Region:Global

Author(s):Rebecca

Product Code:KRAA2841

Pages:93

Published On:August 2025

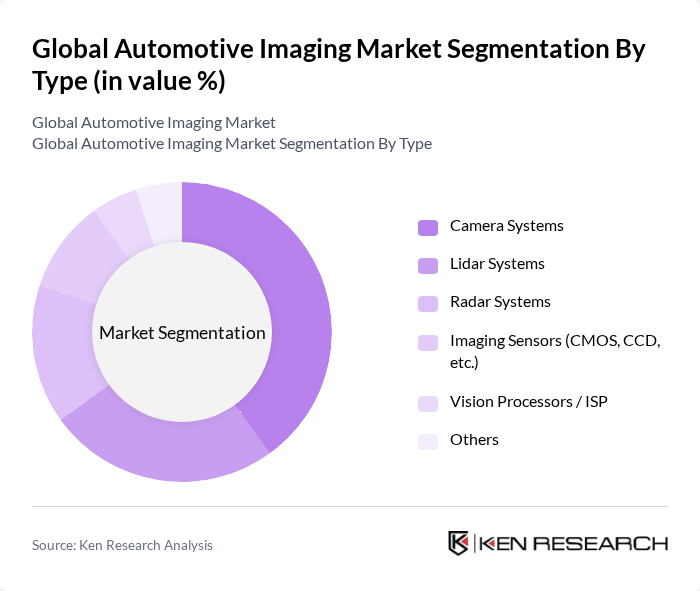

By Type:The automotive imaging market can be segmented into various types, including Camera Systems, Lidar Systems, Radar Systems, Imaging Sensors (CMOS, CCD, etc.), Vision Processors / ISP, and Others. Each of these sub-segments plays a crucial role in enhancing vehicle safety and automation.

The Camera Systems sub-segment is currently dominating the market due to their widespread application in ADAS and autonomous driving technologies. These systems provide critical visual data for functionalities such as parking assistance, collision detection, and lane departure warnings. The increasing consumer preference for safety features in vehicles and regulatory mandates for advanced safety technologies are driving the demand for camera systems, making them a key focus for manufacturers. This sub-segment is expected to maintain its leadership position in the automotive imaging market .

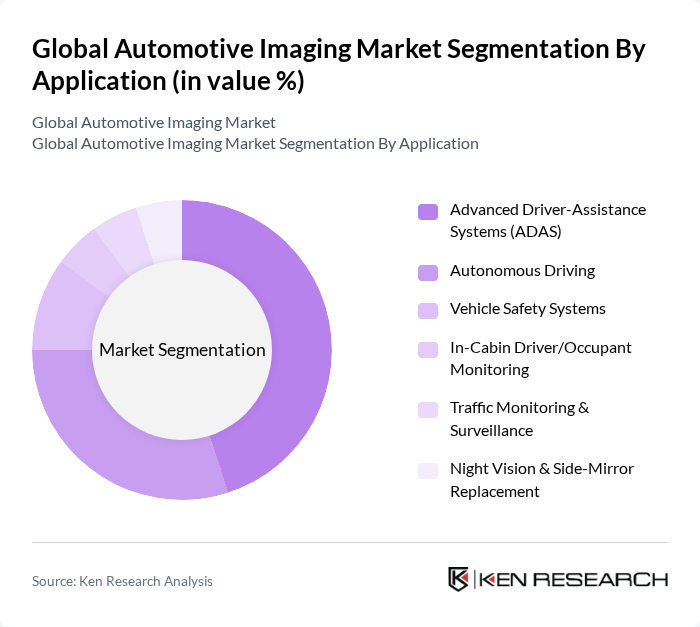

By Application:The automotive imaging market can also be segmented by application, which includes Advanced Driver-Assistance Systems (ADAS), Autonomous Driving, Vehicle Safety Systems, In-Cabin Driver/Occupant Monitoring, Traffic Monitoring & Surveillance, Night Vision & Side-Mirror Replacement, and Others. Each application serves a unique purpose in enhancing vehicle functionality and safety.

The Advanced Driver-Assistance Systems (ADAS) application is leading the market due to the increasing emphasis on vehicle safety and the growing adoption of smart technologies in automobiles. ADAS features, such as adaptive cruise control, automatic emergency braking, and lane-keeping assistance, rely heavily on imaging technologies to function effectively. The rising consumer awareness regarding road safety and the regulatory push for enhanced safety features are further propelling the growth of this application segment .

The Global Automotive Imaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Continental AG, Bosch Mobility Solutions, Denso Corporation, Valeo SA, Aptiv PLC, Magna International Inc., NXP Semiconductors N.V., Texas Instruments Incorporated, Sony Group Corporation, Omnivision Technologies, Inc., STMicroelectronics N.V., Infineon Technologies AG, ON Semiconductor Corporation, Renesas Electronics Corporation, FLIR Systems, Inc., Robert Bosch GmbH, Basler AG, Panasonic Corporation, Mobileye Global Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The automotive imaging market is poised for transformative growth, driven by technological advancements and increasing safety regulations. The integration of AI and machine learning in imaging systems is expected to enhance functionality, improving vehicle safety and user experience. Additionally, the rise of connected vehicles will further propel the demand for sophisticated imaging solutions, as manufacturers seek to leverage data for enhanced performance and safety features. The focus on sustainability will also shape future developments in imaging technologies, promoting eco-friendly manufacturing practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Camera Systems Lidar Systems Radar Systems Imaging Sensors (CMOS, CCD, etc.) Vision Processors / ISP Others |

| By Application | Advanced Driver-Assistance Systems (ADAS) Autonomous Driving Vehicle Safety Systems In-Cabin Driver/Occupant Monitoring Traffic Monitoring & Surveillance Night Vision & Side-Mirror Replacement Others |

| By End-User | OEMs (Original Equipment Manufacturers) Aftermarket Fleet Operators Robotaxis and Shuttles Government Agencies Others |

| By Component | Hardware Software Services |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Distribution Mode | Retail Wholesale E-commerce |

| By Price Range | Low-End Mid-Range High-End |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles Heavy Commercial Vehicles Electric & Hybrid Vehicles Others |

| By Level of Automation | SAE Level 0–1 SAE Level 2 SAE Level 2+ SAE Level 3 SAE Level 4+ |

| By Imaging Technology | D CMOS D ToF / Structured Light Mechanical LiDAR Solid-State LiDAR D Imaging Radar |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive OEMs | 100 | Product Development Managers, Engineering Directors |

| Aftermarket Imaging Solutions | 60 | Sales Managers, Technical Support Engineers |

| Automotive Technology Suppliers | 50 | Supply Chain Managers, R&D Specialists |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Automotive Industry Analysts | 40 | Market Analysts, Research Directors |

The Global Automotive Imaging Market is valued at approximately USD 9 billion, driven by the increasing demand for advanced driver-assistance systems (ADAS) and the rising adoption of autonomous vehicles, among other factors.