Region:Global

Author(s):Geetanshi

Product Code:KRAA2302

Pages:88

Published On:August 2025

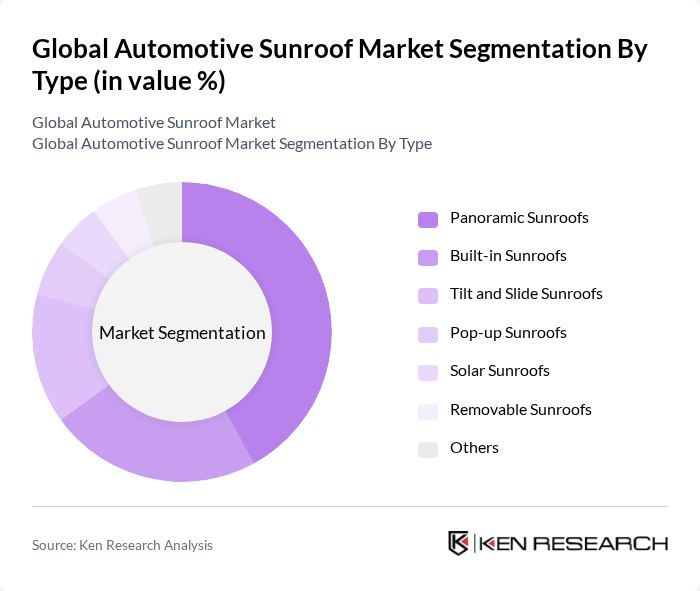

By Type:The market is segmented into various types of sunroofs, including Panoramic Sunroofs, Built-in Sunroofs, Tilt and Slide Sunroofs, Pop-up Sunroofs, Solar Sunroofs, Removable Sunroofs, and Others. Among these, Panoramic Sunroofs are gaining significant traction due to their ability to provide an expansive view and enhance the overall driving experience. Consumers are increasingly favoring vehicles equipped with panoramic options, leading to a notable rise in their adoption. Panoramic sunroofs accounted for the largest share of the market, driven by their popularity in premium and mid-range vehicles .

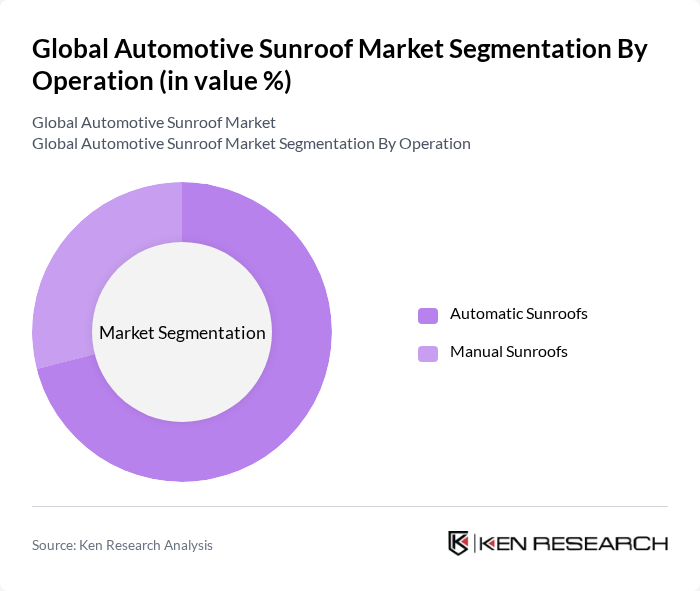

By Operation:The market is categorized into Automatic Sunroofs and Manual Sunroofs. Automatic Sunroofs are leading the market due to their convenience, integration with smart vehicle systems, and ease of use, appealing to modern consumers who prefer advanced features in their vehicles. The trend towards automation and connectivity in vehicle features has significantly boosted the demand for automatic sunroofs, making them the preferred choice among buyers .

The Global Automotive Sunroof Market is characterized by a dynamic mix of regional and international players. Leading participants such as Webasto SE, Inalfa Roof Systems B.V., Yachiyo Industry Co., Ltd., Aisin Corporation, Magna International Inc., CIE Automotive S.A., Inteva Products, LLC, Johnan Manufacturing Inc., BOS Group, Signature Automotive Products, LLC, Valmet Automotive Inc., Mitsuba Corporation, Fuyao Glass Industry Group Co., Ltd., Saint-Gobain Sekurit, AGC Inc. (Asahi Glass Co., Ltd.) contribute to innovation, geographic expansion, and service delivery in this space.

The automotive sunroof market is poised for significant evolution, driven by consumer demand for innovative features and sustainable practices. As electric and hybrid vehicles gain popularity, manufacturers are likely to integrate advanced sunroof technologies that enhance energy efficiency. Additionally, the trend towards customization will encourage manufacturers to offer diverse sunroof options, catering to individual consumer preferences. This shift will not only enhance vehicle aesthetics but also align with the growing emphasis on eco-friendly materials and designs.

| Segment | Sub-Segments |

|---|---|

| By Type | Panoramic Sunroofs Built-in Sunroofs Tilt and Slide Sunroofs Pop-up Sunroofs Solar Sunroofs Removable Sunroofs Others |

| By Operation | Automatic Sunroofs Manual Sunroofs |

| By Material | Glass Fabric Polycarbonate Metal Others |

| By Vehicle Type | Passenger Vehicles Commercial Vehicles Electric Vehicles SUVs Sedans Hatchbacks Coupes Others |

| By Distribution Channel | OEMs Aftermarket Online Sales Retail Stores |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Budget Mid-Range Premium Luxury |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Manufacturers | 100 | Product Development Managers, Design Engineers |

| Luxury Vehicle Segment | 60 | Marketing Directors, Sales Executives |

| Aftermarket Sunroof Installers | 50 | Service Managers, Installation Technicians |

| Automotive Component Suppliers | 40 | Supply Chain Managers, Procurement Specialists |

| Consumer Insights on Sunroof Preferences | 80 | Car Owners, Automotive Enthusiasts |

The Global Automotive Sunroof Market is valued at approximately USD 14.0 billion, reflecting a significant growth trend driven by consumer demand for luxury features and advancements in sunroof technology, including panoramic and solar-powered designs.