Region:Middle East

Author(s):Geetanshi

Product Code:KRAB1166

Pages:91

Published On:January 2026

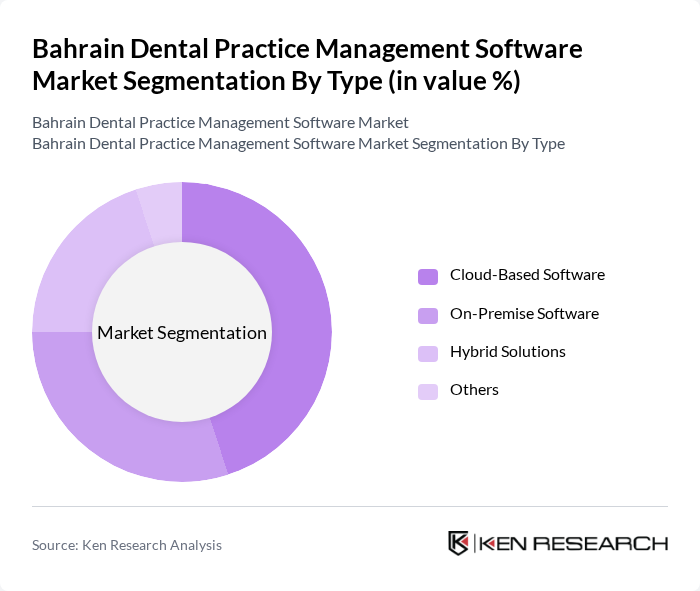

By Type:The market is segmented into various types of dental practice management software, including cloud-based, on-premise, hybrid solutions, and others. Cloud-based software is gaining traction due to its flexibility and cost-effectiveness, allowing dental practices to access their systems remotely. On-premise solutions, while still relevant, are gradually being overshadowed by the growing preference for cloud solutions. Hybrid solutions offer a blend of both, catering to practices that require a mix of local and cloud functionalities.

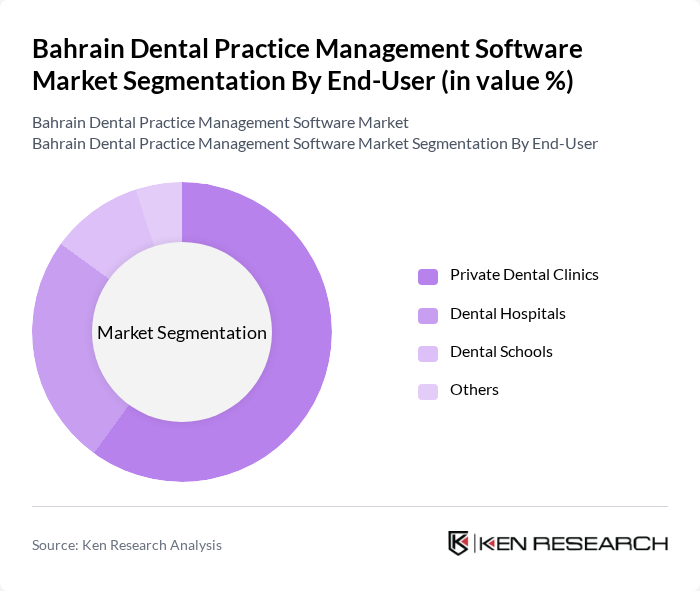

By End-User:The end-user segment includes private dental clinics, dental hospitals, dental schools, and others. Private dental clinics dominate the market due to their increasing adoption of technology to enhance patient management and operational efficiency. Dental hospitals also contribute significantly, leveraging comprehensive software solutions for large-scale operations. Dental schools are gradually adopting these systems for educational purposes, but their impact is less pronounced compared to private clinics.

The Bahrain Dental Practice Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dentrix, Open Dental, Practice-Web, Curve Dental, Carestream Dental, Easy Dental, DentiMax, eClinicalWorks, SoftDent, iDentalSoft, Practice Management Software Solutions, Zocdoc, YAPI, Mogo, Dental Intelligence contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain dental practice management software market appears promising, driven by accelerated digital transformation and significant investments in technology infrastructure. The Information & Communications sector is expected to grow at 12.5% year-on-year in future, indicating a strong demand for IT solutions. Additionally, agreements worth USD 20 billion signed with U.S. firms for digital infrastructure projects will enhance the capacity for advanced software systems in healthcare, fostering innovation and efficiency in dental practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Cloud-Based Software On-Premise Software Hybrid Solutions Others |

| By End-User | Private Dental Clinics Dental Hospitals Dental Schools Others |

| By Functionality | Appointment Scheduling Billing and Invoicing Patient Records Management Others |

| By Deployment Model | SaaS (Software as a Service) IaaS (Infrastructure as a Service) PaaS (Platform as a Service) Others |

| By Region | Capital Governorate Northern Governorate Southern Governorate Muharraq Governorate |

| By Customer Size | Small Practices Medium Practices Large Practices Others |

| By Integration Capability | Standalone Solutions Integrated Solutions with Other Healthcare Systems Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Dental Practices | 100 | Dentists, Practice Managers |

| Pediatric Dental Clinics | 50 | Pediatric Dentists, Administrative Staff |

| Orthodontic Practices | 40 | Orthodontists, Office Managers |

| Cosmetic Dentistry | 30 | Cosmetic Dentists, Marketing Managers |

| Dental Laboratories | 20 | Lab Technicians, Operations Managers |

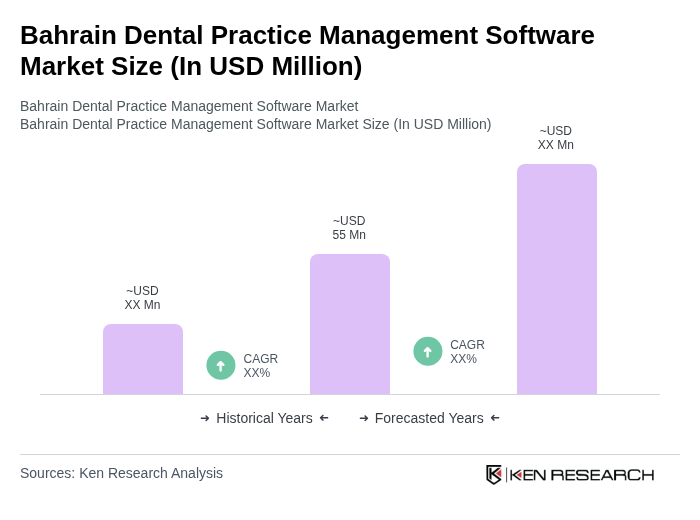

The Bahrain Dental Practice Management Software Market is valued at approximately USD 55 million, reflecting a five-year historical analysis. This growth is attributed to the increasing digital transformation and cloud-based adoption among healthcare providers.