Region:Middle East

Author(s):Geetanshi

Product Code:KRAA2295

Pages:91

Published On:August 2025

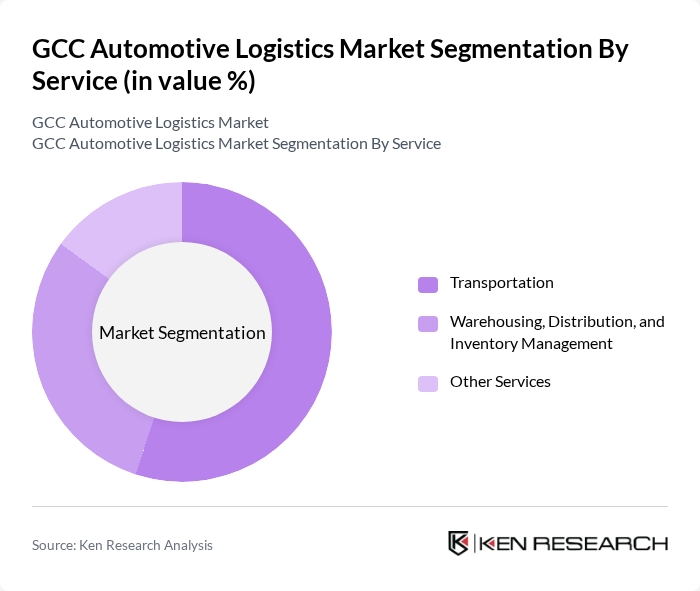

By Service:The automotive logistics market is segmented into Transportation, Warehousing, Distribution, and Inventory Management, and Other Services. Transportation is the leading segment, driven by the increasing demand for efficient vehicle delivery and the expansion of road networks in the GCC region. Warehousing and distribution services are also crucial, as they support the growing e-commerce sector and the need for effective inventory management. The adoption of advanced logistics technologies and the integration of sustainable practices are further enhancing service efficiency .

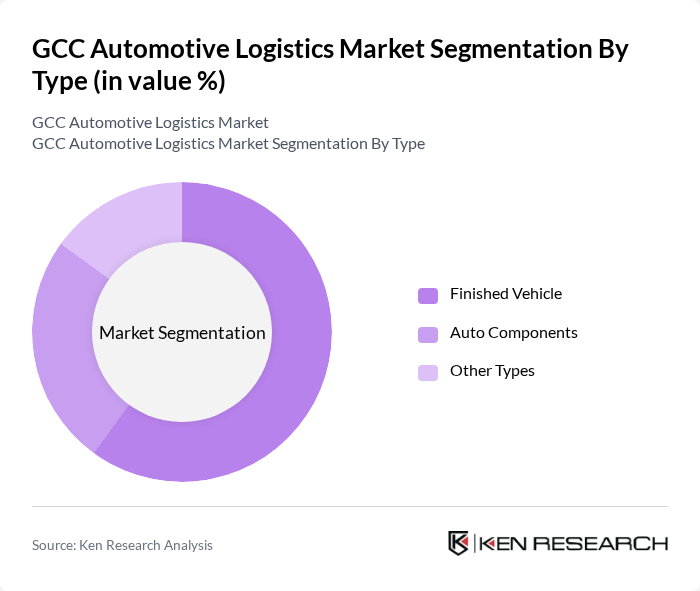

By Type:This market is categorized into Finished Vehicle, Auto Components, and Other Types. The Finished Vehicle segment holds the largest share, driven by the increasing production and sales of vehicles in the region. The demand for auto components is also significant, as manufacturers seek efficient logistics solutions to support their supply chains. The rise in local manufacturing and the establishment of regional production hubs are further propelling the auto components segment .

The GCC Automotive Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, Agility Logistics, CEVA Logistics, Almajdouie Logistics, Al-Futtaim Logistics, GEFCO, Yusen Logistics, DP World, Aramex, Bahri (The National Shipping Company of Saudi Arabia), Hellmann Worldwide Logistics, Tristar Transport, MOSOLF Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC automotive logistics market appears promising, driven by technological advancements and a focus on sustainability. As digital transformation accelerates, logistics providers are expected to adopt innovative solutions such as AI and IoT to enhance operational efficiency. Additionally, the shift towards electric vehicles will create new logistics demands, prompting companies to adapt their strategies. Overall, the market is poised for growth, with significant opportunities arising from evolving consumer preferences and regulatory frameworks.

| Segment | Sub-Segments |

|---|---|

| By Service | Transportation Warehousing, Distribution, and Inventory Management Other Services |

| By Type | Finished Vehicle Auto Components Other Types |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman |

| By Distribution Mode | Road Transport Rail Transport Air Transport Sea Transport |

| By Service Type | Full Truck Load (FTL) Less Than Truck Load (LTL) Dedicated Contract Carriage |

| By Packaging Type | Bulk Packaging Unit Load Devices Custom Packaging |

| By Fleet Type | Owned Fleet Leased Fleet Third-Party Fleet |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturer Logistics | 100 | Logistics Managers, Supply Chain Analysts |

| Third-Party Logistics Providers | 80 | Operations Directors, Business Development Managers |

| Automotive Parts Distribution | 60 | Warehouse Managers, Inventory Control Specialists |

| Vehicle Transportation Services | 50 | Fleet Managers, Transport Coordinators |

| Emerging Technologies in Logistics | 40 | IT Managers, Innovation Leads |

The GCC Automotive Logistics Market is valued at approximately USD 6.4 billion, driven by increased vehicle production, demand for efficient supply chain solutions, and the growth of e-commerce in the region.