Region:Middle East

Author(s):Dev

Product Code:KRAC4149

Pages:82

Published On:October 2025

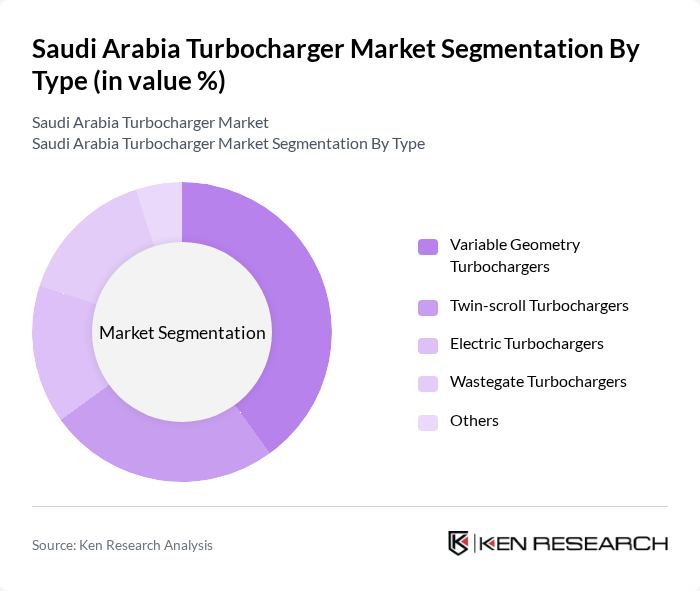

By Type:The market is segmented into various types of turbochargers, including Variable Geometry Turbochargers, Twin-scroll Turbochargers, Electric Turbochargers, Wastegate Turbochargers, and Others. Among these, Variable Geometry Turbochargers are leading due to their efficiency in optimizing engine performance across different speeds and loads. The growing trend towards high-performance vehicles and the need for better fuel economy are driving the demand for this sub-segment. Electric turbochargers are emerging as the fastest-growing segment, expanding at a 19.11% CAGR as 48V mild-hybrid systems proliferate across the automotive industry.

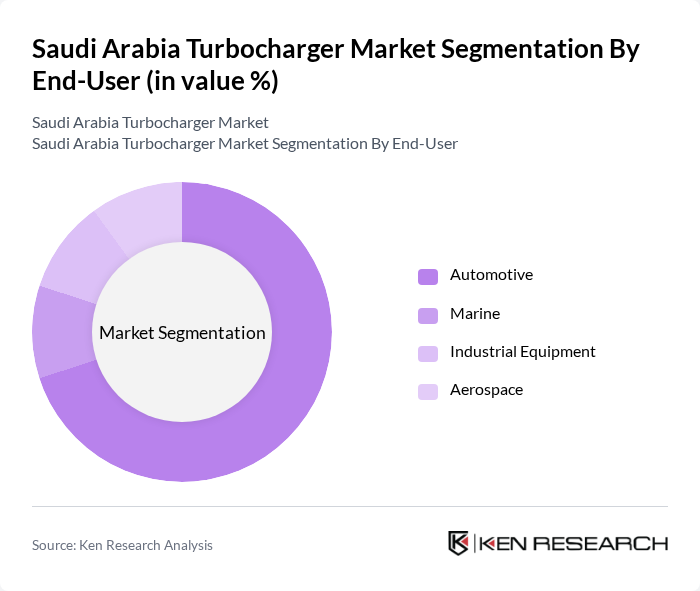

By End-User:The turbocharger market is segmented by end-users, including Automotive, Marine, Industrial Equipment, and Aerospace. The automotive sector is the dominant end-user, driven by the increasing production of fuel-efficient vehicles and the rising consumer preference for performance-oriented cars. The demand for turbochargers in commercial vehicles is also growing, as manufacturers seek to enhance engine efficiency and reduce emissions.

The Saudi Arabia Turbocharger Market is characterized by a dynamic mix of regional and international players. Leading participants such as Garrett Motion Inc., BorgWarner Inc., Honeywell International Inc., Mitsubishi Heavy Industries, Ltd., IHI Corporation, Continental AG, Cummins Inc., Eaton Corporation, Mahle GmbH, Delphi Technologies, Bosch GmbH, Tenneco Inc., Valeo SA, Aisin Seiki Co., Ltd., Hitachi Automotive Systems, Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia turbocharger market appears promising, driven by technological advancements and a growing emphasis on sustainability. As manufacturers increasingly adopt hybrid and electric turbocharging solutions, the market is expected to evolve significantly. Additionally, the integration of smart technologies into turbocharger systems will enhance performance and efficiency, aligning with global automotive trends. The government's commitment to supporting the automotive sector will further bolster market growth, creating a conducive environment for innovation and investment in turbocharger technologies.

| Segment | Sub-Segments |

|---|---|

| By Type | Variable Geometry Turbochargers Twin-scroll Turbochargers Electric Turbochargers Wastegate Turbochargers Others |

| By End-User | Automotive Marine Industrial Equipment Aerospace |

| By Application | Passenger Vehicles Commercial Vehicles Heavy Machinery Power Generation |

| By Component | Turbocharger Housing Compressor Wheel Turbine Wheel Actuator |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Wholesale Retail E-commerce |

| By Price Range | Low Price Mid Price High Price |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| OEM Turbocharger Integration | 60 | Product Development Engineers, Procurement Managers |

| Aftermarket Turbocharger Sales | 50 | Sales Managers, Marketing Directors |

| Turbocharger Repair Services | 40 | Service Center Owners, Automotive Technicians |

| Fuel Efficiency Regulations Impact | 40 | Regulatory Affairs Specialists, Compliance Managers |

| Consumer Preferences in Turbocharged Vehicles | 50 | Automotive Enthusiasts, General Consumers |

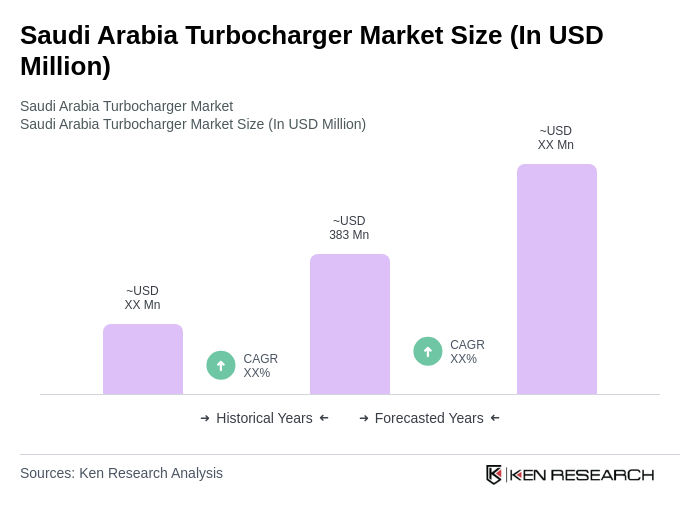

The Saudi Arabia Turbocharger Market is valued at approximately USD 383 million, reflecting a significant growth trend driven by the increasing demand for fuel-efficient vehicles and stringent emission regulations in the automotive sector.