Region:Middle East

Author(s):Shubham

Product Code:KRAA8697

Pages:88

Published On:November 2025

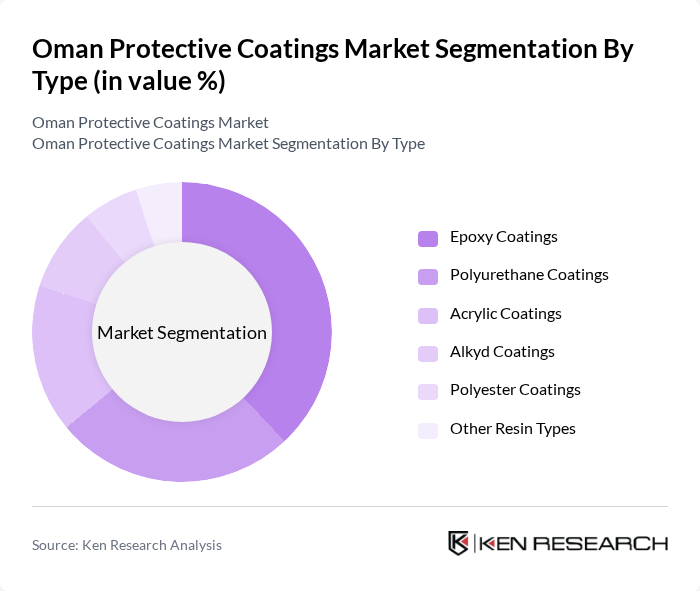

By Type:The protective coatings market in Oman is segmented into epoxy, polyurethane, acrylic, alkyd, polyester, and other resin types. Epoxy coatings hold the largest share due to their superior adhesion, chemical resistance, and durability, making them the preferred choice for industrial and marine applications. Polyurethane coatings are gaining popularity for their flexibility and UV resistance, especially in automotive and architectural uses. Acrylic and alkyd coatings are favored in residential and commercial projects for their cost-effectiveness and ease of application. Water-borne technologies are increasingly adopted across all types due to environmental regulations and user safety .

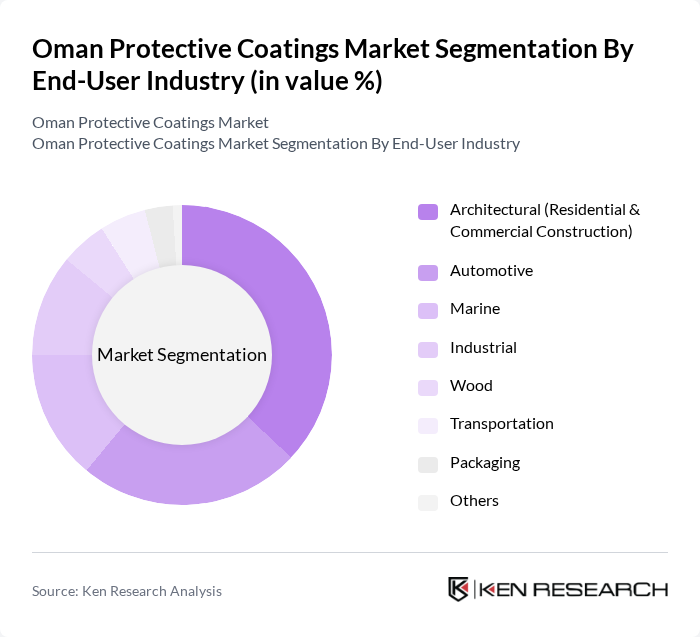

By End-User Industry:Key end-user industries for protective coatings in Oman include architectural (residential and commercial construction), automotive, marine, industrial, wood, transportation, packaging, and others. The architectural segment leads the market, driven by ongoing urbanization and infrastructure development. Automotive and marine sectors follow, supported by vehicle maintenance and port infrastructure investments. Industrial applications, including oil & gas and manufacturing, also contribute significantly, with demand for specialized coatings to withstand harsh environments and ensure asset longevity .

The Oman Protective Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jotun Group, PPG Industries, AkzoNobel, Sherwin-Williams, BASF Coatings, RPM International, Hempel, Asian Paints, Berger Paints, Nippon Paint, National Paints Factories Co. Ltd., Sika AG, DuPont, Valspar, Oman Paints Company LLC contribute to innovation, geographic expansion, and service delivery in this space.

The Oman protective coatings market is poised for significant growth, driven by increasing construction activities and a shift towards sustainable products. In future, the market is expected to see a rise in demand for eco-friendly coatings, spurred by government incentives and consumer preferences. Additionally, advancements in coating technologies will likely enhance product offerings, making them more appealing across various sectors. As the market evolves, strategic partnerships and collaborations will play a crucial role in addressing challenges and capitalizing on emerging opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Epoxy Coatings Polyurethane Coatings Acrylic Coatings Alkyd Coatings Polyester Coatings Other Resin Types |

| By End-User Industry | Architectural (Residential & Commercial Construction) Automotive Marine Industrial Wood Transportation Packaging Others |

| By Application | Abrasion Resistance Chemical Resistance Fire Protection Heat Resistance Corrosion Resistance Pipe Coatings Tank Linings Others |

| By Technology | Water-borne Coatings Solvent-borne Coatings Powder Coatings UV-cured Coatings Nano Coatings Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Stores Others |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah Others |

| By Market Segment | Residential Commercial Industrial Government Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Coatings | 100 | Project Managers, Procurement Officers |

| Automotive Protective Coatings | 60 | Manufacturing Engineers, Quality Control Managers |

| Marine Coatings Applications | 50 | Marine Engineers, Fleet Managers |

| Industrial Coatings Market | 70 | Operations Managers, Facility Maintenance Heads |

| Consumer Goods Coatings | 40 | Product Development Managers, Marketing Directors |

The Oman Protective Coatings Market is valued at approximately USD 210 million, driven by growth in construction, industrial, and marine sectors, alongside increasing demand for high-performance and sustainable coatings.