Region:North America

Author(s):Geetanshi

Product Code:KRAC3027

Pages:93

Published On:October 2025

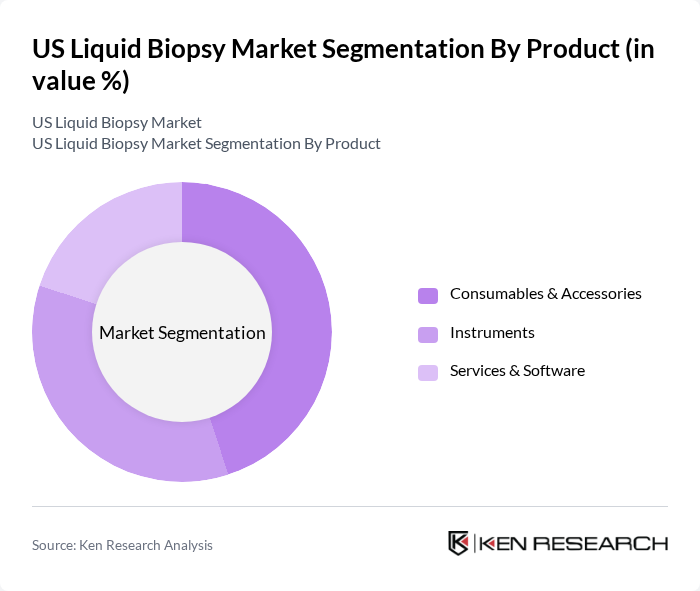

By Product:The product segmentation of the market includes consumables & accessories, instruments, and services & software. Consumables & accessories are essential for the execution of liquid biopsy tests, encompassing reagents, kits, and sample collection materials required for biomarker detection. Instruments are critical for the analysis and processing of samples, utilizing advanced technologies like next-generation sequencing and digital PCR platforms. Services & software support the operational aspects of liquid biopsy testing, including data management, bioinformatics analysis, and clinical interpretation services.

The consumables & accessories segment is currently dominating the market due to the high demand for reagents, kits, and other essential materials required for liquid biopsy testing. This segment benefits from the increasing number of tests being conducted, as well as the need for regular replenishment of consumables. The trend towards personalized medicine and the growing focus on early cancer detection further drive the demand for these products, making them a critical component of the liquid biopsy ecosystem. Advancements in next-generation sequencing technologies have enhanced the accuracy and sensitivity of liquid biopsy assays, further expanding the consumables market as healthcare facilities adopt these innovative diagnostic solutions.

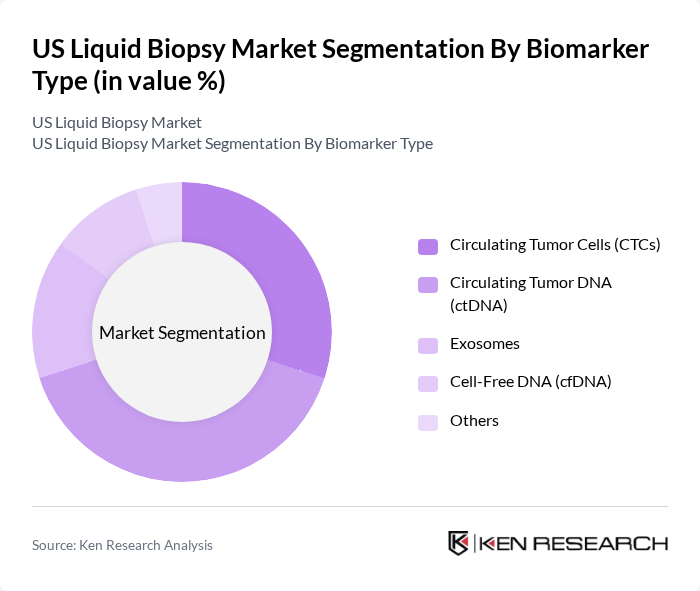

By Biomarker Type:The biomarker type segmentation includes circulating tumor cells (CTCs), circulating tumor DNA (ctDNA), exosomes, cell-free DNA (cfDNA), and others. Each biomarker type plays a unique role in the diagnosis and monitoring of cancer, with varying applications and effectiveness in different clinical scenarios. CTCs provide information about tumor metastasis and treatment response, while ctDNA offers insights into genetic mutations and tumor burden. Exosomes carry molecular information from tumor cells and are increasingly recognized for their diagnostic potential. Cell-free DNA encompasses both tumor-derived and non-tumor DNA fragments circulating in blood, serving as a broader biomarker category.

The circulating tumor DNA (ctDNA) segment is leading the market due to its high sensitivity and specificity in detecting genetic mutations associated with cancer. ctDNA tests are increasingly being adopted for their ability to provide real-time insights into tumor dynamics, making them invaluable for treatment monitoring and recurrence detection. The growing trend towards non-invasive testing and personalized medicine further enhances the appeal of ctDNA, solidifying its position as a market leader. Innovation in ctDNA and NGS technology accelerates the potential for early detection and personalized care, enabling oncologists to tailor treatment strategies based on molecular profiles and monitor therapeutic efficacy with greater precision.

The US Liquid Biopsy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Guardant Health, Inc., Exact Sciences Corporation, Biocept, Inc., Foundation Medicine, Inc., Roche Diagnostics, Illumina, Inc., Natera, Inc., Sysmex Corporation, Qiagen N.V., Abbott Laboratories, Siemens Healthineers, Myriad Genetics, Inc., Freenome Holdings, Inc., GRAIL, Inc., Caris Life Sciences contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. liquid biopsy market appears promising, driven by technological advancements and increasing acceptance among healthcare professionals. As more clinical studies validate the efficacy of liquid biopsies, their integration into routine cancer care is expected to expand. Additionally, the growing emphasis on personalized medicine will likely enhance the relevance of liquid biopsies, positioning them as essential tools for tailored treatment strategies in oncology.

| Segment | Sub-Segments |

|---|---|

| By Product | Consumables & Accessories Instruments Services & Software |

| By Biomarker Type | Circulating Tumor Cells (CTCs) Circulating Tumor DNA (ctDNA) Exosomes Cell-Free DNA (cfDNA) Others |

| By Sample Type | Blood Samples Urine Samples Saliva Samples Others |

| By End-User | Hospitals Diagnostic Laboratories Research Institutions Others |

| By Application | Cancer Diagnosis Treatment Monitoring Recurrence Monitoring Others |

| By Technology | PCR-based Technologies NGS-based Technologies Microarray-based Technologies Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncology Clinics | 100 | Oncologists, Nurse Practitioners |

| Diagnostic Laboratories | 80 | Laboratory Directors, Technicians |

| Healthcare Payers | 60 | Reimbursement Specialists, Policy Analysts |

| Patient Advocacy Groups | 50 | Patient Advocates, Community Leaders |

| Research Institutions | 50 | Clinical Researchers, Biostatisticians |

The US Liquid Biopsy Market is valued at approximately USD 2.3 billion, driven by the increasing prevalence of cancer, advancements in technology, and the demand for non-invasive diagnostic methods. This market is expected to grow significantly in the coming years.