Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8309

Pages:86

Published On:November 2025

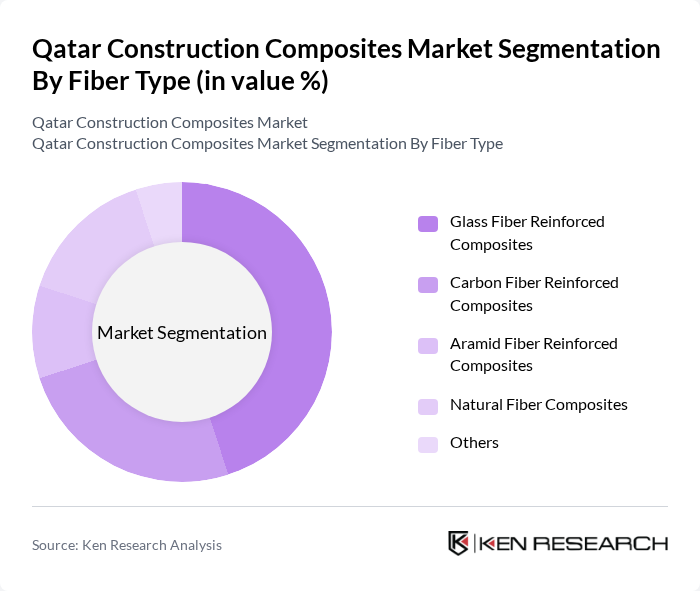

By Fiber Type:The fiber type segmentation includes various materials used in the production of construction composites. The primary subsegments are Glass Fiber Reinforced Composites, Carbon Fiber Reinforced Composites, Aramid Fiber Reinforced Composites, Natural Fiber Composites, and Others. Among these, Glass Fiber Reinforced Composites dominate the market due to their excellent strength-to-weight ratio, corrosion resistance, and cost-effectiveness, making them a preferred choice for various construction applications.

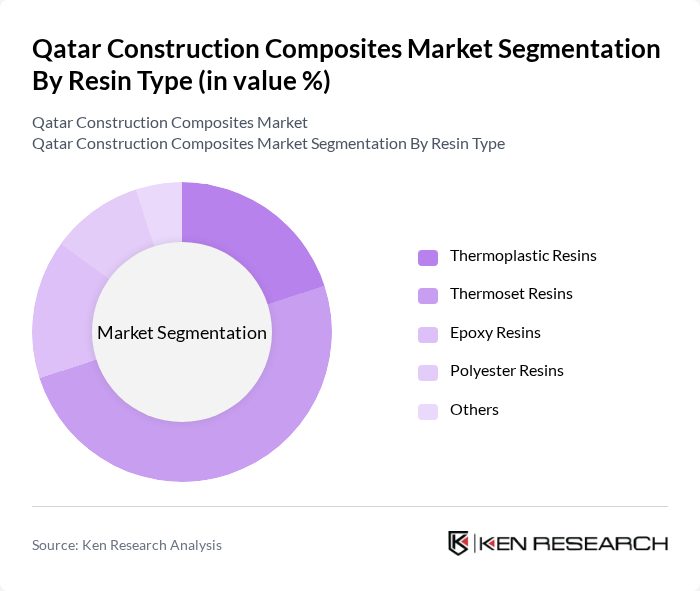

By Resin Type:The resin type segmentation encompasses the various resins used in the manufacturing of construction composites. This includes Thermoplastic Resins, Thermoset Resins, Epoxy Resins, Polyester Resins, and Others. Thermoset Resins are currently leading the market due to their superior mechanical properties and thermal stability, making them ideal for high-performance applications in construction.

The Qatar Construction Composites Market is characterized by a dynamic mix of regional and international players. Leading participants such as QD-SBG Construction, Gulf Contracting Company, HBK Contracting, AlJaber Engineering, Qatar National Cement Company, Doha Cables, Qatar Precast Concrete Company, Qatar Steel Company, Lusail Real Estate Development Company, Ashghal (Public Works Authority), Qatar Petroleum Engineering and Construction Company, Mannai Corporation, Bin Omran Group, Consolidated Contractors Company, Midmac Contracting Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar construction composites market appears promising, driven by increasing investments in sustainable infrastructure and technological innovations. As the government continues to prioritize green building initiatives, the demand for composite materials is expected to rise significantly. Furthermore, the integration of smart technologies in construction processes will likely enhance the efficiency and performance of composite materials, positioning them as a vital component in Qatar's evolving construction landscape.

| Segment | Sub-Segments |

|---|---|

| By Fiber Type | Glass Fiber Reinforced Composites Carbon Fiber Reinforced Composites Aramid Fiber Reinforced Composites Natural Fiber Composites Others |

| By Resin Type | Thermoplastic Resins Thermoset Resins Epoxy Resins Polyester Resins Others |

| By Application | Roofing and Cladding Structural Components Insulation Materials Interior Finishing Infrastructure Projects |

| By End-User | Residential Construction Commercial Construction Industrial Construction Infrastructure and Transportation Others |

| By Manufacturing Process | Hand Lay-Up Spray-Up Filament Winding Compression Molding Pultrusion |

| By Distribution Channel | Direct Sales to Contractors Building Material Distributors Specialty Composite Suppliers Online Sales Platforms Others |

| By Region | Doha Al Rayyan Lusail Al Wakrah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Infrastructure Projects | 85 | Project Managers, Civil Engineers |

| Residential Construction | 75 | Architects, Developers |

| Commercial Building Projects | 65 | Construction Managers, Procurement Officers |

| Composite Material Suppliers | 55 | Sales Managers, Product Development Heads |

| Sustainability Initiatives in Construction | 45 | Sustainability Consultants, Regulatory Affairs Managers |

The Qatar Construction Composites Market is valued at approximately USD 343 million, reflecting significant growth driven by urbanization and infrastructure development, particularly in preparation for major events like the FIFA World Cup.