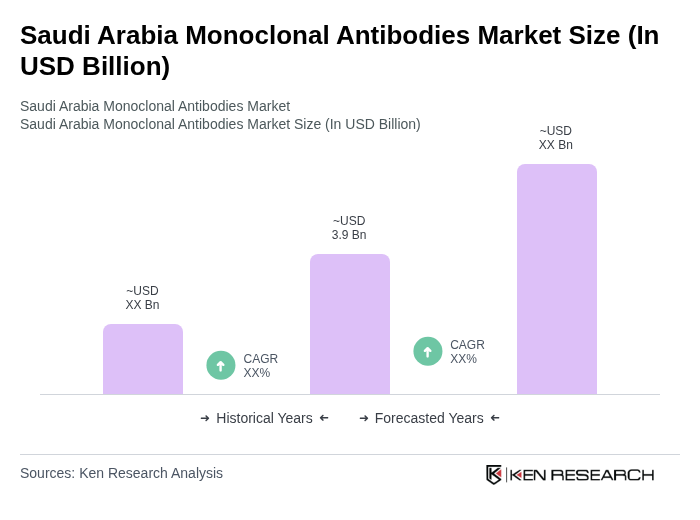

The Saudi Arabia Monoclonal Antibodies Market is valued at approximately USD 3.9 billion, driven by the rising prevalence of chronic diseases, advancements in biotechnology, and increased healthcare expenditure.