Region:North America

Author(s):Geetanshi

Product Code:KRAA9143

Pages:85

Published On:November 2025

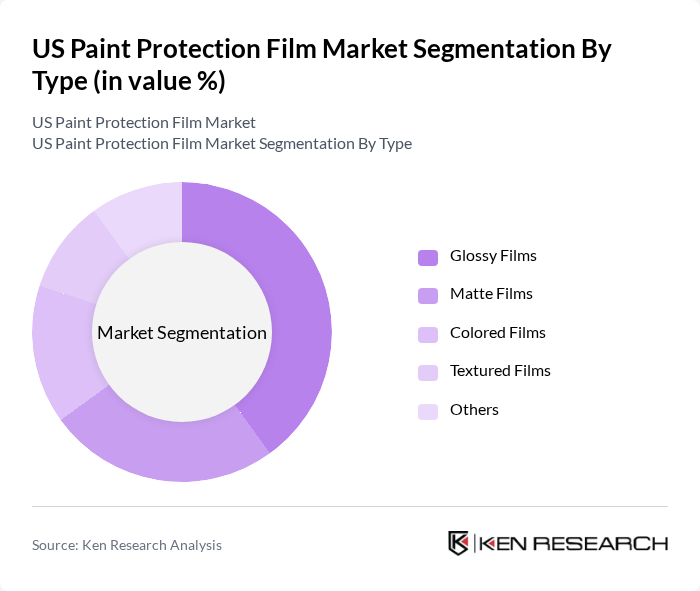

By Type:The market is segmented into various types of paint protection films, including glossy films, matte films, colored films, textured films, and others. Among these, glossy films are currently leading the market due to their popularity in enhancing the aesthetic appeal of vehicles while providing a high level of protection. Matte films are also gaining traction, particularly among luxury vehicle owners who prefer a unique finish. The demand for colored and textured films is growing as consumers seek customization options that reflect their personal style .

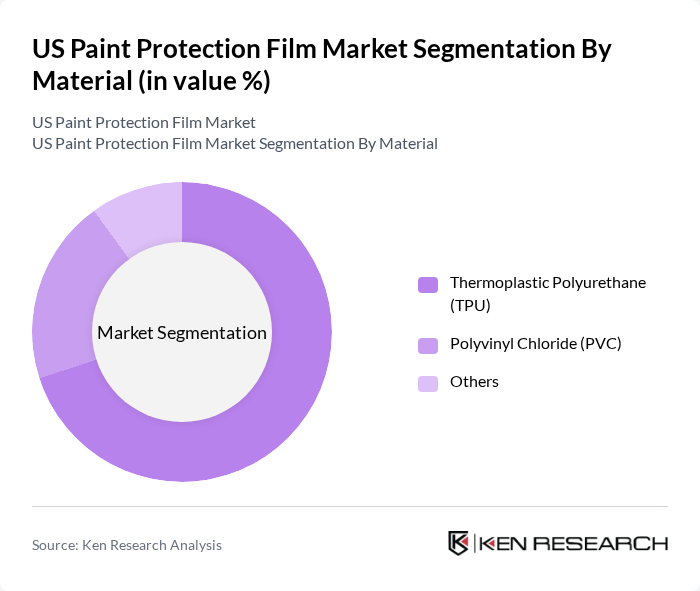

By Material:The paint protection film market is also categorized by material, including Thermoplastic Polyurethane (TPU), Polyvinyl Chloride (PVC), and others. Thermoplastic Polyurethane (TPU) is the dominant material due to its superior flexibility, durability, and self-healing properties, making it the preferred choice for high-end automotive applications. PVC is used in budget-friendly options, but its market share is declining as consumers increasingly opt for higher-quality materials .

The US Paint Protection Film market is characterized by a dynamic mix of regional and international players. Leading participants such as 3M Company, XPEL Inc., SunTek (Eastman Chemical Company), Llumar (Eastman Chemical Company), Avery Dennison Corporation, STEK Automotive, PremiumShield Limited, Hexis S.A.S., VViViD Vinyl Inc., Inozetek, KPMF (Kay Premium Marking Films Ltd.), Rwraps (Custom Auto Trim), ClearGuard Nano, Autobahn Performance Films, DuraShield contribute to innovation, geographic expansion, and service delivery in this space.

The US paint protection film market is poised for significant growth, driven by increasing consumer demand for vehicle aesthetics and advancements in film technology. As awareness of the benefits of paint protection continues to rise, more vehicle owners are expected to invest in these solutions. Additionally, the trend towards customization and personalization will likely create new opportunities for innovative products, enhancing market dynamics and encouraging further investment in this sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Glossy Films Matte Films Colored Films Textured Films Others |

| By Material | Thermoplastic Polyurethane (TPU) Polyvinyl Chloride (PVC) Others |

| By Application | Full Vehicle Coverage Partial Coverage Paint Protection for Specific Areas Others |

| By End-Use Industry | Automotive & Transportation Electronics Aerospace & Defense Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Others |

| By Region | Northeast Midwest South West |

| By Film Thickness | mil mil mil Others |

| By Brand | Premium Brands Mid-Range Brands Budget Brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Detailing Services | 60 | Business Owners, Service Managers |

| Paint Protection Film Installers | 50 | Technicians, Shop Owners |

| Consumer End-Users | 100 | Car Owners, Automotive Enthusiasts |

| Distributors and Wholesalers | 40 | Sales Managers, Product Managers |

| Automotive Industry Experts | 40 | Market Analysts, Industry Consultants |

The US Paint Protection Film market is valued at approximately USD 90 million, driven by increasing demand for vehicle aesthetics and protection against environmental factors such as UV rays, scratches, and road debris.