Region:Global

Author(s):Rebecca

Product Code:KRAA2420

Pages:100

Published On:August 2025

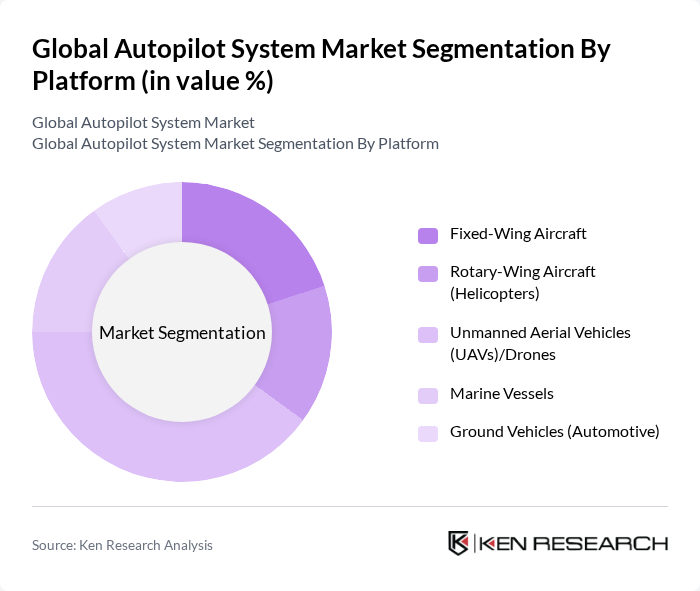

By Platform:The market is segmented into Fixed-Wing Aircraft, Rotary-Wing Aircraft (Helicopters), Unmanned Aerial Vehicles (UAVs)/Drones, Marine Vessels, and Ground Vehicles (Automotive). Among these,Unmanned Aerial Vehicles (UAVs)/Dronesare currently leading the market due to their increasing applications in agriculture, surveillance, logistics, and defense. The demand for UAVs is driven by their versatility, cost-effectiveness, and the growing trend of automation and remote operations in multiple industries .

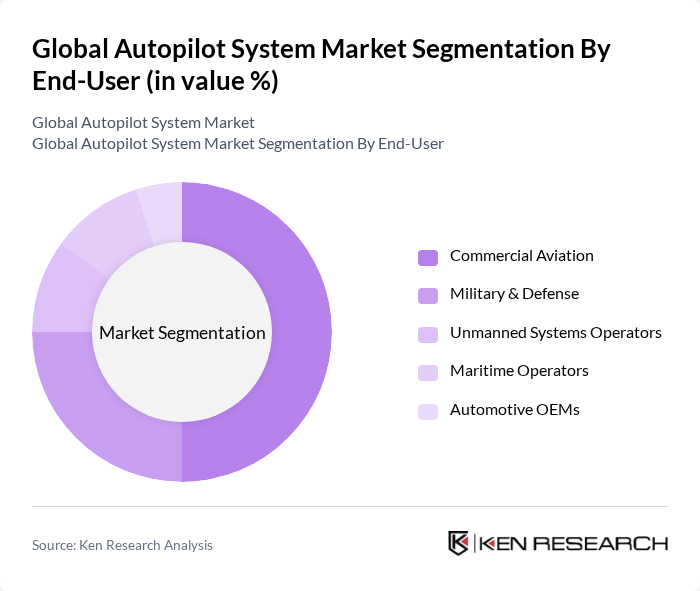

By End-User:The market is segmented into Commercial Aviation, Military & Defense, Unmanned Systems Operators, Maritime Operators, and Automotive OEMs. TheCommercial Aviationsegment is the dominant player in this market, driven by the increasing number of air travel passengers, stringent safety regulations, and the need for enhanced operational efficiency. Airlines are investing heavily in advanced autopilot systems to improve safety, optimize fuel consumption, and reduce pilot workload, which is further propelling the growth of this segment .

The Global Autopilot System Market is characterized by a dynamic mix of regional and international players. Leading participants such as Boeing, Lockheed Martin, Northrop Grumman, Airbus, Thales Group, Honeywell International Inc., RTX Corporation (formerly Raytheon Technologies), General Dynamics, Collins Aerospace (a unit of RTX Corporation), Garmin Ltd., Textron Inc., Safran S.A., BAE Systems, L3Harris Technologies, and Elbit Systems contribute to innovation, geographic expansion, and service delivery in this space.

The future of the autopilot system market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As automakers increasingly collaborate with tech firms, innovative solutions will emerge, enhancing vehicle safety and user experience. Additionally, the integration of autopilot systems with smart city initiatives will create synergies that promote sustainable urban mobility. The focus on electric and autonomous vehicles will likely lead to new business models, fostering a more interconnected transportation ecosystem that prioritizes efficiency and environmental sustainability.

| Segment | Sub-Segments |

|---|---|

| By Platform | Fixed-Wing Aircraft Rotary-Wing Aircraft (Helicopters) Unmanned Aerial Vehicles (UAVs)/Drones Marine Vessels Ground Vehicles (Automotive) |

| By End-User | Commercial Aviation Military & Defense Unmanned Systems Operators Maritime Operators Automotive OEMs |

| By Application | Navigation & Guidance Flight Control Surveillance & Reconnaissance Cargo & Logistics Others |

| By Component | Sensors Software & Algorithms Actuators Control Systems Displays & Interfaces Others |

| By Distribution Channel | OEM (Original Equipment Manufacturer) Aftermarket System Integrators Distributors |

| By Region | North America Europe Asia-Pacific Middle East & Africa Latin America |

| By Price Range | Low-End Systems Mid-Range Systems High-End Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Autopilot Systems | 100 | Product Managers, R&D Engineers |

| Commercial Vehicle Automation | 80 | Fleet Managers, Operations Directors |

| Autonomous Drone Technologies | 60 | Technical Leads, Compliance Officers |

| Regulatory Frameworks for Autopilot | 40 | Policy Makers, Legal Advisors |

| Consumer Acceptance of Autopilot Features | 90 | Market Researchers, Consumer Insights Analysts |

The Global Autopilot System Market is valued at approximately USD 5.4 billion, driven by advancements in automation technology, AI integration, and the increasing demand for unmanned aerial vehicles (UAVs) across various sectors, including aviation, maritime, and automotive.