Region:Middle East

Author(s):Dev

Product Code:KRAC3472

Pages:99

Published On:October 2025

By Packaging Type:The packaging type segment includes various materials used for bottling water, which significantly influences consumer preferences and market dynamics. The primary subsegments are PET Bottles, Glass Bottles, Tetra Pak, Aluminum Cans, and Composite Materials. PET Bottles dominate the market due to their lightweight, durability, cost-effectiveness, and widespread availability, making them the preferred choice for consumers and manufacturers alike. Sustainability trends are driving gradual adoption of alternative formats such as carton-based and composite packaging, although their market share remains modest .

By End-User:The end-user segment encompasses various consumer categories, including Residential Consumers, Commercial (Hotels, Restaurants, Offices), Industrial (Manufacturing, Processing), and Government & Public Institutions. Residential Consumers represent the largest share, driven by the increasing trend of home delivery services, heightened concerns about tap water quality, and the growing preference for bottled water over tap water. Commercial demand is supported by the hospitality and tourism sectors, while industrial and government segments contribute through institutional procurement .

The Bahrain Bottled Water Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé Waters (S.A.), Al Ain Water (Emirates National Factory for Processing & Trading), Bahrain Water Bottling Company (Local Producer), Aqua Pure Bahrain (Local Bottling Specialist), Al Marai Company Limited, PepsiCo International (Aquafina Brand), The Coca-Cola Company (Dasani Brand), Agthia Group PJSC (Regional GCC player), Arwa Water (Saudi-based, GCC distributed), Al Falah Mineral Water (Local Bahrain brand), Blue Water Company (Bahrain-based), Al-Rajhi Water & Beverages (GCC presence) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the bottled water packaging market in Bahrain appears promising, driven by evolving consumer preferences and regulatory changes. As health consciousness continues to rise, the demand for bottled water is expected to grow, particularly in urban areas. Additionally, the shift towards sustainable practices will likely lead to increased adoption of eco-friendly packaging solutions. Companies that innovate and adapt to these trends will be well-positioned to capture market share and meet the needs of environmentally aware consumers.

| Segment | Sub-Segments |

|---|---|

| By Packaging Type | PET Bottles (Primary Segment - ~76-80% market share) Glass Bottles Tetra Pak (Carton-based) Aluminum Cans Composite Materials (Alternative sustainable formats) |

| By End-User | Residential Consumers Commercial (Hotels, Restaurants, Offices) Industrial (Manufacturing, Processing) Government & Public Institutions |

| By Distribution Channel | Supermarkets/Hypermarkets (Primary Off-Trade Channel) Convenience Stores and Grocery Shops Online Retail and E-commerce (Fast-growing segment) Direct Sales and Home Delivery Services On-Trade Channels (Restaurants, Cafes) |

| By Packaging Size | ml - 500ml (39.84% market share - On-the-go segment) ml - 1L (Fastest-growing at 8.30% CAGR) L - 2L (Standard household consumption) L and above (Bulk, Office, and Industrial use) |

| By Brand Positioning | Premium Brands (Functional and enhanced waters) Mid-range Brands (Standard mineral and purified waters) Budget Brands (Mass-market still water) |

| By Water Type | Plain/Still Water (80% volume dominance) Sparkling Water Functional Water (Vitamins, Electrolytes - 10.14% CAGR growth) Flavored Water Mineral Water |

| By Packaging Material Composition | Recycled PET (rPET) - Eco-conscious segment Virgin PET Glass (Recyclable, Premium positioning) Composite Materials (Tetra Pak and alternatives) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Bottled Water Manufacturers | 60 | Production Managers, Quality Control Officers |

| Retail Distribution Channels | 50 | Store Managers, Category Buyers |

| Consumer Preferences | 120 | General Consumers, Health-Conscious Shoppers |

| Packaging Suppliers | 40 | Sales Representatives, Product Development Managers |

| Environmental Impact Analysts | 40 | Sustainability Consultants, Regulatory Affairs Specialists |

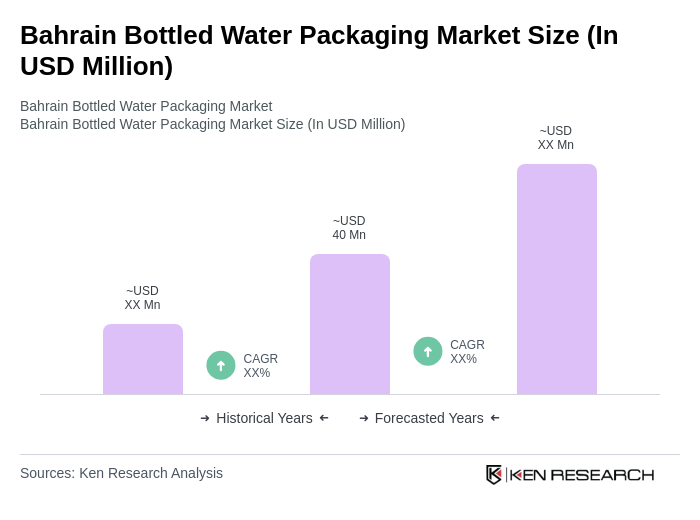

The Bahrain Bottled Water Packaging Market is valued at approximately USD 40 million, reflecting a significant increase driven by health consciousness, rising disposable incomes, and urbanization, alongside a growing demand for convenient hydration solutions.