Region:Africa

Author(s):Geetanshi

Product Code:KRVN6089

Pages:81

Published On:December 2025

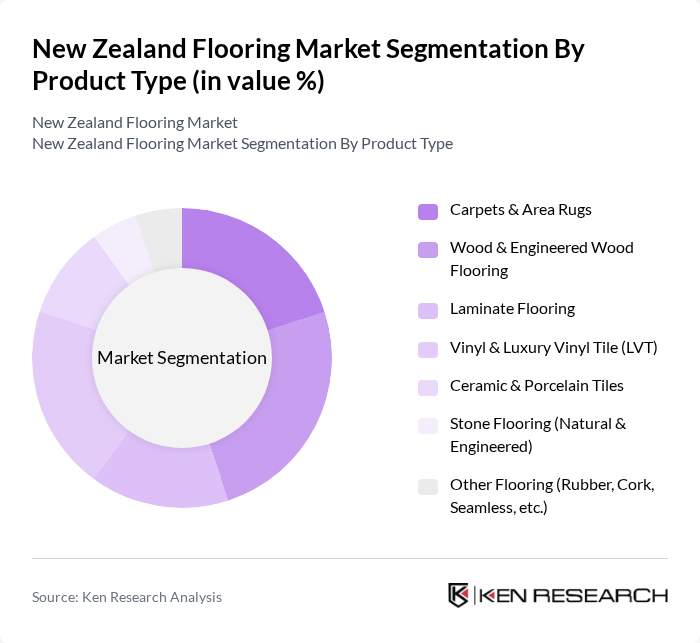

By Product Type:The flooring market can be segmented into various product types, including Carpets & Area Rugs, Wood & Engineered Wood Flooring, Laminate Flooring, Vinyl & Luxury Vinyl Tile (LVT), Ceramic & Porcelain Tiles, Stone Flooring (Natural & Engineered), and Other Flooring (Rubber, Cork, Seamless, etc.). Each of these segments caters to different consumer preferences and applications, with specific trends influencing their market performance.

The Wood & Engineered Wood Flooring segment is currently dominating the market due to its aesthetic appeal, durability, and ease of installation. Consumers are increasingly opting for wood flooring as it offers a warm and natural look, which is highly sought after in both residential and commercial spaces. Additionally, advancements in engineered wood technology have made these products more accessible and affordable, further driving their popularity.

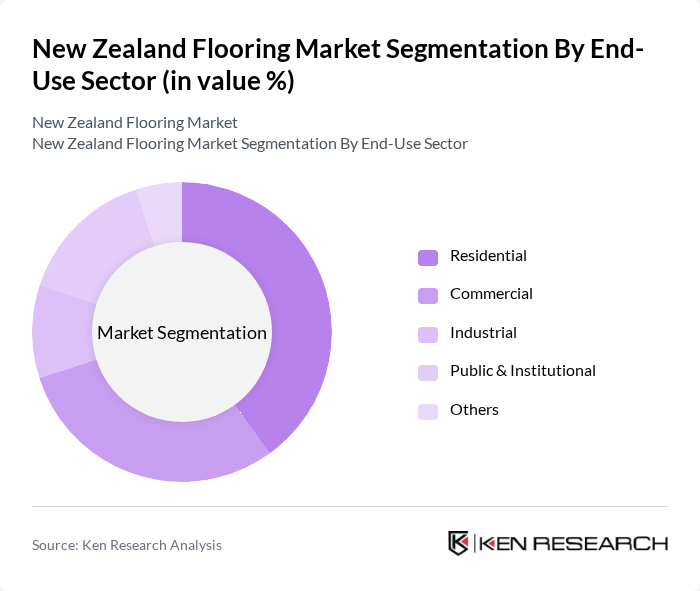

By End-Use Sector:The flooring market is segmented by end-use sectors, including Residential, Commercial, Industrial, Public & Institutional (Education, Healthcare, Government), and Others. Each sector has distinct requirements and preferences, influencing the types of flooring products that are in demand.

The Residential sector is the largest segment in the flooring market, driven by increasing home renovations and new construction projects. Homeowners are investing in high-quality flooring options that enhance the aesthetic appeal and value of their properties. The trend towards sustainable and eco-friendly materials is also influencing purchasing decisions, with many consumers opting for products that align with their environmental values.

The New Zealand Flooring Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fletcher Building Limited, Bunnings Group Limited (Bunnings Warehouse), Carpet Court NZ, Flooring Xtra, Godfrey Hirst New Zealand, Armstrong Flooring Pty Ltd, Quick-Step, Pergo, Bethell Flooring, HARO Flooring New Zealand, Floorwise Group, The Flooring Room, Carpet One, Flooring Direct, and other emerging local players contribute to innovation, geographic expansion, and service delivery in this space.

The New Zealand flooring market is poised for dynamic growth, driven by increasing consumer preferences for sustainable and technologically advanced flooring solutions. As urbanization accelerates, the demand for innovative flooring products that enhance health and wellness will rise. Additionally, the integration of smart technology in flooring solutions is expected to gain traction, providing opportunities for manufacturers to cater to evolving consumer needs. The market is likely to see a shift towards customization, allowing consumers to personalize their flooring choices, further enhancing market potential.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Carpets & Area Rugs Wood & Engineered Wood Flooring Laminate Flooring Vinyl & Luxury Vinyl Tile (LVT) Ceramic & Porcelain Tiles Stone Flooring (Natural & Engineered) Other Flooring (Rubber, Cork, Seamless, etc.) |

| By End-Use Sector | Residential Commercial Industrial Public & Institutional (Education, Healthcare, Government) Others |

| By Application | New Construction Renovation & Remodeling Repair & Maintenance Others |

| By Material Class | Non-resilient Flooring (Wood, Ceramic, Stone, etc.) Resilient Flooring (Vinyl, LVT, Linoleum, Rubber) Soft Flooring (Carpets & Rugs) Seamless & Specialty Flooring |

| By Distribution Channel | DIY Retail Chains & Home Improvement Stores Specialty Flooring Retailers Direct Sales to Builders & Contractors Online & Omnichannel Platforms Wholesalers & Distributors |

| By Region | North Island – Auckland North Island – Rest of North Island South Island – Canterbury South Island – Rest of South Island Other Territories |

| By Price Range | Economy / Budget Mid-Range Premium Luxury / Designer |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Flooring Installations | 120 | Homeowners, Interior Designers |

| Commercial Flooring Projects | 100 | Facility Managers, Architects |

| Retail Flooring Sales | 80 | Store Managers, Sales Representatives |

| Flooring Material Suppliers | 70 | Procurement Managers, Product Development Leads |

| Sustainable Flooring Solutions | 60 | Sustainability Officers, Product Managers |

The New Zealand Flooring Market is valued at approximately USD 950 million, reflecting a robust growth trend driven by increased residential and commercial construction activities and a rising demand for sustainable flooring solutions.