Region:Global

Author(s):Rebecca

Product Code:KRAA9399

Pages:81

Published On:November 2025

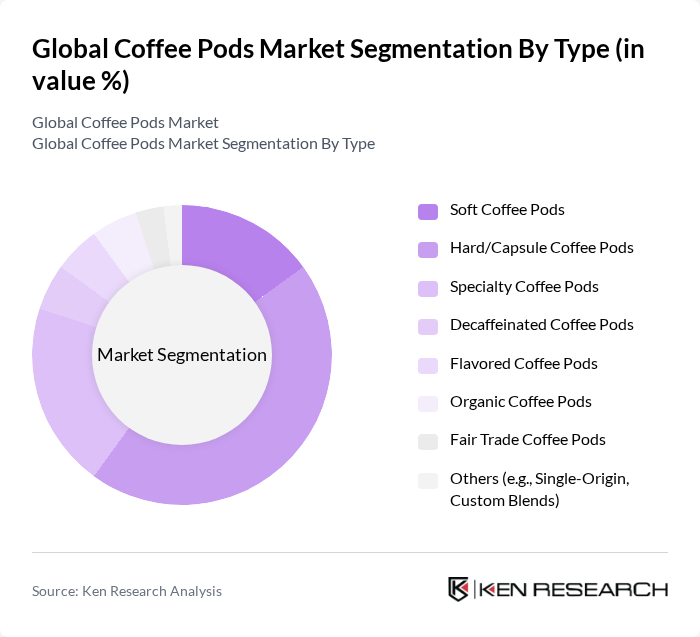

By Type:The coffee pods market is segmented into Soft Coffee Pods, Hard/Capsule Coffee Pods, Specialty Coffee Pods, Decaffeinated Coffee Pods, Flavored Coffee Pods, Organic Coffee Pods, Fair Trade Coffee Pods, and Others (e.g., Single-Origin, Custom Blends). Among these, Hard/Capsule Coffee Pods dominate the market due to their convenience, airtight construction, and compatibility with popular coffee machines. The trend towards specialty, organic, and fair trade options is gaining traction as consumers become more health-conscious and environmentally aware, seeking premium and ethically sourced products.

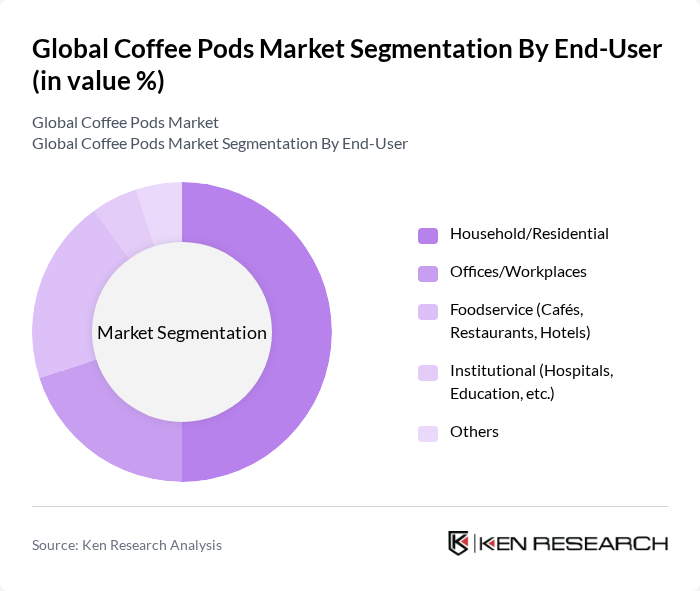

By End-User:The market is segmented by end-user into Household/Residential, Offices/Workplaces, Foodservice (Cafés, Restaurants, Hotels), Institutional (Hospitals, Education, etc.), and Others. The Household/Residential segment leads the market, driven by the increasing trend of home brewing, convenience of single-serve solutions, and the growing availability of premium coffee pods for home use. The Foodservice segment is also significant, as cafés and restaurants seek to offer high-quality, consistent coffee experiences to their customers.

The Global Coffee Pods Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé Nespresso, Keurig Dr Pepper, Luigi Lavazza S.p.A., Starbucks Corporation, JDE Peet's N.V., illycaffè S.p.A., Dunkin' Brands Group, Inc., Tchibo GmbH, The J.M. Smucker Company (incl. Folgers, Café Bustelo), Caffè Nero Group Ltd., Costa Coffee (The Coca-Cola Company), Tim Hortons Inc., Blue Bottle Coffee, Inc., Stumptown Coffee Roasters, Verena Street Coffee Co. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the coffee pods market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, manufacturers are likely to invest in eco-friendly materials and practices. Additionally, the integration of smart technology in coffee machines is expected to enhance user experience, making coffee preparation more efficient. These trends indicate a dynamic market landscape, with opportunities for growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Soft Coffee Pods Hard/Capsule Coffee Pods Specialty Coffee Pods Decaffeinated Coffee Pods Flavored Coffee Pods Organic Coffee Pods Fair Trade Coffee Pods Others (e.g., Single-Origin, Custom Blends) |

| By End-User | Household/Residential Offices/Workplaces Foodservice (Cafés, Restaurants, Hotels) Institutional (Hospitals, Education, etc.) Others |

| By Packaging Type | Plastic Pods Aluminum Pods Biodegradable/Compostable Pods Paper Pods Others |

| By Roast Type | Light Roast Medium Roast Medium-Dark Roast Dark Roast Extra Dark Roast |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Specialty Stores Online Retail/Direct-to-Consumer Foodservice/Institutional Others |

| By Machine Compatibility | Nespresso-Compatible Pods Keurig-Compatible Pods Tassimo-Compatible Pods Senseo-Compatible Pods Dolce Gusto-Compatible Pods Lavazza-Compatible Pods Illy-Compatible Pods Multi-Compatible Pods Others |

| By Price Range | Economy Mid-Range Premium Super-Premium Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Coffee Pod Sales | 150 | Store Managers, Category Buyers |

| Consumer Preferences for Coffee Pods | 120 | Regular Coffee Drinkers, Occasional Users |

| Manufacturing Insights | 100 | Production Managers, Quality Control Officers |

| Distribution Channel Analysis | 80 | Logistics Coordinators, Supply Chain Analysts |

| Market Trends and Innovations | 70 | Product Development Managers, Marketing Executives |

The Global Coffee Pods Market is valued at approximately USD 26.5 billion, reflecting a significant growth trend driven by increasing consumer demand for convenient coffee solutions and the rise of single-serve coffee machines.