Region:Middle East

Author(s):Rebecca

Product Code:KRAB8747

Pages:83

Published On:October 2025

Market.png)

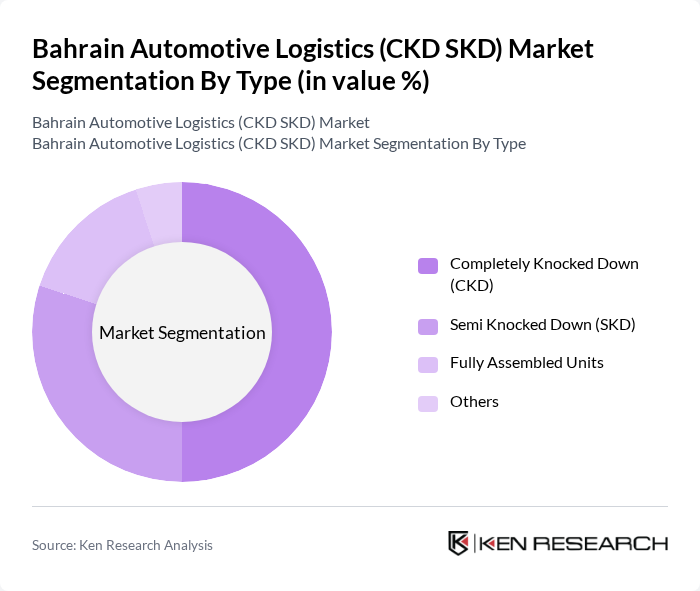

By Type:

The segmentation by type includes Completely Knocked Down (CKD), Semi Knocked Down (SKD), Fully Assembled Units, and Others. Among these, the Completely Knocked Down (CKD) segment is leading the market due to its cost-effectiveness and flexibility in assembly. Automotive manufacturers prefer CKD kits as they allow for localized assembly, reducing import duties and transportation costs. The SKD segment also shows significant demand, particularly from manufacturers looking to minimize logistics costs while maintaining quality control. Fully assembled units are less favored due to higher shipping costs and tariffs.

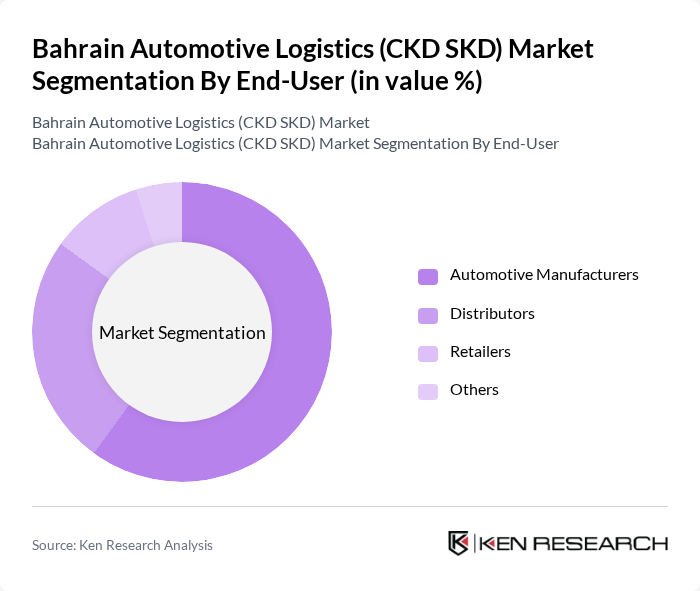

By End-User:

This segmentation includes Automotive Manufacturers, Distributors, Retailers, and Others. Automotive Manufacturers dominate the market, driven by the increasing number of assembly plants in Bahrain and the surrounding regions. These manufacturers are focusing on local assembly to cater to the growing demand for vehicles while minimizing costs. Distributors and retailers also play a crucial role, as they facilitate the supply chain and ensure that vehicles reach consumers efficiently. The Others category includes service providers and logistics companies that support the automotive supply chain.

The Bahrain Automotive Logistics (CKD SKD) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Agency Company (GAC), Agility Logistics, DB Schenker, Kuehne + Nagel, DHL Supply Chain, CEVA Logistics, Aramex, FedEx Logistics, Maersk Logistics, Panalpina, XPO Logistics, UPS Supply Chain Solutions, Yusen Logistics, Rhenus Logistics, and Toll Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive logistics market in Bahrain appears promising, driven by increasing demand for electric vehicles and advancements in logistics technology. As e-commerce continues to expand, logistics providers are likely to adopt innovative solutions to enhance efficiency and customer satisfaction. Additionally, government support for local assembly initiatives will likely attract international automotive brands, further solidifying Bahrain's position as a key logistics hub in the region, fostering sustainable growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Completely Knocked Down (CKD) Semi Knocked Down (SKD) Fully Assembled Units Others |

| By End-User | Automotive Manufacturers Distributors Retailers Others |

| By Distribution Mode | Road Transport Sea Freight Air Freight Others |

| By Sales Channel | Direct Sales Online Sales Third-Party Logistics Providers Others |

| By Component | Transportation Services Warehousing Services Customs Clearance Services Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Application | Passenger Vehicles Commercial Vehicles Electric Vehicles Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| CKD Logistics Operations | 100 | Logistics Managers, Supply Chain Analysts |

| SKD Assembly Processes | 80 | Operations Managers, Production Supervisors |

| Customs and Regulatory Compliance | 60 | Customs Officers, Compliance Managers |

| Automotive Parts Distribution | 70 | Warehouse Managers, Distribution Coordinators |

| Market Trends and Insights | 90 | Industry Analysts, Market Researchers |

The Bahrain Automotive Logistics (CKD SKD) Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by increasing demand for automotive assembly and Bahrain's strategic position as a logistics hub in the GCC region.