Region:Global

Author(s):Rebecca

Product Code:KRAA2469

Pages:86

Published On:August 2025

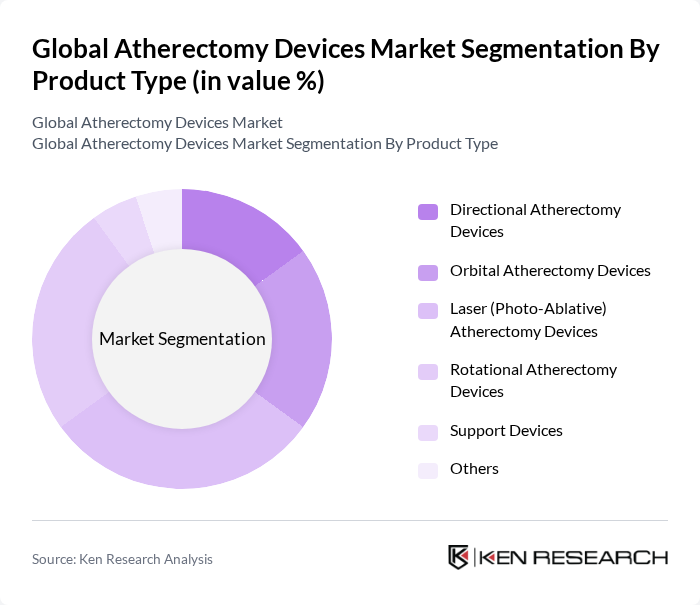

By Product Type:The product type segmentation includes devices designed for specific atherectomy procedures: Directional Atherectomy Devices, Orbital Atherectomy Devices, Laser (Photo-Ablative) Atherectomy Devices, Rotational Atherectomy Devices, Support Devices, and Others. Laser (Photo-Ablative) Atherectomy Devices are increasingly favored due to their precision, reduced risk of vessel injury, and effectiveness in removing both soft and calcified plaque. Technological advancements, such as real-time imaging integration and improved catheter designs, have further enhanced the adoption of laser-based systems among healthcare professionals.

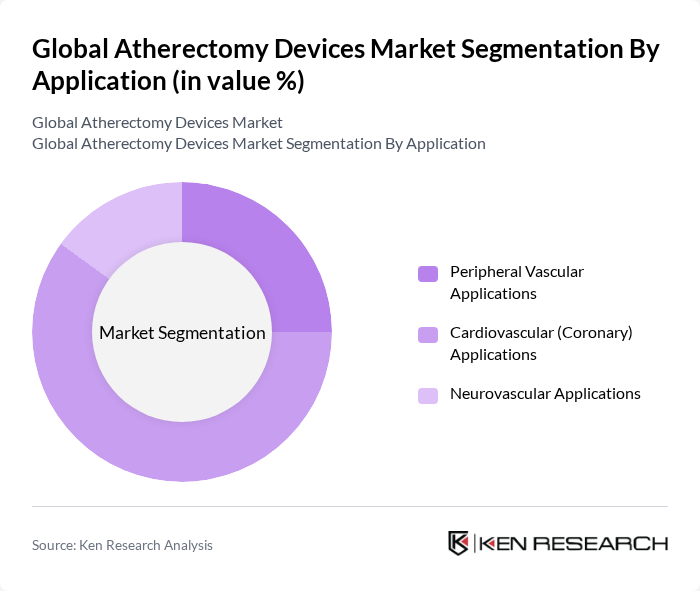

By Application:The application segmentation covers Peripheral Vascular Applications, Cardiovascular (Coronary) Applications, and Neurovascular Applications. Cardiovascular (Coronary) Applications remain the largest segment, driven by the rising incidence of coronary artery disease and the increasing use of atherectomy procedures for complex lesions. Peripheral Vascular Applications are also expanding due to the growing prevalence of peripheral artery disease and the advantages of minimally invasive interventions. Neurovascular Applications are emerging, supported by ongoing research into plaque removal in cerebral vessels.

The Global Atherectomy Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Boston Scientific Corporation, Medtronic plc, Abbott Laboratories, Cardiovascular Systems, Inc., Spectranetics Corporation (now part of Philips), Koninklijke Philips N.V. (Philips Healthcare), Terumo Corporation, B. Braun Melsungen AG, Johnson & Johnson (Biosense Webster, Cordis), Cook Medical, Asahi Intecc Co., Ltd., Straub Medical AG, Avinger, Inc., Endologix LLC, Biotronik SE & Co. KG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the atherectomy devices market appears promising, driven by ongoing advancements in technology and an increasing focus on patient-centric care. As healthcare systems evolve, there is a notable shift towards outpatient procedures, which are expected to enhance patient access to atherectomy treatments. Additionally, the integration of digital technologies, such as telemedicine and remote monitoring, will likely facilitate better patient management and follow-up, further supporting market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Directional Atherectomy Devices Orbital Atherectomy Devices Laser (Photo-Ablative) Atherectomy Devices Rotational Atherectomy Devices Support Devices Others |

| By Application | Peripheral Vascular Applications Cardiovascular (Coronary) Applications Neurovascular Applications |

| By End-User | Hospitals and Surgical Centers Ambulatory Care Centers Research Laboratories Academic Institutes |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Range Medium Price Range High Price Range |

| By Technology | Mechanical Atherectomy Thermal Atherectomy Chemical Atherectomy Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cardiologists in Major Hospitals | 100 | Interventional Cardiologists, Electrophysiologists |

| Healthcare Procurement Managers | 60 | Hospital Procurement Officers, Supply Chain Managers |

| Medical Device Sales Representatives | 50 | Sales Managers, Territory Representatives |

| Clinical Researchers in Cardiology | 40 | Clinical Trial Coordinators, Research Scientists |

| Healthcare Policy Makers | 40 | Health Economists, Policy Analysts |

The Global Atherectomy Devices Market is valued at approximately USD 1.0 billion, driven by the rising prevalence of cardiovascular diseases, advancements in medical technology, and an increasing geriatric population seeking minimally invasive treatment options.