Region:Global

Author(s):Dev

Product Code:KRAA3073

Pages:91

Published On:August 2025

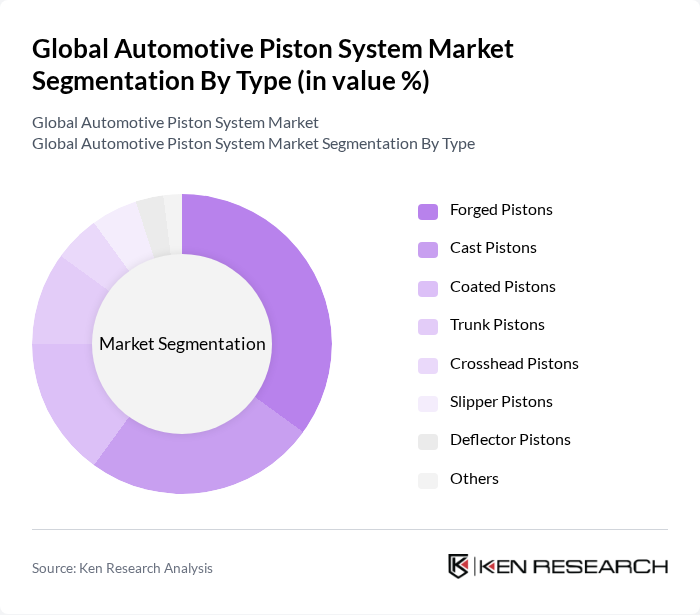

By Type:The automotive piston system market is segmented into forged pistons, cast pistons, coated pistons, trunk pistons, crosshead pistons, slipper pistons, deflector pistons, and others.Forged pistonsare gaining traction due to their superior strength, lightweight properties, and suitability for high-performance and heavy-duty applications.Cast pistonsremain widely used, but are increasingly challenged by advancements in forged piston technology and material science.Coated pistonsare experiencing rising demand, as advanced coatings improve durability, reduce friction, and enhance thermal resistance—attributes valued by both OEMs and aftermarket segments.Other types, including trunk, crosshead, slipper, and deflector pistons, serve specialized roles in commercial and industrial engines, with ongoing innovation focused on weight reduction and thermal management.

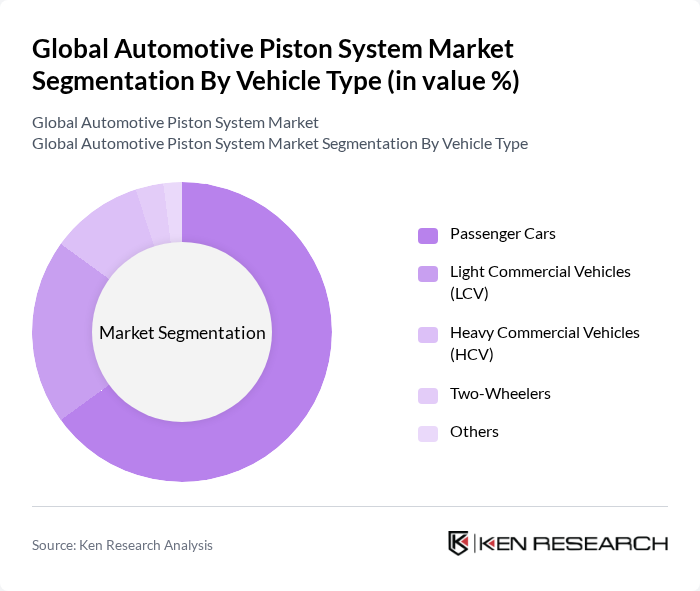

By Vehicle Type:The market is segmented by vehicle type, including passenger cars, light commercial vehicles (LCV), heavy commercial vehicles (HCV), two-wheelers, and others.Passenger carsdominate the market, accounting for the majority share due to high production volumes and strong consumer demand for personal mobility.Light commercial vehiclesare witnessing notable growth, driven by the expansion of e-commerce and logistics sectors.Heavy commercial vehiclesmaintain steady demand, particularly in regions with robust infrastructure and industrial activity.Two-wheelersand other vehicle segments contribute to overall market diversity, with ongoing innovation in piston design to meet evolving performance and emissions requirements.

The Global Automotive Piston System Market is characterized by a dynamic mix of regional and international players. Leading participants such as MAHLE GmbH, Federal-Mogul LLC (Tenneco Inc.), Aisin Seiki Co., Ltd., Hitachi Astemo, Ltd., Toyota Industries Corporation, Rheinmetall AG (KSPG/Kolbenschmidt), Shriram Pistons & Rings Ltd., India Pistons Limited, Capricorn Automotive Ltd., CP-Carrillo, Inc., Arias Pistons, Ross Racing Pistons, Piston Automotive LLC, ElringKlinger AG, Sogefi S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The automotive piston system market is poised for transformative growth, driven by the ongoing shift towards electric and hybrid vehicles. As manufacturers adapt to changing consumer preferences, innovations in piston technology will play a crucial role in enhancing engine performance and efficiency. Additionally, the integration of smart technologies in automotive systems is expected to redefine traditional piston applications, creating new avenues for growth. The focus on sustainability will further influence manufacturing processes, leading to a more environmentally friendly industry landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Forged Pistons Cast Pistons Coated Pistons Trunk Pistons Crosshead Pistons Slipper Pistons Deflector Pistons Others |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles (LCV) Heavy Commercial Vehicles (HCV) Two-Wheelers Others |

| By Engine Type | Gasoline Engines Diesel Engines Hybrid Engines Others |

| By Material | Aluminum Steel Composite Materials Others |

| By Application | OEM Automotive Manufacturing Aftermarket Replacement Performance/High-Performance Vehicles Others |

| By Distribution Channel | Direct Sales Distributors/Dealers Online Sales Others |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| OEM Piston System Manufacturers | 60 | Product Development Engineers, R&D Managers |

| Aftermarket Parts Distributors | 50 | Sales Managers, Supply Chain Coordinators |

| Automotive Service Centers | 40 | Service Managers, Automotive Technicians |

| Automotive Industry Analysts | 40 | Market Analysts, Industry Consultants |

| Regulatory Bodies and Standards Organizations | 40 | Policy Makers, Compliance Officers |

The Global Automotive Piston System Market is valued at approximately USD 2.7 billion, reflecting a five-year historical analysis. This valuation is influenced by the increasing demand for fuel-efficient vehicles and advancements in piston technology.