Region:Global

Author(s):Rebecca

Product Code:KRAD7504

Pages:92

Published On:December 2025

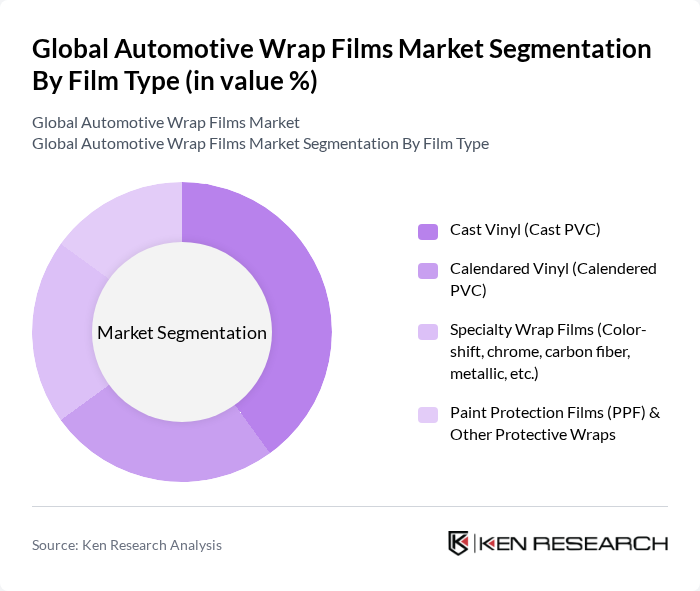

By Film Type:The film type segmentation includes various categories such as Cast Vinyl (Cast PVC), Calendared Vinyl (Calendered PVC), Specialty Wrap Films (Color-shift, chrome, carbon fiber, metallic, etc.), and Paint Protection Films (PPF) & Other Protective Wraps. Cast Vinyl is gaining traction due to its superior conformability, durability, and color stability, making it a preferred choice for full wraps and high-end vehicle customization where complex curves and long service life are required . Calendared Vinyl is also popular for its cost-effectiveness in short- to medium-term applications, such as partial wraps, graphics, and commercial branding, especially where extreme stretching is not required . Specialty Wrap Films cater to niche markets seeking unique aesthetics, including color?shift, textured, chrome, and carbon fiber effects that are particularly popular in the aftermarket and among enthusiasts . Paint Protection Films are increasingly favored for their protective qualities against stone chips, abrasion, and UV exposure, with strong adoption among owners of premium cars and fleet operators aiming to maintain residual vehicle value .

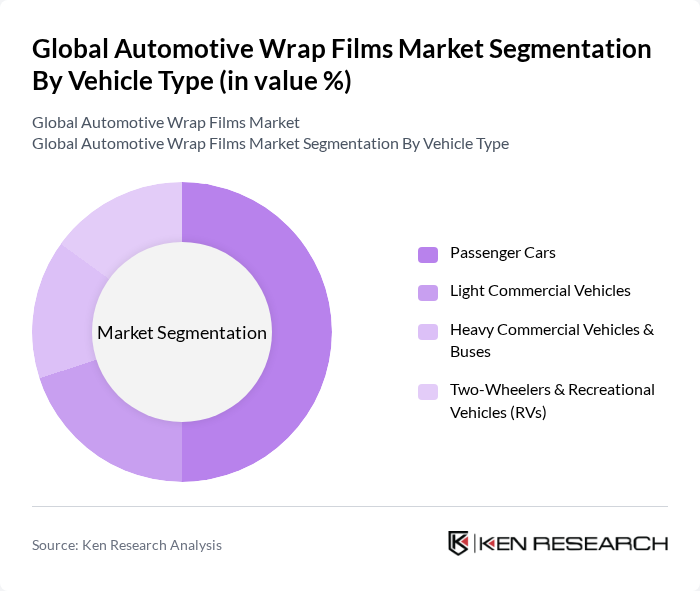

By Vehicle Type:The vehicle type segmentation encompasses Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles & Buses, and Two-Wheelers & Recreational Vehicles (RVs). Passenger Cars dominate the market due to the high volume of personal vehicles, rising sales of luxury and sports cars, and the growing trend of aesthetic customization and paint protection among individual owners . Light Commercial Vehicles are also significant, driven by businesses seeking branding solutions and mobile advertising on vans and small trucks, where full and partial wraps offer high visibility and measurable campaign effectiveness . Heavy Commercial Vehicles & Buses are increasingly adopting wrap films for large-format advertising surfaces and fleet identification, taking advantage of the extensive wrapping area and frequent use in high-traffic corridors . Two-Wheelers & RVs are gaining traction as consumers and rental operators look for unique ways to personalize, protect, and periodically refresh the appearance of motorcycles, caravans, and motorhomes without permanent repainting .

The Global Automotive Wrap Films Market is characterized by a dynamic mix of regional and international players. Leading participants such as 3M Company, Avery Dennison Corporation, ORAFOL Europe GmbH, Hexis S.A., Arlon Graphics, LLC, Ritrama S.p.A. (Fedrigoni Group), Kay Premium Marking Films Ltd. (KPMF), Mactac LLC, VViViD Vinyl Inc., Guangzhou Carbins Film Co., Ltd., Grafityp Selfadhesive Products NV, Spandex AG, Orafol Americas Inc., Inozetek Inc., TeckWrap contribute to innovation, geographic expansion, and service delivery in this space, with a strong focus on new colors and finishes, improved adhesive technologies, and longer?lasting, easier?to?install films .

The automotive wrap films market is poised for significant growth, driven by increasing consumer demand for customization and protection. As technological advancements continue to enhance film quality, the market is likely to see a rise in adoption rates. Additionally, sustainability trends will push manufacturers to develop eco-friendly materials, aligning with consumer preferences for environmentally responsible products. The expansion into emerging markets will further bolster growth, as awareness and acceptance of wrap films increase among diverse consumer bases.

| Segment | Sub-Segments |

|---|---|

| By Film Type | Cast Vinyl (Cast PVC) Calendared Vinyl (Calendered PVC) Specialty Wrap Films (Color?shift, chrome, carbon fiber, metallic, etc.) Paint Protection Films (PPF) & Other Protective Wraps |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles Heavy Commercial Vehicles & Buses Two?Wheelers & Recreational Vehicles (RVs) |

| By Application | Color Change & Restyling Wraps Fleet & Commercial Graphics Paint Protection & Protective Wraps Window, Roof & Accent Wraps |

| By Material Technology | Polyvinyl Chloride (PVC) Films Polyurethane & Thermoplastic Polyolefin (TPO) Films Polymeric & Monomeric Plasticized Films Reflective, Metallic & Other Advanced Materials |

| By Finish Type | Gloss & High?Gloss Finish Matte & Satin Finish Textured & Special Effect Finishes (Carbon fiber, brushed, etc.) Chrome, Color?Shift & Other Specialty Finishes |

| By Distribution Channel | Direct Sales to OEMs & Large Fleets Distributors & Wholesalers Specialty Wrap & Sign Shops Online Retail & Marketplace Platforms |

| By Geographic Region | North America Europe Asia?Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Wrap Film Manufacturers | 60 | Product Managers, R&D Directors |

| Vehicle Customization Shops | 50 | Shop Owners, Lead Installers |

| Fleet Management Companies | 40 | Fleet Managers, Procurement Officers |

| Automotive Trade Shows and Exhibitions | 40 | Exhibitors, Attendees, Industry Experts |

| End-Users of Wrap Films | 60 | Vehicle Owners, Branding Managers |

The Global Automotive Wrap Films Market is valued at approximately USD 3.1 billion, driven by increasing demand for vehicle customization, protection, and branding solutions. This market is expected to grow significantly due to rising disposable incomes and consumer preferences for unique finishes.