Region:Global

Author(s):Geetanshi

Product Code:KRAC0141

Pages:93

Published On:August 2025

By Type:The cryptocurrency market is segmented into various types, including Bitcoin (BTC), Ethereum (ETH), Stablecoins, Altcoins, Privacy Coins, Meme Coins, and Others.Bitcoinremains the most recognized and widely used cryptocurrency, often regarded as digital gold and a store of value.Ethereumis prominent for its smart contract functionality and ecosystem of decentralized applications.Stablecoinshave gained significant traction due to their price stability and utility in trading and payments.Altcoinsencompass a diverse range of projects focused on scalability, interoperability, and specialized use cases.Privacy CoinsandMeme Coinsserve niche communities, with privacy coins emphasizing transaction anonymity and meme coins driven by online communities and viral trends .

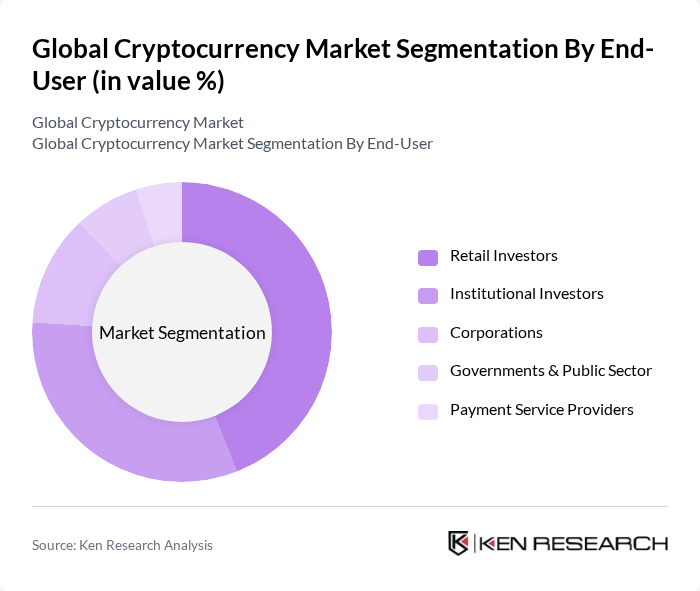

By End-User:The end-user segmentation of the cryptocurrency market includes Retail Investors, Institutional Investors, Corporations, Governments & Public Sector, and Payment Service Providers.Retail investorsare increasingly active, driven by easy access to trading platforms, mobile apps, and the appeal of high returns.Institutional investorsare expanding their presence, motivated by portfolio diversification and the launch of regulated investment products such as spot bitcoin ETFs.Corporationsare leveraging blockchain for operational efficiencies, supply chain management, and treasury diversification.Governmentsand thepublic sectorare exploring central bank digital currencies (CBDCs) and regulatory oversight, whilepayment service providersare integrating crypto for cross-border payments and remittances .

The Global Cryptocurrency Market is characterized by a dynamic mix of regional and international players. Leading participants such as Binance, Coinbase Global, Inc., Kraken, Bitfinex, Gemini Trust Company, LLC, and Ripple Labs Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The cryptocurrency market is poised for transformative growth, driven by technological advancements and increasing integration with traditional finance. As blockchain technology matures, the adoption of smart contracts and decentralized applications will likely accelerate. Furthermore, the rise of Central Bank Digital Currencies (CBDCs) is expected to enhance legitimacy and foster collaboration between governments and the crypto sector, paving the way for a more stable and regulated environment that encourages innovation and investment.

| Segment | Sub-Segments |

|---|---|

| By Type | Bitcoin (BTC) Ethereum (ETH) Stablecoins (USDT, USDC, DAI, etc.) Altcoins (e.g., Solana, Cardano, Polkadot, Avalanche, etc.) Privacy Coins (e.g., Monero, Zcash) Meme Coins (e.g., Dogecoin, Shiba Inu) Others |

| By End-User | Retail Investors Institutional Investors Corporations Governments & Public Sector Payment Service Providers |

| By Application | Payment Solutions Investment and Trading Remittances & Cross-Border Transfers Smart Contracts & Decentralized Applications (dApps) Non-Fungible Tokens (NFTs) Decentralized Finance (DeFi) |

| By Distribution Channel | Cryptocurrency Exchanges (Centralized & Decentralized) Over-the-Counter (OTC) Services Peer-to-Peer (P2P) Platforms Crypto ATMs |

| By Regulatory Compliance | Fully Compliant Partially Compliant Non-Compliant |

| By Market Maturity | Emerging Markets Established Markets |

| By Investment Size | Small Investments (< $10,000) Medium Investments ($10,000 - $1 million) Large Investments (> $1 million) |

| By Region | North America Europe Asia-Pacific Middle East & Africa Latin America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Cryptocurrency Investors | 120 | Individual Investors, Crypto Enthusiasts |

| Institutional Investment Strategies | 60 | Portfolio Managers, Hedge Fund Analysts |

| Blockchain Technology Developers | 40 | Software Engineers, Blockchain Architects |

| Cryptocurrency Exchange Operations | 50 | Exchange Managers, Compliance Officers |

| Regulatory Impact Assessment | 45 | Legal Advisors, Compliance Specialists |

The Global Cryptocurrency Market is valued at approximately USD 3.4 trillion, reflecting significant growth driven by increased adoption of digital currencies, advancements in blockchain technology, and rising institutional participation.