Region:Middle East

Author(s):Rebecca

Product Code:KRAC8515

Pages:95

Published On:November 2025

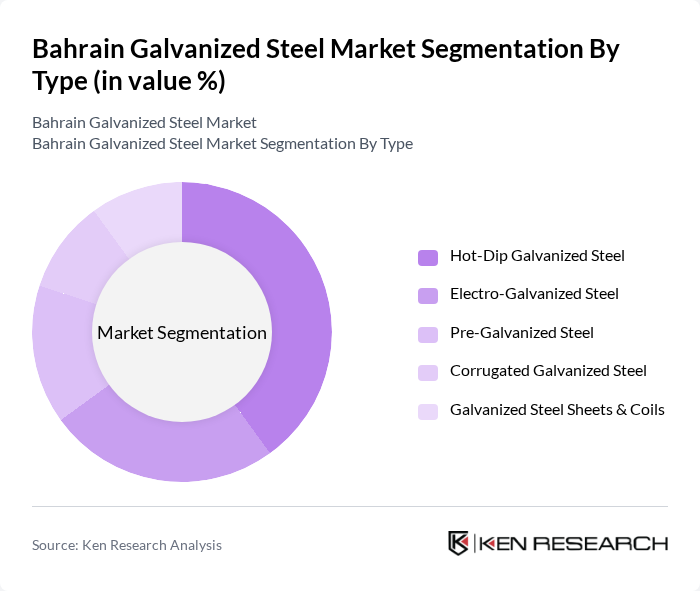

By Type:The market is segmented into Hot-Dip Galvanized Steel, Electro-Galvanized Steel, Pre-Galvanized Steel, Corrugated Galvanized Steel, and Galvanized Steel Sheets & Coils. Hot-Dip Galvanized Steel leads the segment due to its superior corrosion resistance and mechanical durability, making it the preferred choice for structural, roofing, and industrial applications. Corrugated variants are particularly favored for roofing and cladding in Bahrain’s climate, while electro-galvanized and pre-galvanized types serve specialized manufacturing and appliance needs .

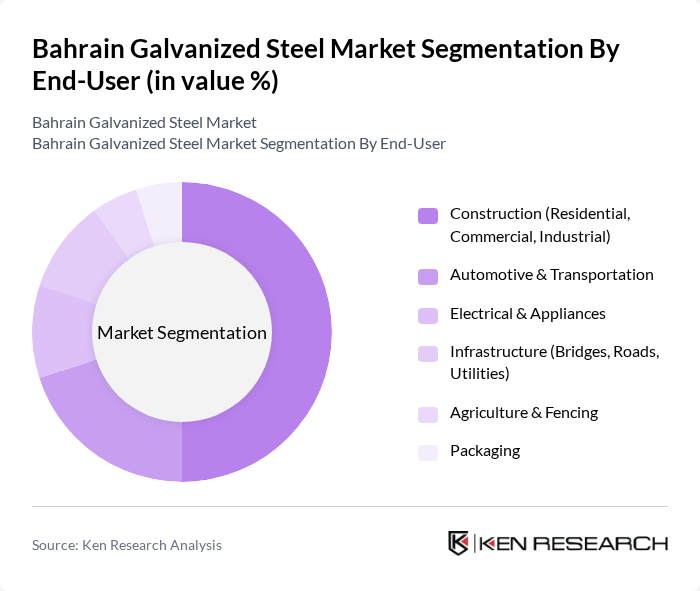

By End-User:The end-user segmentation includes Construction (Residential, Commercial, Industrial), Automotive & Transportation, Electrical & Appliances, Infrastructure (Bridges, Roads, Utilities), Agriculture & Fencing, and Packaging. The Construction sector is the dominant end-user, accounting for roughly half of total demand, driven by ongoing infrastructure development, government housing initiatives, and commercial building projects. Automotive & Transportation and Infrastructure follow, reflecting Bahrain’s investment in logistics, roads, and utilities .

The Bahrain Galvanized Steel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Steel, Universal Rolling (Unirol), Al Zamil Steel (Zamil Steel Construction Co.), United Steel Company (SULB Bahrain), Arabian Gulf Manufacturers, Al Jazeera Steel Products Co. SAOG, Emirates Steel, Qatar Steel Company, Sabic (Saudi Iron & Steel Company - Hadeed), Al-Futtaim Engineering, AIC Steel (Arabian International Company for Steel Structures), Al-Moayyed Ironmongery & Steel W.L.L., BRC Arabia, Al-Bahar Industries, Al-Hassan Engineering Co. SAOG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain galvanized steel market appears promising, driven by ongoing construction projects and a growing emphasis on sustainable building practices. As the government continues to invest in infrastructure, the demand for high-quality galvanized steel is expected to rise. Additionally, advancements in production technologies and a shift towards eco-friendly practices will likely enhance the market's resilience. Stakeholders must remain agile to adapt to evolving consumer preferences and regulatory requirements, ensuring sustained growth in this dynamic sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Hot-Dip Galvanized Steel Electro-Galvanized Steel Pre-Galvanized Steel Corrugated Galvanized Steel Galvanized Steel Sheets & Coils |

| By End-User | Construction (Residential, Commercial, Industrial) Automotive & Transportation Electrical & Appliances Infrastructure (Bridges, Roads, Utilities) Agriculture & Fencing Packaging |

| By Application | Structural Components Roofing and Cladding Fencing & Barriers Pipes & Tubes Fasteners & Hardware |

| By Thickness | Up to 1 mm (Thin Gauge) –3 mm (Medium Gauge) Above 3 mm (Heavy Gauge) |

| By Coating Weight | Light Coating (up to 120 gsm) Medium Coating (121–275 gsm) Heavy Coating (above 275 gsm) |

| By Distribution Channel | Direct Sales (Manufacturers to End-Users) Distributors & Stockists Online Sales |

| By Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Demand | 100 | Project Managers, Procurement Officers |

| Manufacturing Applications | 80 | Operations Managers, Production Supervisors |

| Automotive Industry Usage | 60 | Supply Chain Managers, Quality Control Engineers |

| Infrastructure Projects | 70 | Government Officials, Urban Planners |

| Retail and Distribution Channels | 50 | Sales Managers, Distribution Coordinators |

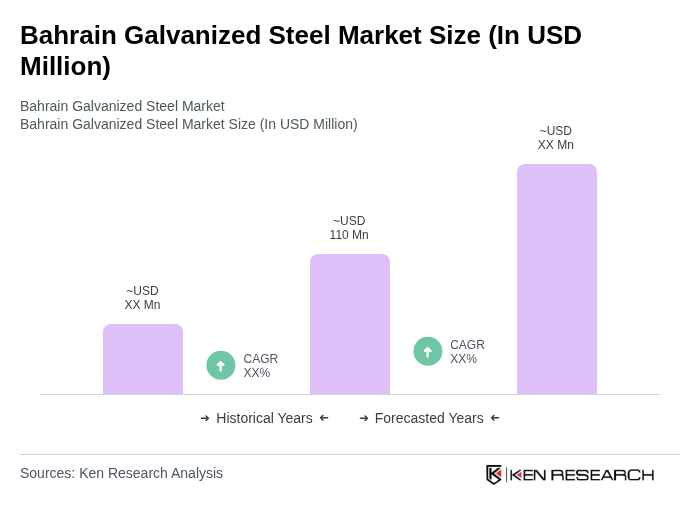

The Bahrain Galvanized Steel Market is valued at approximately USD 110 million, driven by strong demand from sectors such as construction, automotive, and infrastructure, supported by ongoing urbanization and government investment initiatives.