Region:Global

Author(s):Shubham

Product Code:KRAD6634

Pages:94

Published On:December 2025

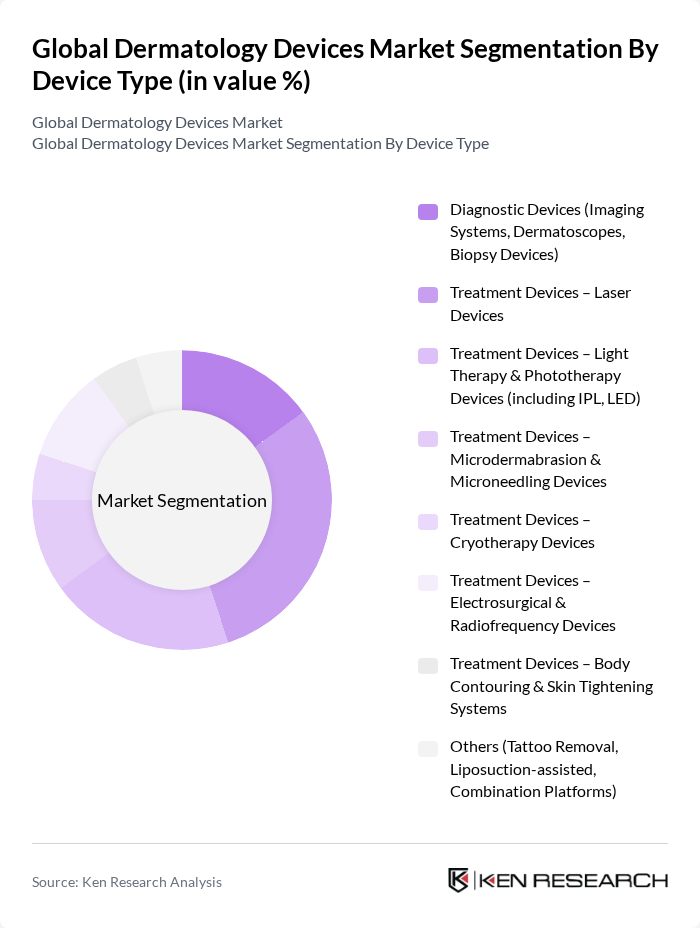

By Device Type:The device type segmentation includes various categories such as diagnostic devices, treatment devices, and others. Among these, treatment devices are particularly significant due to the increasing demand for non-invasive and minimally invasive procedures. The sub-segments include laser devices, light therapy devices (including LED therapy and IPL), microdermabrasion devices, cryotherapy devices, electrosurgical equipment, radiofrequency devices, and liposuction devices, each catering to specific dermatological needs.

By Application:The application segmentation encompasses various dermatological conditions and treatments, including skin cancer diagnosis, acne management, and skin rejuvenation. Skin cancer diagnosis and treatment is a leading application due to the rising incidence of skin cancer globally. Other applications like acne management, psoriasis, skin rejuvenation, wrinkle reduction, pigmentation disorders, hair removal, body contouring and skin tightening, and tattoo and vascular lesion removal are also gaining traction as consumers increasingly seek aesthetic improvements.

The Global Dermatology Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cutera, Inc., Lumenis Be Ltd., Candela Corporation, Alma Lasers, Ltd., Cynosure, LLC (Hologic, Inc.), Solta Medical, Inc. (Bausch Health Companies Inc.), Canfield Scientific, Inc., 3Gen, Inc. (DermLite), Heine Optotechnik GmbH & Co. KG, Ambicare Health Ltd., Genesis Biosystems, Inc., Cortex Technology ApS, AMD Global Telemedicine, Inc., Michelson Diagnostics Ltd., Image Derm, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the dermatology devices market in future appears promising, driven by ongoing technological advancements and increasing consumer demand for effective skin treatments. The integration of artificial intelligence and teledermatology is expected to enhance diagnostic accuracy and patient engagement. Additionally, the trend towards personalized skincare solutions is likely to gain momentum, as consumers seek tailored treatments that address their unique skin concerns, fostering further innovation and market growth.

| Segment | Sub-Segments |

|---|---|

| By Device Type | Diagnostic Devices (Imaging Systems, Dermatoscopes, Biopsy Devices) Treatment Devices – Laser Devices Treatment Devices – Light Therapy & Phototherapy Devices (including IPL, LED) Treatment Devices – Microdermabrasion & Microneedling Devices Treatment Devices – Cryotherapy Devices Treatment Devices – Electrosurgical & Radiofrequency Devices Treatment Devices – Body Contouring & Skin Tightening Systems Others (Tattoo Removal, Liposuction-assisted, Combination Platforms) |

| By Application | Skin Cancer Diagnosis and Treatment Acne and Scar Management Psoriasis and Other Inflammatory Skin Diseases Skin Rejuvenation, Wrinkle Reduction & Pigmentation Hair Removal Body Contouring & Cellulite Reduction Tattoo and Vascular Lesion Removal Others |

| By End-User | Hospitals Dermatology Clinics & Centers Medical Spas & Aesthetic Centers Home Care Settings Research & Academic Institutions Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | Energy-based Non-invasive Technologies (Laser, Light, RF, Ultrasound) Minimally Invasive Technologies (Microneedling, Microdermabrasion, Fractional) Invasive Surgical Technologies (Liposuction-assisted, Excisional) Digital & AI-enabled Imaging and Analytics |

| By Distribution Channel | Direct Sales to Healthcare Providers Distributors & Value-added Resellers Online / E-commerce Channels Group Purchasing Organizations (GPOs) & Tenders Others |

| By Price Range | Premium Capital Equipment Mid-range Systems Entry-level & Portable Devices Consumables & Accessories |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dermatology Clinics | 120 | Dermatologists, Clinic Managers |

| Hospital Procurement Departments | 100 | Procurement Officers, Medical Device Buyers |

| Medical Device Manufacturers | 80 | Product Managers, R&D Directors |

| Regulatory Bodies | 50 | Regulatory Affairs Specialists, Compliance Officers |

| Healthcare Technology Consultants | 70 | Consultants, Market Analysts |

The Global Dermatology Devices Market is valued at approximately USD 13.5 billion, reflecting a significant growth driven by the rising prevalence of skin disorders and advancements in technology that enhance treatment efficacy.