Global Dental Practice Management Software Market Overview

- The Global Dental Practice Management Software Market is valued at USD 2.5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital solutions in dental practices, enhancing operational efficiency and patient management. The rising demand for integrated software solutions that streamline billing, scheduling, and patient communication has significantly contributed to the market's expansion. The market is further propelled by the shift toward cloud-based platforms, artificial intelligence integration, and analytics-driven insights, which improve both administrative and clinical outcomes .

- Key players in this market are predominantly located in North America and Europe, with the United States and Germany leading due to their advanced healthcare infrastructure and high investment in dental technology. North America holds over 40% of the global market share, supported by a high rate of independent dental practices and strong demand for digital tools that enhance efficiency and patient care. The presence of major software providers and a growing number of dental practices adopting these solutions further solidify their dominance in the market .

- The U.S. government’s regulatory framework for electronic health records (EHR) in dental practices is governed by the Health Information Technology for Economic and Clinical Health (HITECH) Act, enacted by the U.S. Department of Health & Human Services in 2009. This regulation mandates compliance with standards for electronic health record adoption, data interoperability, and patient privacy under the broader scope of the Health Insurance Portability and Accountability Act (HIPAA). These requirements have spurred the adoption of dental practice management software, as practices seek compliant solutions to meet these standards .

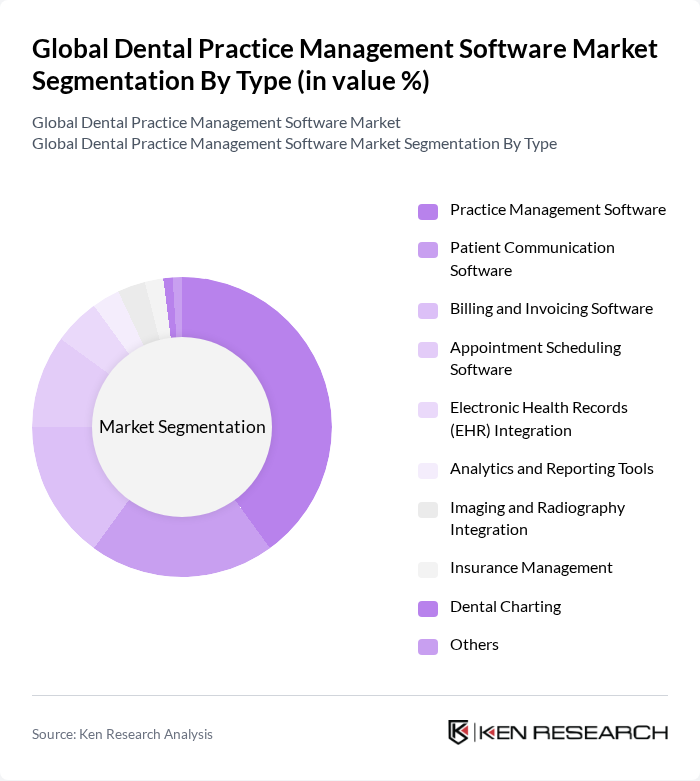

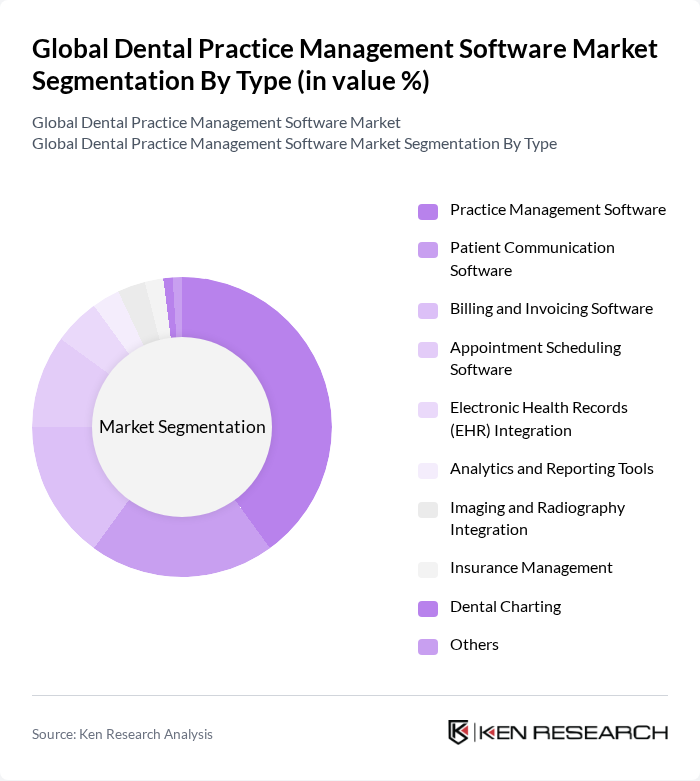

Global Dental Practice Management Software Market Segmentation

By Type:The market is segmented into various types of software solutions that cater to different operational needs within dental practices. The dominant sub-segment is Practice Management Software, which is widely adopted for its comprehensive features that streamline administrative tasks such as scheduling, billing, and patient records management. Other notable segments include Patient Communication Software, which supports automated reminders and digital engagement, and Billing and Invoicing Software, which facilitates insurance claims and payment processing. The increasing focus on analytics, cloud-based integration, and interoperability with imaging and EHR systems is driving innovation across all segments .

By End-User:The end-user segment includes various types of dental practices that utilize management software. Dental Clinics represent the largest share, driven by the need for efficient patient management and operational workflows. Dental Hospitals and Laboratories also contribute significantly, as they require specialized software for complex operations and patient care. The growing trend of digitalization in dental education has led to an increase in software adoption among Dental Schools as well. Dental clinics account for the majority of installations globally, reflecting the sector’s focus on streamlined operations and compliance .

Global Dental Practice Management Software Market Competitive Landscape

The Global Dental Practice Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Henry Schein, Inc. (Dentrix, Easy Dental, SoftDent), Patterson Companies, Inc. (Eaglesoft), Open Dental Software, Inc., Practice-Web, Inc., Curve Dental, Inc., Carestream Dental LLC, DentiMax, Inc., Planet DDS (Denticon), Tab32, iDentalSoft, CD Newco, LLC (Dental Intelligence), MOGO, Inc., YAPI, Inc., Admor Limited, Gaargle Solutions Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Global Dental Practice Management Software Market Industry Analysis

Growth Drivers

- Increasing Demand for Efficient Practice Management:The dental industry is witnessing a surge in demand for efficient practice management solutions, driven by the need to streamline operations. In future, the global dental services market is projected to reach $500 billion, with a significant portion attributed to software solutions that enhance operational efficiency. This demand is further supported by the increasing patient volume, which necessitates effective scheduling, billing, and record-keeping systems to manage growing workloads effectively.

- Rising Adoption of Cloud-Based Solutions:Cloud-based dental practice management software is gaining traction, with an estimated 60% of dental practices expected to adopt such solutions in future. This shift is driven by the flexibility, scalability, and cost-effectiveness of cloud solutions, which allow practices to access data remotely and reduce IT overhead. The global cloud computing market is projected to reach $1 trillion, indicating a robust trend that supports the transition of dental practices to cloud-based management systems.

- Technological Advancements in Dental Software:The dental software landscape is rapidly evolving, with advancements in artificial intelligence (AI) and machine learning (ML) enhancing practice management capabilities. In future, it is estimated that AI-driven solutions will account for 30% of the dental software market, improving patient diagnostics and operational efficiencies. These technological innovations are crucial for practices aiming to provide high-quality care while optimizing their workflows and resource management.

Market Challenges

- High Initial Investment Costs:One of the significant barriers to adopting dental practice management software is the high initial investment required. Many dental practices, particularly small and mid-sized ones, face challenges in allocating budgets for software implementation, which can range from $10,000 to $50,000. This financial burden can deter practices from upgrading their systems, limiting their operational efficiency and competitiveness in the market.

- Data Security and Privacy Concerns:As dental practices increasingly adopt digital solutions, concerns regarding data security and patient privacy have escalated. In future, it is projected that over 70% of dental practices will experience data breaches, leading to potential legal repercussions and loss of patient trust. Compliance with regulations such as HIPAA is essential, yet many practices struggle to implement adequate security measures, posing a significant challenge to the market's growth.

Global Dental Practice Management Software Market Future Outlook

The future of dental practice management software is poised for significant transformation, driven by technological advancements and evolving patient expectations. As practices increasingly adopt AI and machine learning, operational efficiencies will improve, leading to enhanced patient care. Additionally, the integration of tele-dentistry will expand access to dental services, particularly in underserved areas. The emphasis on data interoperability will further facilitate seamless communication between healthcare providers, ultimately enhancing patient outcomes and practice efficiency.

Market Opportunities

- Expansion into Emerging Markets:Emerging markets present a substantial opportunity for dental practice management software providers. With a growing middle class and increasing healthcare expenditure, countries like India and Brazil are expected to see a rise in dental practices adopting modern management solutions. This trend could lead to a market expansion worth approximately $2 billion by future, driven by the need for efficient practice management.

- Development of Mobile Applications:The development of mobile applications for dental practice management is a promising opportunity. With over 3 billion smartphone users globally, mobile solutions can enhance patient engagement and streamline practice operations. In future, it is anticipated that mobile applications will account for 25% of the dental software market, providing practices with tools to manage appointments, billing, and patient communication effectively.