Region:Middle East

Author(s):Rebecca

Product Code:KRAD5048

Pages:99

Published On:December 2025

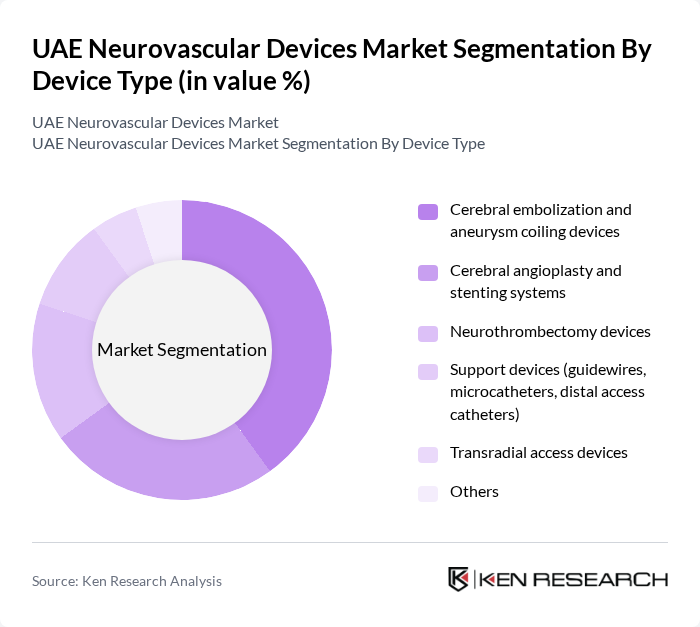

By Device Type:The device type segmentation includes various categories of neurovascular devices that cater to different medical needs. The subsegments are as follows:

The cerebral embolization and aneurysm coiling devices segment is currently dominating the market due to the rising incidence of aneurysms and the increasing preference for minimally invasive endovascular procedures. These devices are essential for treating cerebral aneurysms and arteriovenous malformations, which are becoming more frequently detected due to greater use of neuroimaging and aging demographics. Advancements in coil technology, flow-diverting stents, liquid embolics, and adjunctive devices have led to improved efficacy and safety profiles, shorter hospital stays, and wider adoption of endovascular treatment over open surgery in clinical settings.

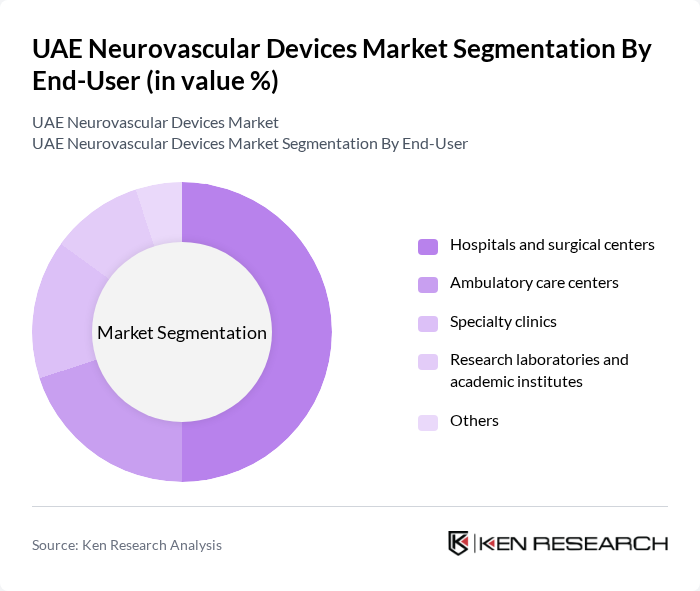

By End-User:The end-user segmentation categorizes the market based on the types of facilities utilizing neurovascular devices. The subsegments are as follows:

Hospitals and surgical centers are the leading end-users of neurovascular devices, accounting for a significant portion of the market. This dominance is attributed to the high volume of acute ischemic stroke interventions, aneurysm coiling, and complex neurointerventional procedures performed in tertiary and comprehensive stroke centers, coupled with the availability of hybrid operating rooms, biplane angiography suites, and multidisciplinary neurocritical care teams. The increasing number of stroke cases in the Gulf region, emphasis on door-to-needle and door-to-groin time metrics, and expansion of 24/7 neurointerventional call coverage further bolster the demand for neurovascular devices in these settings.

The UAE Neurovascular Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Stryker Corporation, Cerenovus (Johnson & Johnson MedTech), Boston Scientific Corporation, Terumo Corporation, Abbott Laboratories, Penumbra, Inc., MicroVention, Inc. (Terumo Group), Asahi Intecc Co., Ltd., B. Braun Melsungen AG, Balt Group, Phenox GmbH (Wallaby Medical), MicroPort Scientific Corporation, Sequent Medical (Aliso Viejo, part of Terumo/MicroVention legacy), Local and regional distributors active in UAE neurovascular segment (e.g., Gulf Drug LLC, Leader Healthcare Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE neurovascular devices market appears promising, driven by technological advancements and increasing healthcare investments. The integration of artificial intelligence in diagnostics and treatment planning is expected to enhance patient outcomes significantly. Additionally, the shift towards personalized medicine will likely lead to tailored treatment options, improving the efficacy of neurovascular interventions. As healthcare infrastructure continues to develop, the market is poised for substantial growth, addressing the rising demand for innovative neurovascular solutions.

| Segment | Sub-Segments |

|---|---|

| By Device Type | Cerebral embolization and aneurysm coiling devices Cerebral angioplasty and stenting systems Neurothrombectomy devices Support devices (guidewires, microcatheters, distal access catheters) Transradial access devices Others |

| By End-User | Hospitals and surgical centers Ambulatory care centers Specialty clinics Research laboratories and academic institutes Others |

| By Application | Ischemic stroke treatment Aneurysm treatment Arteriovenous malformation & fistula treatment Intracerebral hemorrhage management Others |

| By Distribution Channel | Direct sales to hospitals and surgical centers Local distributors and importers Group purchasing organizations (GPOs) and tender-based procurement Online and e-procurement platforms Others |

| By Region | Abu Dhabi Dubai Sharjah Northern Emirates (Ajman, Umm Al Quwain, Ras Al Khaimah, Fujairah) |

| By Technology | Embolization & coiling technology Balloon and stent-based technology Mechanical thrombectomy technology Flow diversion and flow disruption technology Access & support technologies Others |

| By Patient Demographics | Age group (pediatric, adult, geriatric) Gender Presence of comorbidities (hypertension, diabetes, atrial fibrillation, obesity) Insurance coverage status (public, private, self-pay) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Neurosurgery Device Utilization | 60 | Neurosurgeons, Interventional Radiologists |

| Hospital Procurement Insights | 50 | Procurement Managers, Supply Chain Directors |

| Device Distribution Channels | 45 | Medical Device Distributors, Sales Representatives |

| Clinical Adoption Rates | 55 | Healthcare Administrators, Clinical Managers |

| Market Trends and Innovations | 40 | Medical Researchers, Product Development Managers |

The UAE Neurovascular Devices Market is valued at approximately USD 400 million, based on historical analysis and its share of the broader Middle East neurovascular devices market, which is estimated at around USD 538 million.