Region:North America

Author(s):Rebecca

Product Code:KRAD7370

Pages:94

Published On:December 2025

By Component:The components of the market include Software & Platforms, Services, Hardware & Devices, and Others. Among these, Software & Platforms are leading due to the increasing integration of electronic health records (EHR), growth in patient portals, mobile apps, and care management platforms, and the growing demand for user-friendly applications that enhance patient interaction. Services, including implementation, integration, training, and support, are also crucial as they ensure the effective deployment, configuration, and ongoing utilization of these technologies by healthcare organizations. Hardware & Devices, such as self-service kiosks, wearables, and remote home monitoring devices, are increasingly used to collect real-time patient data and support remote care programs, but are currently less dominant in revenue terms compared to software-centric solutions.

By Type:The market is segmented into Standalone Patient Engagement Solutions, Integrated Patient Engagement Solutions, AI-Driven Engagement Tools, Telehealth & Virtual Care Solutions, and Others. Integrated Patient Engagement Solutions are currently the most dominant segment, driven by the need for seamless interoperability between EHRs, practice management systems, revenue cycle platforms, and population health tools, enabling a unified view of the patient across care settings. Telehealth & Virtual Care Solutions have also gained substantial traction post-pandemic as they provide convenient, remote access to healthcare services, support chronic disease management, and extend care beyond traditional settings. Standalone solutions remain popular among smaller practices for targeted use cases such as appointment reminders or secure messaging, but face growing competition from integrated and AI-enabled offerings that provide more comprehensive, workflow-embedded approaches to patient engagement.

The US Patient Engagement Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Epic Systems Corporation, Oracle Health (formerly Cerner Corporation), Allscripts Healthcare Solutions (Veradigm Inc.), athenahealth, Inc., Philips Healthcare (Royal Philips), McKesson Corporation, Salesforce, Inc. (Health Cloud), IBM (including legacy Watson Health assets), NextGen Healthcare, Inc., WELL Health Technologies (WELL Health / Well Health Inc. – patient communication), Solutionreach, Inc., Luma Health, Inc., GetWellNetwork, Inc., CipherHealth Inc., Zocdoc, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the US patient engagement solutions market appears promising, driven by ongoing technological advancements and a strong focus on improving patient outcomes. As healthcare providers increasingly adopt value-based care models, the demand for effective engagement solutions will likely rise. Additionally, the integration of artificial intelligence and machine learning into patient engagement tools is expected to enhance personalization and efficiency, further driving market growth. The emphasis on remote patient monitoring will also play a crucial role in shaping the future landscape of this market.

| Segment | Sub-Segments |

|---|---|

| By Component | Software & Platforms (EHR-Integrated, Standalone) Services (Implementation, Training, Support & Maintenance) Hardware & Devices (Kiosks, Wearables, Home Monitoring Devices) Others |

| By Type | Standalone Patient Engagement Solutions Integrated Patient Engagement Solutions AI-Driven Engagement Tools Telehealth & Virtual Care Solutions Others |

| By Functionality | Communication & Messaging (Portals, Secure Messaging, Chat) Remote Patient Monitoring & Health Tracking Appointment Scheduling & Care Coordination Billing, Payments & Revenue Cycle Engagement Patient Education & Coaching Population Health & Care Management Others |

| By Delivery Mode | Web & Cloud-Based Solutions On-Premise Solutions Hybrid Deployment Models Others |

| By Application / Use Case | Chronic Disease Management Preventive & Wellness Programs Inpatient Health Management Outpatient & Ambulatory Care Management Population Health Management Medication Adherence & Reminder Solutions Others |

| By Therapeutic Area | Cardiovascular Diseases Diabetes & Metabolic Disorders Oncology Respiratory Diseases Mental & Behavioral Health Health & Wellness Others |

| By End-User | Healthcare Providers (Hospitals & Health Systems) Physician Practices & Clinics Payers (Health Plans & Insurance Companies) Employers & Corporates Patients & Caregivers Others |

| By Geographic Region (US) | Northeast Midwest South West |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 150 | Hospital Administrators, Patient Engagement Managers |

| Patients | 120 | Chronic Disease Patients, General Patient Population |

| Technology Providers | 100 | Product Managers, Technology Developers |

| Healthcare Policy Experts | 80 | Healthcare Analysts, Policy Makers |

| Insurance Companies | 70 | Claims Managers, Customer Service Representatives |

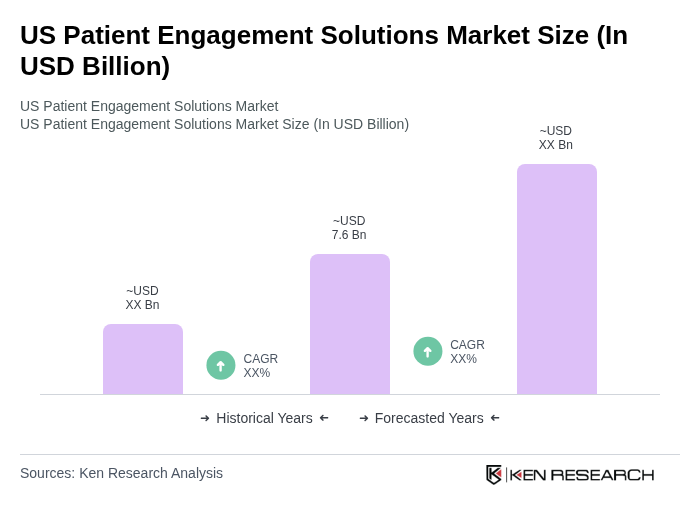

The US Patient Engagement Solutions Market is valued at approximately USD 7.6 billion, reflecting a significant growth trend driven by the adoption of digital health technologies and increasing patient awareness regarding healthcare services.