Region:Global

Author(s):Geetanshi

Product Code:KRAD6052

Pages:92

Published On:December 2025

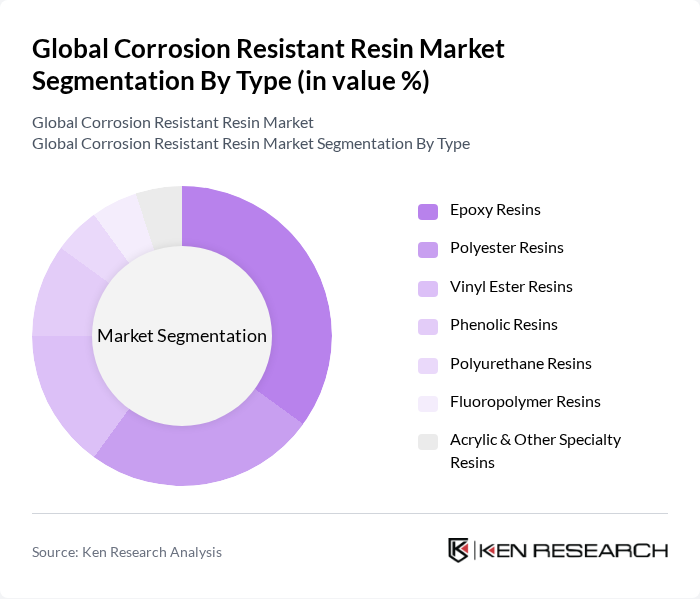

By Type:The market is segmented into various types of resins, including Epoxy Resins, Polyester Resins, Vinyl Ester Resins, Phenolic Resins, Polyurethane Resins, Fluoropolymer Resins, and Acrylic & Other Specialty Resins. Among these, Epoxy Resins are leading due to their superior adhesion, chemical resistance, and versatility in applications. The increasing demand for high-performance coatings and adhesives in industries such as automotive and construction is driving the growth of this segment.

By End-User:The end-user segments include Chemical Processing, Oil & Gas, Marine, Infrastructure & Construction, Power Generation, Automotive & Transportation, Pulp & Paper, Food & Beverage, and Others. The Infrastructure & Construction segment is currently the largest due to the increasing investments in infrastructure projects globally, which require durable and corrosion-resistant materials to ensure longevity and safety.

The Global Corrosion Resistant Resin Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Dow Inc., Huntsman International LLC, Ashland Inc., Sika AG, 3M Company, Covestro AG, DuPont de Nemours, Inc., Momentive Performance Materials Inc., Wacker Chemie AG, Reichhold LLC, Polynt Group, Hexion Inc., KUKDO Chemical Co., Ltd., AOC, LLC, Scott Bader Company Ltd., Allnex GmbH, Olin Corporation, Sino Polymer Co., Ltd., Swancor Holding Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the corrosion-resistant resin market appears promising, driven by ongoing innovations and a shift towards sustainable practices. As industries increasingly prioritize eco-friendly materials, the adoption of bio-based resins is expected to rise significantly. Additionally, the integration of smart materials into resin formulations will enhance performance and functionality, catering to evolving consumer demands. This dynamic landscape presents opportunities for companies to innovate and expand their product offerings, ensuring competitiveness in a rapidly changing market.

| Segment | Sub-Segments |

|---|---|

| By Type | Epoxy Resins Polyester Resins Vinyl Ester Resins Phenolic Resins Polyurethane Resins Fluoropolymer Resins Acrylic & Other Specialty Resins |

| By End-User | Chemical Processing Oil & Gas Marine Infrastructure & Construction Power Generation Automotive & Transportation Pulp & Paper Food & Beverage Others |

| By Application | Coatings & Linings FRP Composites Adhesives & Sealants Concrete Protection & Repair Tanks, Pipes, & Vessels Others |

| By Formulation | Solvent-Based Systems Water-Based Systems Solvent-free / 100% Solids Systems Powder Coatings Others |

| By Geography | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Performance Characteristics | High-Temperature Resistance Chemical Resistance Abrasion & Mechanical Strength UV & Weathering Resistance Others |

| By Market Channel | Direct Sales to OEMs & End Users Specialty Chemical Distributors EPC / Engineering Contractor Channel Online & E-commerce Platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Resin Applications | 100 | Product Engineers, Procurement Managers |

| Construction Material Resins | 80 | Project Managers, Architects |

| Marine Coating Resins | 70 | Marine Engineers, Quality Control Managers |

| Consumer Goods Packaging Resins | 90 | Packaging Designers, Supply Chain Analysts |

| Industrial Adhesives and Sealants | 75 | Manufacturing Supervisors, R&D Specialists |

The Global Corrosion Resistant Resin Market is valued at approximately USD 10 billion, driven by the increasing demand for durable materials across various industries, including construction, automotive, and marine sectors.