Region:Middle East

Author(s):Dev

Product Code:KRAC2023

Pages:85

Published On:October 2025

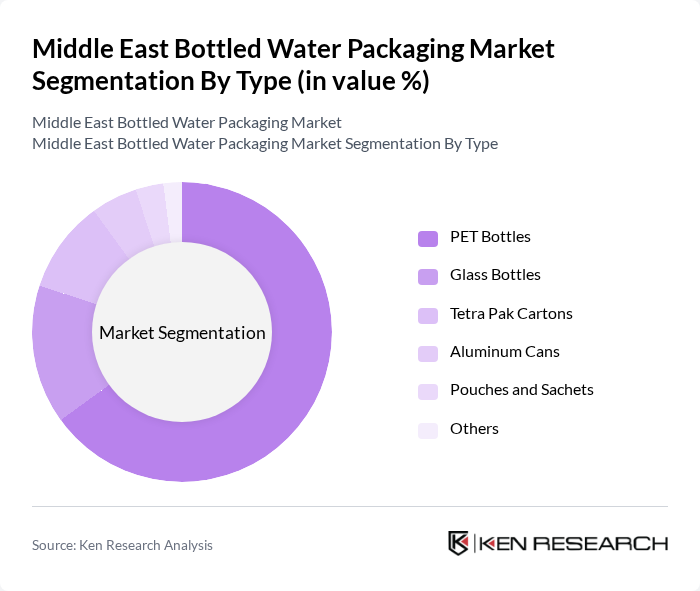

By Type:The market is segmented into various types of packaging, including PET bottles, glass bottles, Tetra Pak cartons, aluminum cans, pouches and sachets, and others. Among these, PET bottles dominate the market due to their lightweight, durability, and cost-effectiveness, making them the preferred choice for both manufacturers and consumers. The convenience of PET bottles aligns with the fast-paced lifestyle of consumers in urban areas, further driving their popularity. Sustainability concerns are also prompting manufacturers to explore recyclable and eco-friendly PET options.

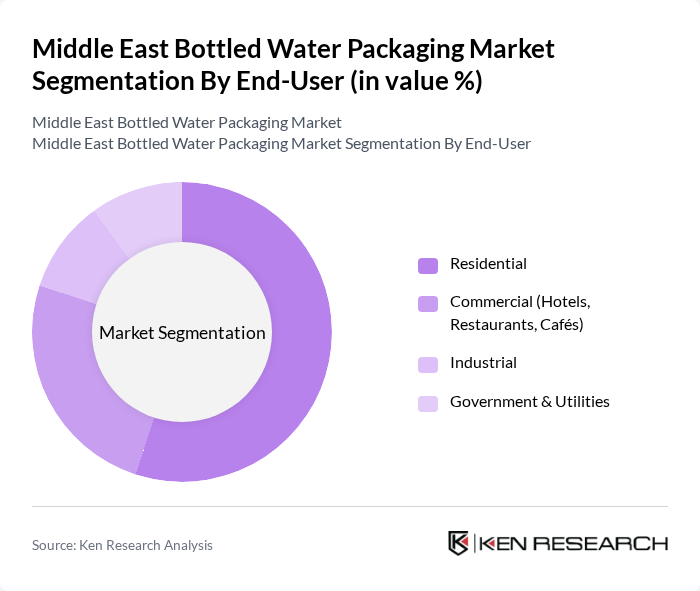

By End-User:The end-user segmentation includes residential, commercial (hotels, restaurants, cafés), industrial, and government & utilities. The residential segment leads the market, driven by the increasing demand for convenient and safe drinking water solutions in households. The trend of health and wellness has also encouraged consumers to opt for bottled water over tap water, further boosting this segment's growth. Commercial establishments, especially in hospitality and tourism, are also significant contributors due to the region's robust travel industry.

The Middle East Bottled Water Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé Waters, The Coca-Cola Company, PepsiCo, Inc., Danone S.A., Al Ain Water (Agthia Group PJSC), Masafi Co. LLC, Mai Dubai LLC, Almarai Company, Al Jazeera Water, Al Waha Water, Al Bawadi Water, Ras Al Khaimah Water, Pure Life (Nestlé), Al Qusais Water, Emirates Water and Electricity Company, Barakat Quality Plus LLC, Safa Water, Aquafina (PepsiCo), Arwa Water (Coca-Cola), Sirma Water contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bottled water packaging market in the Middle East appears promising, driven by ongoing trends in health consciousness and sustainability. As urbanization accelerates, the demand for convenient and eco-friendly packaging solutions is expected to rise. Additionally, advancements in smart packaging technologies will likely enhance consumer engagement and product traceability. Companies that adapt to these trends and invest in sustainable practices will be well-positioned to capture market share and meet evolving consumer preferences in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | PET Bottles Glass Bottles Tetra Pak Cartons Aluminum Cans Pouches and Sachets Others |

| By End-User | Residential Commercial (Hotels, Restaurants, Cafés) Industrial Government & Utilities |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Direct Sales Vending Machines Others |

| By Packaging Size | Small (Up to 330ml) Medium (330ml to 1.5L) Large (Above 1.5L) |

| By Price Range | Economy Mid-range Premium |

| By Brand Positioning | Mass Market Niche Market Private Label |

| By Sustainability Initiatives | Recyclable Packaging Biodegradable Options Water Conservation Practices Lightweight/Tethered Caps Use of Recycled Content |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Bottled Water Manufacturers | 60 | Production Managers, Quality Assurance Officers |

| Retail Distribution Channels | 50 | Supply Chain Managers, Retail Buyers |

| Consumer Preferences | 100 | Health-Conscious Consumers, Eco-Friendly Shoppers |

| Packaging Suppliers | 40 | Sales Representatives, Product Development Managers |

| Regulatory Bodies | 40 | Policy Makers, Environmental Compliance Officers |

The Middle East Bottled Water Packaging Market is valued at approximately USD 4.6 billion, reflecting a significant increase driven by health consciousness, rising disposable incomes, and the demand for convenient hydration solutions.