Region:Global

Author(s):Geetanshi

Product Code:KRAD3920

Pages:92

Published On:November 2025

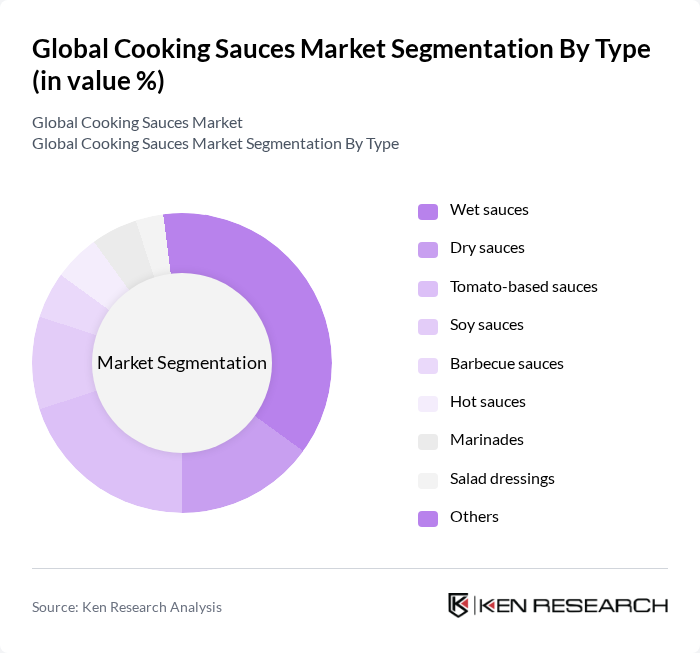

By Type:The cooking sauces market can be segmented into various types, including wet sauces, dry sauces, tomato-based sauces, soy sauces, barbecue sauces, hot sauces, marinades, salad dressings, and others. Among these, wet sauces are currently leading the market due to their versatility and ease of use in various culinary applications. Consumers are increasingly opting for ready-to-use sauces that enhance flavor without requiring extensive preparation, driving the demand for this sub-segment.

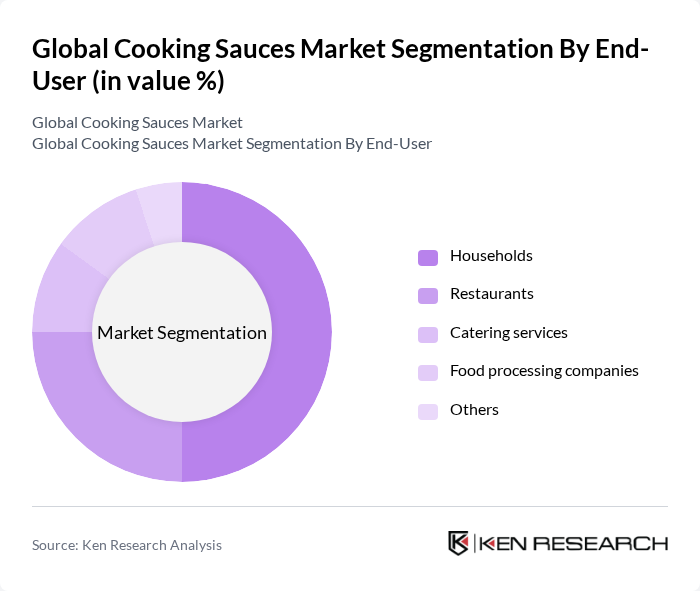

By End-User:The end-user segmentation includes households, restaurants, catering services, food processing companies, and others. Households represent the largest segment, driven by the increasing trend of home cooking and the desire for convenient meal solutions. The rise in cooking shows and social media influence has also encouraged consumers to experiment with different sauces, further boosting household consumption.

The Global Cooking Sauces Market is characterized by a dynamic mix of regional and international players. Leading participants such as Unilever PLC, The Kraft Heinz Company, McCormick & Company, Inc., Conagra Brands, Inc., Nestlé S.A., General Mills, Inc., Del Monte Foods, Inc., Campbell Soup Company, Barilla Group S.p.A., Kikkoman Corporation, Prego (owned by Barilla Group), Huy Fong Foods, Inc., Thai Kitchen (owned by ACH Food Companies, Inc.), Tasty Bite Eatables Limited, Annie's Homegrown (owned by General Mills, Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cooking sauces market appears promising, driven by evolving consumer preferences and innovative product offerings. As health-conscious consumers increasingly seek natural and organic options, brands that adapt to these trends are likely to thrive. Additionally, the rise of e-commerce is transforming how consumers purchase cooking sauces, with online sales projected to grow significantly. Companies that leverage technology and sustainability in their operations will be well-positioned to capture market share and meet the demands of a changing consumer landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Wet sauces Dry sauces Tomato-based sauces Soy sauces Barbecue sauces Hot sauces Marinades Salad dressings Others |

| By End-User | Households Restaurants Catering services Food processing companies Others |

| By Packaging Type | Glass bottles Plastic bottles Pouches Cans Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online retail Convenience stores Specialty stores Others |

| By Flavor Profile | Sweet Spicy Savory Tangy Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Health Claims | Low sodium Gluten-free Organic Non-GMO Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Cooking Sauce Sales | 100 | Store Managers, Category Buyers |

| Food Service Industry Insights | 80 | Restaurant Owners, Executive Chefs |

| Consumer Preferences in Sauces | 120 | Home Cooks, Culinary Enthusiasts |

| Trends in Organic and Health-Conscious Sauces | 60 | Health Food Store Managers, Nutritionists |

| Market Dynamics in International Sauces | 40 | Import/Export Managers, Culinary Export Specialists |

The Global Cooking Sauces Market is valued at approximately USD 55 billion, driven by increasing demand for convenience foods, global culinary trends, and the popularity of ethnic cuisines. This market is expected to continue growing as consumer preferences evolve.