Region:Global

Author(s):Geetanshi

Product Code:KRAD4182

Pages:88

Published On:December 2025

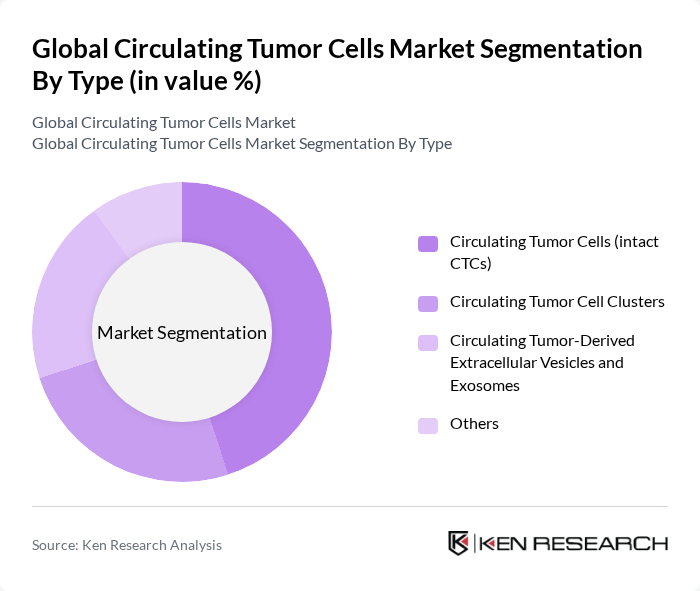

By Type:The market is segmented into various types, including Circulating Tumor Cells (intact CTCs), Circulating Tumor Cell Clusters, Circulating Tumor-Derived Extracellular Vesicles and Exosomes, and Others. Among these, Circulating Tumor Cells (intact CTCs) dominate the market due to their critical role in cancer diagnosis and monitoring. Their ability to provide real-time insights into tumor dynamics and treatment response makes them invaluable in clinical settings. The increasing adoption of CTCs in personalized medicine and their integration into routine clinical practice further solidify their leading position in the market.

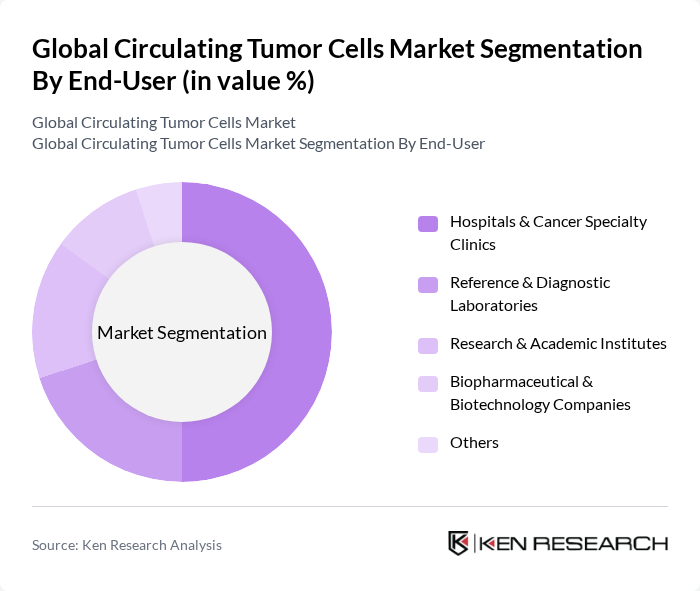

By End-User:The market is categorized by end-users, including Hospitals & Cancer Specialty Clinics, Reference & Diagnostic Laboratories, Research & Academic Institutes, Biopharmaceutical & Biotechnology Companies, and Others. Hospitals & Cancer Specialty Clinics are the leading end-users, driven by the increasing number of cancer patients seeking advanced diagnostic services. These facilities are equipped with the latest technologies and skilled professionals, enabling them to provide comprehensive cancer care, including the use of circulating tumor cells for diagnosis and treatment monitoring.

The Global Circulating Tumor Cells Market is characterized by a dynamic mix of regional and international players. Leading participants such as Menarini Silicon Biosystems S.p.A., Biocept, Inc., Epic Sciences, Inc., Celsee, Inc. (a Bio-Rad Laboratories company), Clearbridge BioMedics Pte Ltd (Clearbridge Health), QIAGEN N.V., Miltenyi Biotec B.V. & Co. KG, ANGLE plc, Sysmex Corporation, F. Hoffmann-La Roche Ltd (Roche Diagnostics), Johnson & Johnson (Veridex LLC – CellSearch System), Thermo Fisher Scientific Inc., Siemens Healthineers AG, Abbott Laboratories, Bio-Techne Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the CTC market appears promising, driven by ongoing technological advancements and a growing emphasis on early cancer detection. As healthcare systems increasingly adopt liquid biopsy techniques, the integration of artificial intelligence in CTC analysis is expected to enhance diagnostic accuracy and efficiency. Furthermore, the expansion of telemedicine services will facilitate remote monitoring of cancer patients, making CTC testing more accessible and convenient, ultimately improving patient outcomes and driving market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Circulating Tumor Cells (intact CTCs) Circulating Tumor Cell Clusters Circulating Tumor-Derived Extracellular Vesicles and Exosomes Others |

| By End-User | Hospitals & Cancer Specialty Clinics Reference & Diagnostic Laboratories Research & Academic Institutes Biopharmaceutical & Biotechnology Companies Others |

| By Application | Cancer Diagnosis & Screening Treatment Monitoring & Therapy Response Assessment Prognosis & Minimal Residual Disease (MRD) Assessment Drug Discovery & Clinical Trials Others |

| By Technology | Immunoaffinity-based Enrichment (positive and negative selection) Microfluidics and Lab-on-a-Chip Technologies Size-based Filtration and Density Gradient Centrifugation Dielectrophoresis and Other Label-free Techniques Molecular Characterization (PCR, NGS, FISH, Immunocytochemistry) Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Biomarker | Epithelial Markers (EpCAM, Cytokeratins) Mesenchymal and Stem Cell Markers Tumor-specific Genetic Alterations (e.g., EGFR, HER2, ALK) Multimodal Panels (CTCs with ctDNA/ctRNA and protein markers) Others |

| By Sample Type | Peripheral Blood Samples Bone Marrow Samples Other Body Fluids (e.g., pleural effusion, cerebrospinal fluid) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncology Clinics and Hospitals | 120 | Oncologists, Clinical Researchers |

| Diagnostic Laboratories | 90 | Laboratory Managers, Technicians |

| Biotechnology Firms | 70 | Product Development Managers, R&D Directors |

| Regulatory Bodies | 40 | Regulatory Affairs Specialists, Policy Makers |

| Patient Advocacy Groups | 60 | Patient Advocates, Healthcare Educators |

The Global Circulating Tumor Cells Market is valued at approximately USD 13.5 billion, driven by the increasing prevalence of cancer and advancements in diagnostic technologies, including liquid biopsy and personalized medicine.