Global Business Jet Market Overview

- The Global Business Jet Market is valued at USD 46 billion, based on a five-year historical analysis. This growth is primarily driven by rising private air travel among high?net?worth individuals and corporates, expansion of fractional/charter models, and sustained upgrades in avionics, cabins, and fuel?efficient airframes that enhance performance, comfort, and operating economics.

- Key players in this market include the United States, Europe, and the Asia Pacific region. The United States leads due to the largest installed business aviation fleet, dense network of general aviation airports/FBOs, and high concentration of high?net?worth individuals. Europe follows with strong corporate demand and established charter/fractional ecosystems, while Asia Pacific is growing on increasing wealth creation and expanding business aviation infrastructure.

- In 2023, the U.S. government advanced multiple safety and certification updates applicable to business aviation, including FAA rulemaking to strengthen flight crew record sharing and continued operational safety directives; however, there was no single, universal mandate that “all new business jets” comply with a newly introduced safety protocol in that year. Instead, business jets remain subject to ongoing FAA airworthiness, certification, and safety management requirements applied through existing rules and directives.

Global Business Jet Market Segmentation

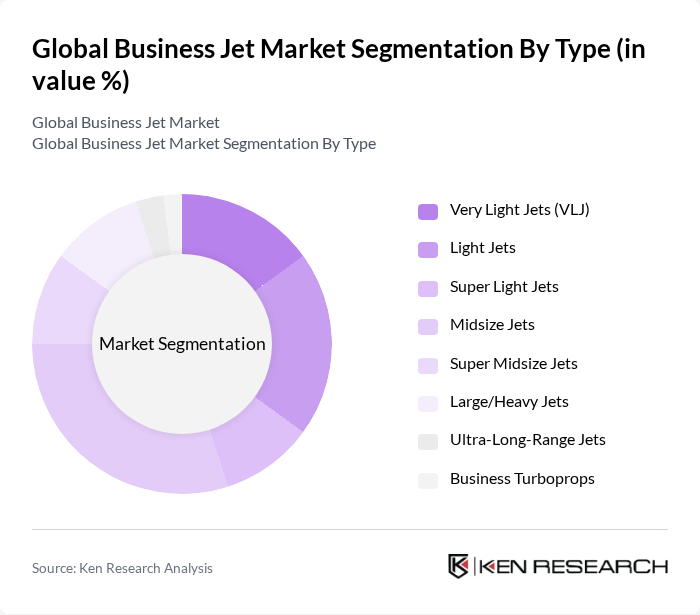

By Type:The business jet market is segmented into various types, including Very Light Jets (VLJ), Light Jets, Super Light Jets, Midsize Jets, Super Midsize Jets, Large/Heavy Jets, Ultra-Long-Range Jets, and Business Turboprops. Midsize and Super Midsize categories collectively account for a significant portion of demand due to their balance of range, cabin size, and operating cost, serving most corporate missions efficiently.

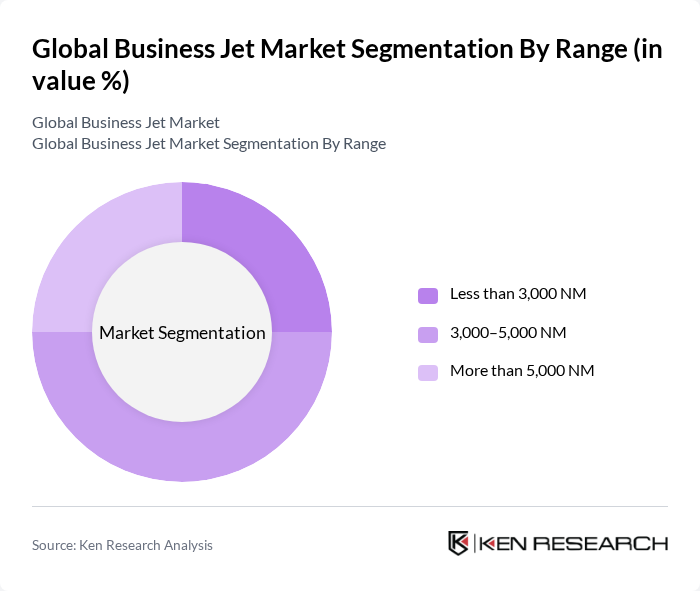

By Range:The market is also segmented by range, including Less than 3,000 NM, 3,000–5,000 NM, and More than 5,000 NM. The 3,000–5,000 NM segment covers core corporate city?pairs, enabling non?stop missions across major regional hubs while optimizing acquisition and operating costs—hence it captures the largest share.

Global Business Jet Market Competitive Landscape

The Global Business Jet Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bombardier Inc., Gulfstream Aerospace Corporation, Dassault Aviation, Embraer S.A., Textron Aviation Inc. (Cessna, Beechcraft), Boeing Business Jets (BBJ), Airbus Corporate Jets (ACJ), Honda Aircraft Company, Pilatus Aircraft Ltd, Cirrus Aircraft, Piaggio Aerospace, Piper Aircraft, Inc., Nextant Aerospace, Textron Inc., Saab AB contribute to innovation, geographic expansion, and service delivery in this space.

Global Business Jet Market Industry Analysis

Growth Drivers

- Increasing Demand for Private Travel:The global business jet market is experiencing a surge in demand for private travel, driven by a projected increase in the number of high-net-worth individuals (HNWIs). According to the World Wealth Report, the number of HNWIs is expected to reach 24 million in the future, up from 22 million previously. This growth translates to a higher demand for private jets, as affluent individuals seek personalized travel solutions that offer convenience and flexibility.

- Expansion of Business Operations Globally:As companies expand their operations internationally, the need for efficient travel solutions has intensified. The International Monetary Fund (IMF) forecasts global GDP growth of 3.5% in the future, encouraging businesses to invest in private aviation for quicker access to emerging markets. This trend is particularly evident in Asia-Pacific, where business jet registrations increased by 18% in the future, reflecting the region's growing economic significance and the demand for rapid business travel.

- Technological Advancements in Aircraft Design:Innovations in aircraft technology are enhancing the appeal of business jets. The introduction of lighter materials and more efficient engines has improved fuel efficiency by up to 25%, according to industry reports. Furthermore, advancements in avionics and cabin comfort are attracting buyers. The global investment in aviation technology is projected to reach $12 billion in the future, fostering a competitive environment that drives the development of next-generation business jets.

Market Challenges

- High Operational Costs:Operating a business jet involves significant costs, including maintenance, fuel, and crew salaries. The average annual operating cost for a mid-size business jet is approximately $1.8 million, according to the National Business Aviation Association (NBAA). These high costs can deter potential buyers, particularly in regions where economic growth is slower, limiting market expansion and accessibility for smaller enterprises seeking private aviation solutions.

- Stringent Regulatory Compliance:The business jet industry faces rigorous regulatory frameworks that can complicate operations. Compliance with Federal Aviation Administration (FAA) regulations and International Civil Aviation Organization (ICAO) standards requires substantial investment in safety and operational protocols. In the future, the FAA is expected to increase oversight, which may lead to additional costs for operators. This regulatory burden can hinder market entry for new players and stifle innovation within the industry.

Global Business Jet Market Future Outlook

The future of the business jet market appears promising, driven by ongoing technological advancements and a growing emphasis on sustainability. As electric and hybrid aircraft gain traction, manufacturers are likely to invest heavily in research and development, enhancing operational efficiency. Additionally, the rise of on-demand air mobility services is expected to reshape travel patterns, making private aviation more accessible. These trends indicate a dynamic market landscape that will adapt to evolving consumer preferences and regulatory requirements.

Market Opportunities

- Growth in Emerging Markets:Emerging markets, particularly in Asia and Africa, present significant opportunities for business jet manufacturers. With a projected GDP growth rate of 6.0% in these regions, demand for private aviation services is expected to rise. This growth is driven by increasing wealth and a burgeoning middle class, creating a favorable environment for business jet acquisitions and charter services.

- Increasing Demand for Charter Services:The charter services segment is poised for expansion, with the global charter market expected to grow by $3 billion in the future. This growth is fueled by the rising preference for flexible travel options among businesses and individuals. As companies seek cost-effective solutions, charter services offer an attractive alternative to ownership, enhancing market accessibility and driving overall industry growth.