Region:Global

Author(s):Geetanshi

Product Code:KRAD0036

Pages:100

Published On:August 2025

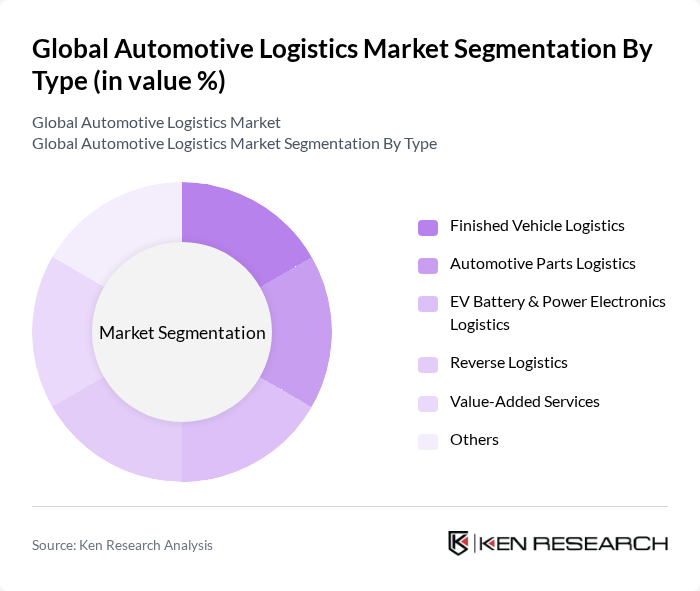

By Type:The automotive logistics market is segmented into Finished Vehicle Logistics, Automotive Parts Logistics, EV Battery & Power Electronics Logistics, Reverse Logistics, Value-Added Services, and Others. Finished Vehicle Logistics remains a significant segment, driven by increasing global vehicle production and the need for efficient transportation solutions. Automotive Parts Logistics is also expanding, supported by the rising demand for spare parts, aftermarket components, and essential vehicle assemblies, especially as electric vehicle adoption accelerates and supply chains become more complex .

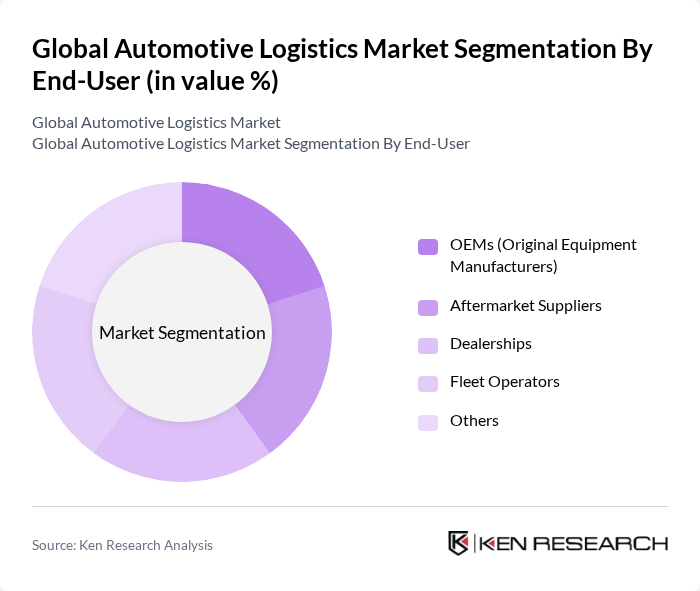

By End-User:The market is also segmented by end-user, including OEMs (Original Equipment Manufacturers), Aftermarket Suppliers, Dealerships, Fleet Operators, and Others. OEMs are the leading end-users, requiring extensive logistics services to manage the supply chain for vehicle production and distribution. The aftermarket segment is also significant, driven by growing demand for spare parts, accessories, and maintenance services as vehicle parc expands globally .

The Global Automotive Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, XPO Logistics, C.H. Robinson, GEODIS, Nippon Express, CEVA Logistics, Penske Logistics, Ryder Supply Chain Solutions, Expeditors International, DSV A/S, Toll Group, Agility Logistics, Kintetsu World Express, Sinotrans Limited, BLG Logistics Group, SNCF Logistics, Hellmann Worldwide Logistics, and GEFCO Group contribute to innovation, geographic expansion, and service delivery in this space .

The automotive logistics market is poised for transformative growth, driven by technological innovations and evolving consumer preferences. As companies increasingly adopt automation and AI, operational efficiencies will improve, reducing costs and enhancing service delivery. Additionally, the shift towards electric and autonomous vehicles will create new logistics demands, necessitating specialized transportation solutions. The focus on sustainability will further shape logistics strategies, compelling companies to invest in green practices and technologies to meet regulatory requirements and consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Type | Finished Vehicle Logistics Automotive Parts Logistics EV Battery & Power Electronics Logistics Reverse Logistics Value-Added Services Others |

| By End-User | OEMs (Original Equipment Manufacturers) Aftermarket Suppliers Dealerships Fleet Operators Others |

| By Mode of Transportation | Road Transport Rail Transport Sea / Ro-Ro / Short-Sea Transport Air Transport Others |

| By Service Type | Inbound Logistics Outbound Logistics Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Freight Forwarding Customs Brokerage Others |

| By Geographic Coverage | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Customer Type | B2B (Business to Business) B2C (Business to Consumer) C2C (Consumer to Consumer) Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive OEM Logistics | 100 | Logistics Directors, Supply Chain Managers |

| Aftermarket Parts Distribution | 60 | Warehouse Managers, Distribution Center Supervisors |

| Electric Vehicle Supply Chain | 40 | Procurement Managers, Sustainability Officers |

| Freight Forwarding Services | 50 | Operations Managers, Freight Coordinators |

| Logistics Technology Solutions | 45 | IT Managers, Logistics Software Developers |

The Global Automotive Logistics Market is valued at approximately USD 281 billion, reflecting a significant growth trend driven by the demand for efficient supply chain solutions and the rise of electric vehicles.