Region:Global

Author(s):Shubham

Product Code:KRAB0538

Pages:94

Published On:August 2025

By Type:The automotive sensors market is segmented into various types, including pressure sensors, temperature sensors, proximity/ultrasonic sensors, speed and RPM sensors, position and level sensors, light and imaging sensors, inertial and motion sensors, radar, lidar, and ToF sensors, gas and chemical sensors, magnetic and Hall-effect sensors, and others. Among these, pressure sensors are leading the market due to their critical role in tire pressure monitoring, brake/ESC systems, fuel and oil monitoring, and engine management, where high-volume, regulatory-driven applications sustain leadership. The increasing focus on fuel efficiency and emissions control further drives the demand for temperature and gas sensors, including oxygen and NOx sensors used in emissions aftertreatment and thermal management for ICE and electrified powertrains.

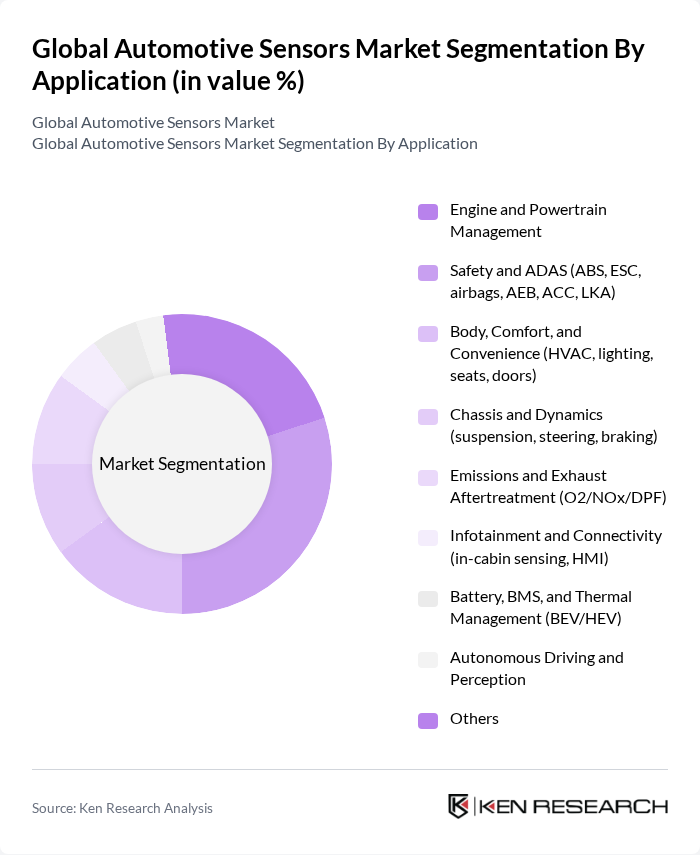

By Application:The automotive sensors market is also segmented by application, which includes engine and powertrain management, safety and ADAS, body, comfort, and convenience, chassis and dynamics, emissions and exhaust aftertreatment, infotainment and connectivity, battery management systems, and autonomous driving. The safety and ADAS segment is currently the most dominant due to regulatory requirements under frameworks like the EU GSR and NCAP roadmaps, as well as growing consumer demand for features such as AEB, ACC, and LKA that rely on camera, radar, lidar/ToF, ultrasonic, and inertial sensors.

The Global Automotive Sensors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Robert Bosch GmbH, Continental AG, DENSO Corporation, Honeywell International Inc., NXP Semiconductors N.V., Infineon Technologies AG, STMicroelectronics N.V., Texas Instruments Incorporated, Analog Devices, Inc., BorgWarner Inc. (incl. former Delphi Technologies), Autoliv Inc., Valeo S.A., ZF Friedrichshafen AG, Aisin Corporation, Mitsubishi Electric Corporation, ams-OSRAM AG, ON Semiconductor Corporation (onsemi), Renesas Electronics Corporation, Aptiv PLC, HELLA GmbH & Co. KGaA (FORVIA HELLA) contribute to innovation, geographic expansion, and service delivery in this space.

The automotive sensors market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. By future, the integration of IoT technologies is expected to enhance vehicle connectivity, leading to smarter and more efficient automotive systems. Additionally, the development of autonomous vehicles will create new demand for sophisticated sensor technologies, further shaping the market landscape. As manufacturers adapt to these trends, collaboration with tech companies will be crucial for innovation and competitive advantage.

| Segment | Sub-Segments |

|---|---|

| By Type | Pressure Sensors (e.g., TPMS, fuel/oil, brake/ESP) Temperature Sensors (coolant, exhaust gas, battery/pack, cabin) Proximity/Ultrasonic Sensors (parking, low-speed ADAS) Speed and RPM Sensors (wheel speed, transmission, crank/cam) Position and Level Sensors (throttle, pedal, steering angle, fluid level) Light and Imaging Sensors (CMOS cameras, ambient light, rain) Inertial and Motion Sensors (accelerometers, gyroscopes, IMU) Radar, Lidar, and ToF Sensors Gas and Chemical Sensors (NOx, O2/Lambda, particulate, cabin air quality) Magnetic and Hall-effect Sensors Others |

| By Application | Engine and Powertrain Management Safety and ADAS (ABS, ESC, airbags, AEB, ACC, LKA) Body, Comfort, and Convenience (HVAC, lighting, seats, doors) Chassis and Dynamics (suspension, steering, braking) Emissions and Exhaust Aftertreatment (O2/NOx/DPF) Infotainment and Connectivity (in-cabin sensing, HMI) Battery, BMS, and Thermal Management (BEV/HEV) Autonomous Driving and Perception Others |

| By End-User | Passenger Vehicles (ICE, HEV, PHEV, BEV) Commercial Vehicles (LCV, M&HCV, buses, off-highway) Electric Vehicles (HEV, PHEV, BEV, FCEV) Autonomous and Robo-taxi Fleets Motorsports and Specialty Vehicles Others |

| By Distribution Channel | OEMs and Tier-1 Suppliers Aftermarket (replacement/retrofit) Online Sales and E-commerce Retail and Authorized Service Networks Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Component | Hardware (sensor ICs, MEMS, modules) Software and Algorithms (sensor fusion, perception, calibration) Services (integration, validation, testing) |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Sensors | 150 | Product Managers, Automotive Engineers |

| Commercial Vehicle Sensors | 100 | Fleet Managers, Technical Directors |

| Electric Vehicle Sensor Technologies | 80 | R&D Specialists, Battery Engineers |

| Autonomous Driving Sensors | 70 | AI Developers, Safety Compliance Officers |

| Aftermarket Sensor Solutions | 60 | Sales Managers, Distribution Executives |

The Global Automotive Sensors Market is valued at approximately USD 31 billion, driven by the increasing demand for advanced driver assistance systems (ADAS), electric vehicles (EVs), and stringent vehicle safety and emissions regulations.