Region:Global

Author(s):Dev

Product Code:KRAA2996

Pages:99

Published On:August 2025

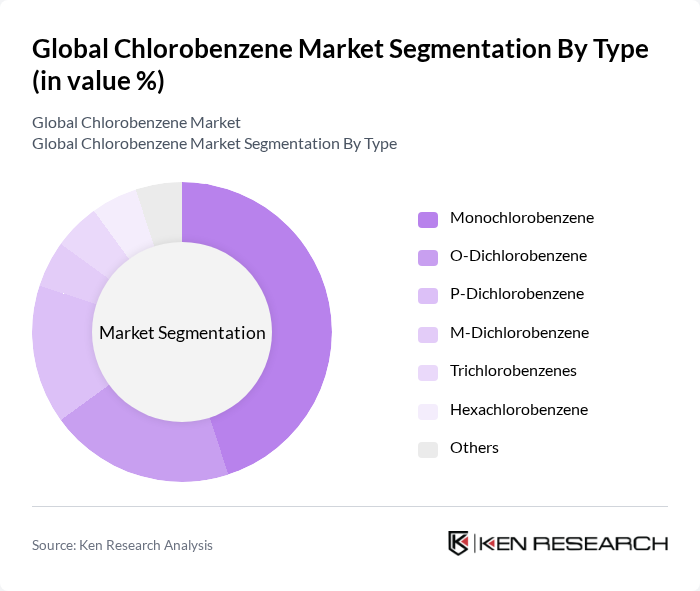

By Type:The chlorobenzene market is segmented into various types, including Monochlorobenzene, O-Dichlorobenzene, P-Dichlorobenzene, M-Dichlorobenzene, Trichlorobenzenes, Hexachlorobenzene, and Others. Among these,Monochlorobenzeneis the leading sub-segment due to its extensive use as a solvent and intermediate in the production of chemicals such as pesticides, dyes, and pharmaceuticals. The demand for Monochlorobenzene is driven by its critical role in the synthesis of downstream products, especially in agriculture and pharmaceuticals .

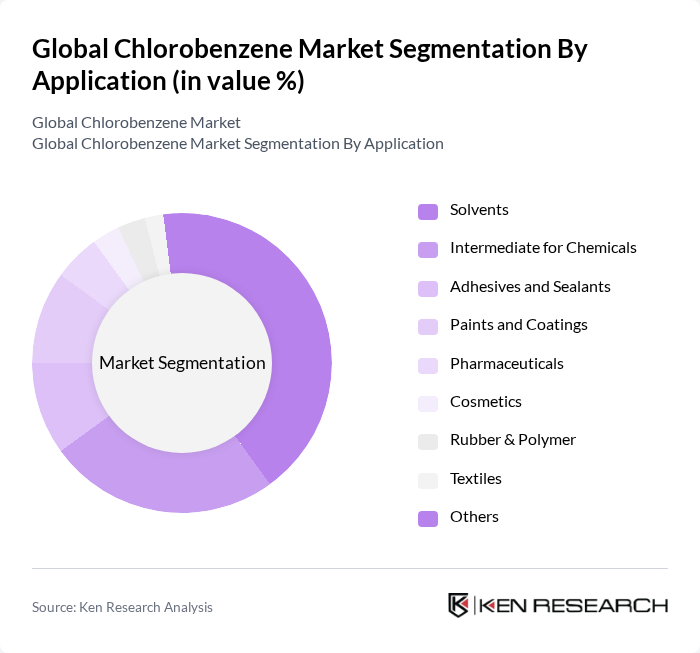

By Application:The applications of chlorobenzene include Solvents, Intermediate for Chemicals, Adhesives and Sealants, Paints and Coatings, Pharmaceuticals, Cosmetics, Rubber & Polymer, Textiles, and Others. TheSolventssegment holds the largest market share, driven by the increasing demand for chlorobenzene as a solvent in industrial processes, particularly in the production of paints, coatings, adhesives, and agrochemicals. Its effectiveness in dissolving a wide range of substances and its role as a precursor in chemical synthesis reinforce its dominance in the market .

The Global Chlorobenzene Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Dow Chemical Company, Mitsubishi Gas Chemical Company, Inc., Solvay S.A., INEOS Group Limited, Arkema S.A., Kureha Corporation, China Petrochemical Corporation (Sinopec), Jiangsu Yangnong Chemical Group Co., Ltd., Henan Kaipu Chemical Co., Ltd., Jinhua Chemical (Group) Corporation, Nanjing Chemical Industry Co., Ltd., Tianjin Bohai Chemical Co., Ltd., PPG Industries, Inc., ITW Reagents Division (PanReac AppliChem) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the chlorobenzene market appears promising, driven by ongoing innovations and a shift towards sustainable practices. As industries increasingly adopt green chemistry solutions, the demand for eco-friendly alternatives to traditional chlorobenzene applications is expected to rise. Furthermore, emerging markets in Asia-Pacific and Latin America are anticipated to contribute significantly to market growth, fueled by industrialization and urbanization trends. Companies that invest in research and development will likely gain a competitive edge in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Monochlorobenzene O-Dichlorobenzene P-Dichlorobenzene M-Dichlorobenzene Trichlorobenzenes Hexachlorobenzene Others |

| By Application | Solvents Intermediate for Chemicals Adhesives and Sealants Paints and Coatings Pharmaceuticals Cosmetics Rubber & Polymer Textiles Others |

| By End-User | Chemical Industry Pharmaceutical Industry Agriculture Paints & Coatings Industry Rubber & Polymer Industry Cosmetics Industry Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America United States Canada Mexico Europe United Kingdom Germany France Italy Spain Russia Benelux Nordics Rest of Europe Asia-Pacific China India Japan South Korea ASEAN Oceania Rest of Asia-Pacific Latin America Brazil Argentina Rest of Latin America Middle East & Africa Turkey Israel GCC North Africa South Africa Rest of Middle East & Africa |

| By Pricing Strategy | Premium Pricing Competitive Pricing Discount Pricing Others |

| By Regulatory Compliance | REACH Compliance OSHA Standards EPA Regulations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 100 | R&D Managers, Quality Control Analysts |

| Agrochemical Production | 80 | Product Development Scientists, Regulatory Affairs Specialists |

| Coatings and Adhesives | 60 | Formulation Chemists, Production Supervisors |

| Industrial Solvents | 50 | Procurement Managers, Operations Directors |

| Research Institutions | 40 | Academic Researchers, Industry Analysts |

The Global Chlorobenzene Market is valued at approximately USD 3.5 billion, driven by increasing demand in various applications such as solvents, pharmaceuticals, and agrochemicals, particularly in the expanding chemical industry in the Asia Pacific region.