Region:Middle East

Author(s):Geetanshi

Product Code:KRAA9022

Pages:84

Published On:November 2025

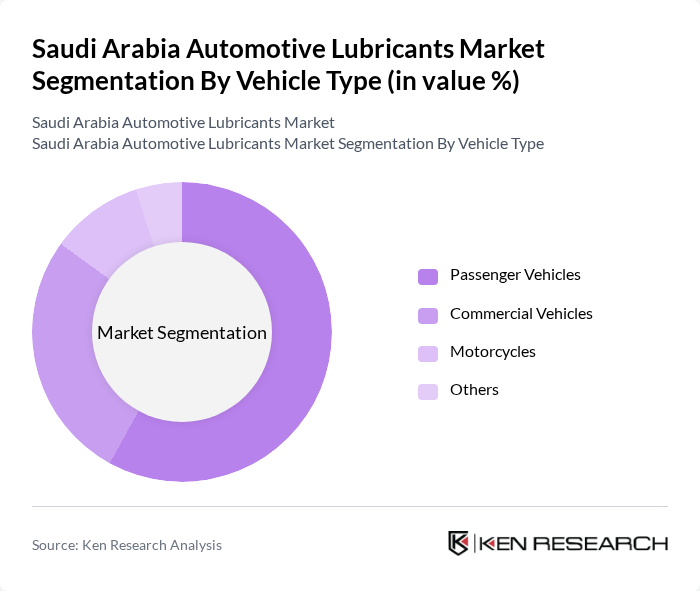

By Vehicle Type:The automotive lubricants market is segmented by vehicle type into passenger vehicles, commercial vehicles, motorcycles, and others. Among these, passenger vehicles dominate the market due to the high number of personal vehicles in Saudi Arabia. The increasing disposable income and urbanization have led to a surge in passenger vehicle ownership, driving the demand for lubricants tailored for these vehicles. Commercial vehicles also represent a significant segment, supported by the growing logistics and transportation sectors, especially with infrastructure projects and economic diversification under Vision 2030. The adoption of electric and hybrid vehicles is also influencing lubricant demand, with new formulations being developed for these segments .

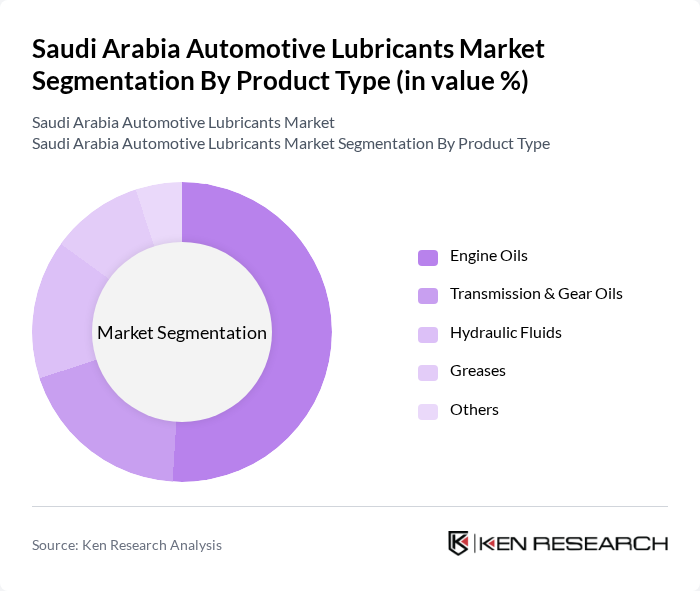

By Product Type:The market is also segmented by product type, including engine oils, transmission & gear oils, hydraulic fluids, greases, and others. Engine oils are the leading product type, driven by the necessity for regular oil changes in vehicles and the increasing demand for high-performance lubricants, especially synthetic and low-viscosity oils suitable for modern engines and harsh climatic conditions. Transmission & gear oils follow closely, as they are essential for the smooth operation of vehicles, particularly in commercial applications where heavy-duty performance is required. Hydraulic fluids and greases are also gaining traction due to their applications in specialized and commercial vehicles .

The Saudi Arabia Automotive Lubricants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Aramco, Al-Jomaih and Shell Lubricating Oil Company (Shell Saudi Arabia), TotalEnergies Marketing Saudi Arabia, Castrol (BP PLC), ExxonMobil Saudi Arabia, FUCHS Lubricants Arabia, Gulf Oil Middle East Limited, Petromin Corporation, Zahrat Al Waha for Trading Company, Al-Muhaidib Group, Alesayi Group, National Oil & Lubricants Company, Al-Futtaim Automotive Saudi Arabia, Al-Babtain Group, and Al-Hokair Group contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Saudi Arabia automotive lubricants market appears promising, driven by technological advancements and evolving consumer preferences. The shift towards eco-friendly lubricants is expected to gain momentum, aligning with global sustainability trends. Additionally, the integration of digital technologies in supply chain management will enhance operational efficiency. As the market adapts to these changes, companies that invest in research and development will likely lead the way in innovation, catering to the growing demand for high-performance and environmentally friendly products.

| Segment | Sub-Segments |

|---|---|

| By Vehicle Type | Passenger Vehicles Commercial Vehicles Motorcycles Others |

| By Product Type | Engine Oils Transmission & Gear Oils Hydraulic Fluids Greases Others |

| By End-User | Individual Consumers Fleet Operators Government & Institutional Others |

| By Distribution Channel | OEMs Aftermarket/Retail Outlets Online Sales Distributors Direct Sales Others |

| By Packaging Type | Bulk Packaging Retail Packaging Others |

| By Brand Type | Premium Brands Mid-Range Brands Economy Brands Others |

| By Region | Central Region Eastern Region Western Region Southern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Service Centers | 150 | Service Managers, Workshop Owners |

| Lubricant Distributors | 100 | Distribution Managers, Sales Representatives |

| Automotive Manufacturers | 80 | Procurement Managers, Product Development Engineers |

| End-Users (Vehicle Owners) | 120 | Car Owners, Fleet Managers |

| Industry Experts | 40 | Automotive Analysts, Lubricant Technologists |

The Saudi Arabia Automotive Lubricants Market is valued at approximately USD 750 million, driven by factors such as increasing vehicle ownership, consumer awareness regarding maintenance, and advancements in lubricant technology.