Region:Global

Author(s):Dev

Product Code:KRAD0576

Pages:83

Published On:August 2025

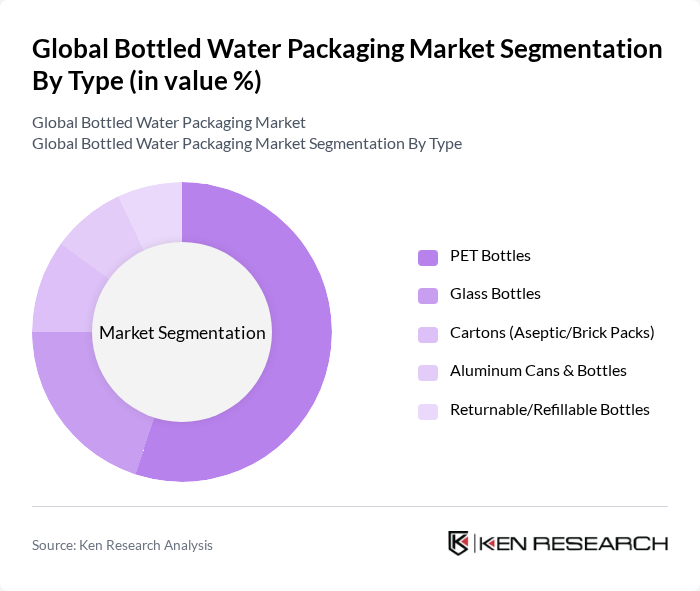

By Type:The bottled water packaging market is segmented into various types, including PET bottles, glass bottles, cartons (aseptic/brick packs), aluminum cans & bottles, and returnable/refillable bottles. Among these, PET bottles dominate the market due to their lightweight, durability, and cost-effectiveness, making them the preferred choice for both manufacturers and consumers. Industry sources consistently show plastics holding a majority share of bottled water packaging volumes globally .

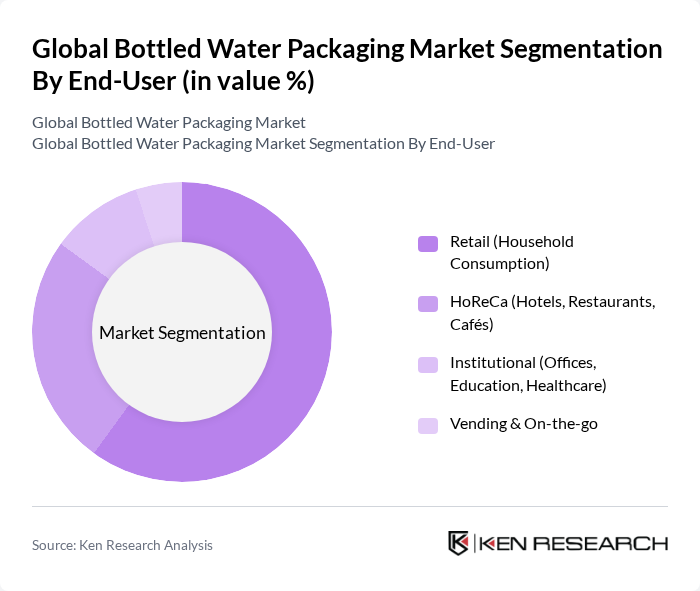

By End-User:The end-user segmentation includes retail (household consumption), HoReCa (hotels, restaurants, cafés), institutional (offices, education, healthcare), and vending & on-the-go. The retail segment is the largest, driven by the increasing trend of bottled water consumption in households and the convenience it offers to consumers; widespread off-trade retail availability and vending also reinforce take-home and on-the-go purchases .

The Global Bottled Water Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, ALPLA Werke Alwin Lehner GmbH & Co KG, Berry Global Group, Inc., Silgan Holdings Inc., Graham Packaging Company, Plastipak Holdings, Inc., Gerresheimer AG, Ardagh Group S.A., Tetra Pak (Tetra Laval Group), Ball Corporation, O-I Glass, Inc., Sidel (Tetra Laval Group), Krones AG, SIG Group AG, Crown Holdings, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bottled water packaging market is poised for transformation, driven by sustainability and innovation. As consumer preferences shift towards eco-friendly products, companies are increasingly investing in biodegradable materials and reusable packaging solutions. Additionally, the integration of smart packaging technologies is expected to enhance consumer engagement and product traceability. With the anticipated growth in e-commerce and the expansion into emerging markets, the industry is likely to witness significant changes in distribution and consumer interaction, shaping its trajectory in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | PET Bottles Glass Bottles Cartons (Aseptic/Brick Packs) Aluminum Cans & Bottles Returnable/Refillable Bottles |

| By End-User | Retail (Household Consumption) HoReCa (Hotels, Restaurants, Cafés) Institutional (Offices, Education, Healthcare) Vending & On-the-go |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail/E-commerce Foodservice/On-premise Vending Machines & Kiosks |

| By Packaging Material | Plastic (PET, rPET, HDPE) Glass Metal (Aluminum, Steel) Paperboard/Liquid Packaging Board Others (Bio-based & Compostable Materials) |

| By Product Type | Still Water Sparkling/Carbonated Water Flavored Water Mineral/Spring Water Functional/Enhanced Water |

| By Price Range | Economy Mid-Range Premium |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Bottled Water Manufacturers | 120 | Production Managers, Quality Control Officers |

| Retail Distribution Channels | 100 | Retail Buyers, Category Managers |

| Packaging Suppliers | 80 | Sales Directors, Product Development Managers |

| Environmental Consultants | 60 | Sustainability Analysts, Regulatory Affairs Specialists |

| Consumer Focus Groups | 100 | End Consumers, Health and Wellness Advocates |

The Global Bottled Water Packaging Market is valued at approximately USD 120 billion, reflecting a significant growth trend driven by health consciousness, demand for convenient hydration solutions, and expanded retail distribution channels.