Region:Global

Author(s):Shubham

Product Code:KRAA2695

Pages:87

Published On:August 2025

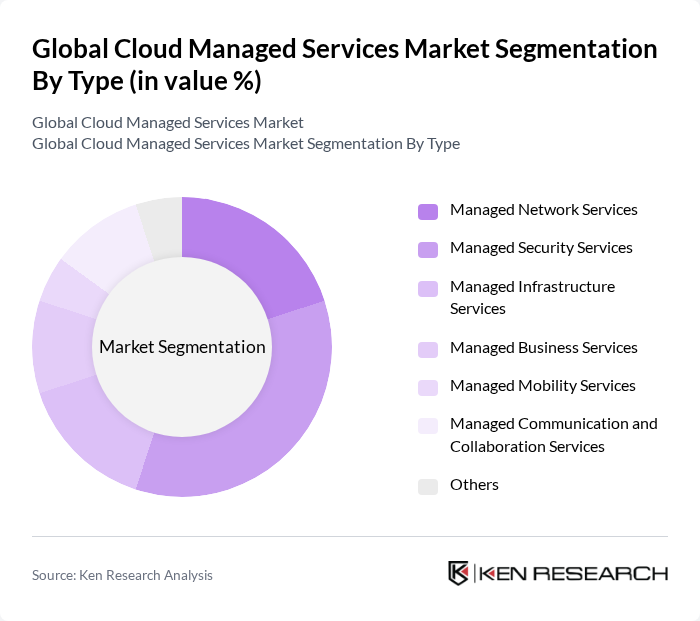

By Type:The market is segmented into various types of managed services, includingManaged Network Services, Managed Security Services, Managed Infrastructure Services, Managed Business Services, Managed Mobility Services, Managed Communication and Collaboration Services, and Others. Each of these segments caters to specific business needs, with varying levels of complexity and service delivery. Managed Security Services and Managed Infrastructure Services are particularly prominent due to heightened cybersecurity concerns and the need for robust, scalable IT environments .

TheManaged Security Servicessegment is currently dominating the market due to the increasing frequency of cyber threats and the growing need for organizations to protect their sensitive data. Businesses are investing heavily in security solutions to mitigate risks, leading to a higher demand for managed security services. This trend is further fueled by regulatory requirements and the need for compliance, making it a critical area for cloud managed services .

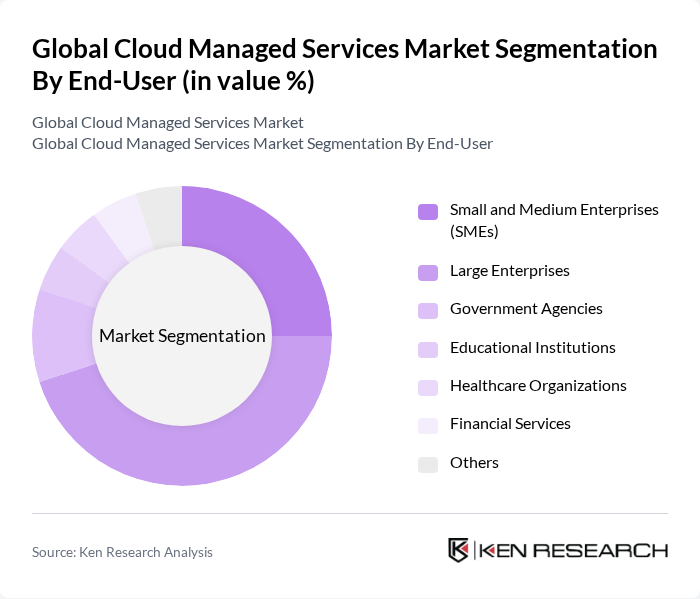

By End-User:The market is segmented by end-users, includingSmall and Medium Enterprises (SMEs), Large Enterprises, Government Agencies, Educational Institutions, Healthcare Organizations, Financial Services, and Others. Each segment has unique requirements and challenges that managed services aim to address. Large Enterprises are leading the market due to their extensive IT infrastructure and the need for comprehensive managed services to streamline operations and enhance security. The trend towards digital transformation and the need for scalability further drive this segment's growth .

The Global Cloud Managed Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon Web Services, Inc., Microsoft Corporation, IBM Corporation, Google LLC (Google Cloud Platform), Oracle Corporation, Alibaba Cloud (Alibaba Group Holding Limited), Rackspace Technology, Inc., Cisco Systems, Inc., Accenture plc, DXC Technology Company, Atos SE, Fujitsu Limited, NTT DATA Corporation, Tata Consultancy Services Limited, Wipro Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of cloud managed services is poised for significant evolution, driven by technological advancements and changing business needs. As organizations increasingly adopt hybrid cloud models, the demand for integrated solutions will rise. Furthermore, automation technologies are expected to streamline service delivery, enhancing efficiency and reducing operational costs. The emphasis on sustainability will also shape service offerings, as companies seek eco-friendly cloud solutions to meet corporate social responsibility goals and regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Type | Managed Network Services Managed Security Services Managed Infrastructure Services Managed Business Services Managed Mobility Services Managed Communication and Collaboration Services Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Educational Institutions Healthcare Organizations Financial Services Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Multi-Cloud Others |

| By Service Level Agreement (SLA) | Standard SLA Customized SLA Premium SLA Others |

| By Industry Vertical | IT and Telecommunications Retail & Consumer Goods Manufacturing & Automotive Energy and Utilities BFSI (Banking, Financial Services, and Insurance) Healthcare Government Others |

| By Geographic Presence | North America Europe Asia-Pacific Latin America Middle East and Africa Others |

| By Pricing Model | Pay-as-you-go Subscription-based Tiered Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Cloud Adoption | 100 | IT Managers, CTOs, Cloud Architects |

| SMB Cloud Managed Services | 80 | Business Owners, IT Consultants, Operations Managers |

| Industry-Specific Cloud Solutions | 60 | Sector Specialists, Compliance Officers, IT Directors |

| Cloud Security Services | 50 | Security Analysts, Risk Management Officers, CIOs |

| Cloud Migration Strategies | 40 | Project Managers, Cloud Engineers, Business Analysts |

The Global Cloud Managed Services Market is valued at approximately USD 137 billion, driven by the increasing adoption of cloud technologies and the demand for scalable IT solutions. This growth reflects a significant trend towards outsourcing IT management for operational efficiency.