Region:Europe

Author(s):Dev

Product Code:KRAB0921

Pages:98

Published On:October 2025

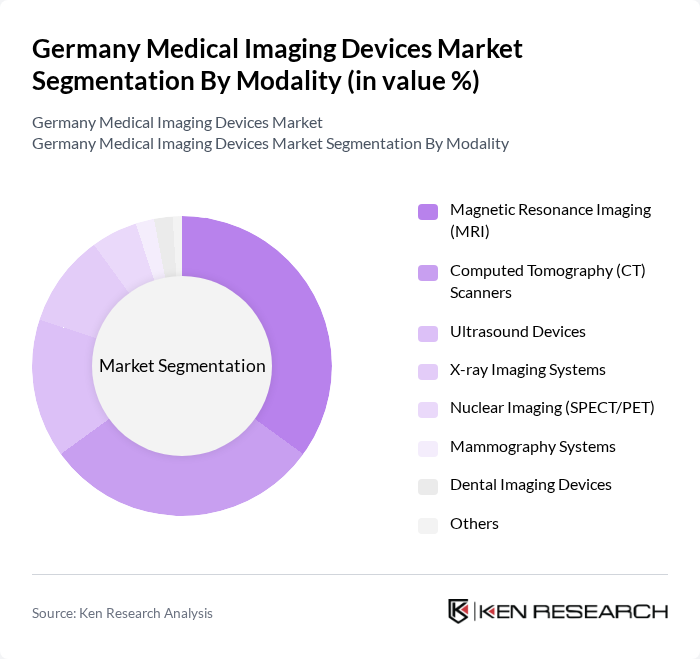

By Modality:The market is segmented into various modalities, including Magnetic Resonance Imaging (MRI), Computed Tomography (CT) Scanners, Ultrasound Devices, X-ray Imaging Devices, Nuclear Imaging (SPECT/PET), Mammography Devices, Dental Imaging Devices, Portable/Handheld Imaging Devices, and Others. MRI and CT scanners are the most widely adopted modalities, driven by their ability to deliver detailed, high-resolution images for accurate diagnosis. The increasing demand for non-invasive diagnostic procedures and the growing burden of chronic diseases are key factors accelerating the growth of these segments .

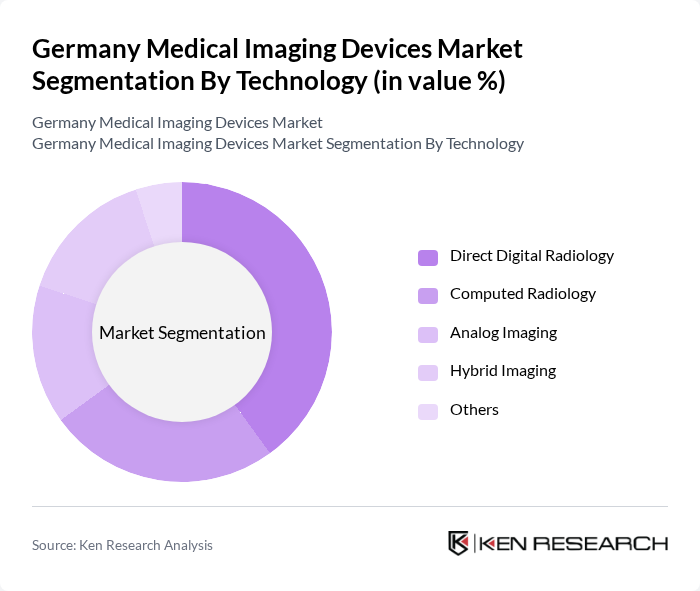

By Technology:The market is also segmented by technology, including Direct Digital Radiology, Computed Radiology, Analog Imaging, Hybrid Imaging, 3D Imaging, and Others. Direct Digital Radiology leads the segment due to its efficiency, high image quality, and lower radiation exposure. The rapid adoption of digital and 3D imaging solutions is a significant trend, as these technologies streamline clinical workflows and support advanced diagnostic capabilities .

The Germany Medical Imaging Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers AG, Philips Healthcare (Koninklijke Philips N.V.), GE HealthCare Technologies Inc., Canon Medical Systems Corporation, Fujifilm Healthcare Europe GmbH, Hitachi Medical Systems Europe Holding AG, Agfa HealthCare NV, Carestream Health, Inc., Mindray Medical International Limited, Hologic, Inc., Samsung Medison Co., Ltd., Varian Medical Systems, Inc. (a Siemens Healthineers company), Esaote S.p.A., Bracco Imaging S.p.A., Neusoft Medical Systems Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the medical imaging devices market in Germany appears promising, driven by technological advancements and a growing focus on preventive healthcare. As healthcare providers increasingly adopt AI and machine learning technologies, diagnostic accuracy is expected to improve significantly. Additionally, the integration of imaging with electronic health records will streamline workflows, enhancing patient care. The market is likely to see a surge in demand for portable imaging solutions, catering to the needs of remote diagnostics and telemedicine, further shaping the landscape of healthcare delivery.

| Segment | Sub-Segments |

|---|---|

| By Modality | Magnetic Resonance Imaging (MRI) Computed Tomography (CT) Scanners Ultrasound Devices X-ray Imaging Devices Nuclear Imaging (SPECT/PET) Mammography Devices Dental Imaging Devices Portable/Handheld Imaging Devices Others |

| By Technology | Direct Digital Radiology Computed Radiology Analog Imaging Hybrid Imaging D Imaging Others |

| By Application | Oncology Cardiology Neurology Musculoskeletal Gynecology Urology Dental Pelvic and Abdominal Others |

| By End-User | Hospitals Diagnostic Imaging Centers Academic & Research Institutes Ambulatory Surgical Centers Specialty Clinics Outpatient Clinics Others |

| By Patient Age | Pediatric Adult |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North Germany South Germany East Germany West Germany |

| By Price Range | Premium Mid-range Budget |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Imaging Departments | 120 | Radiologists, Imaging Technologists |

| Private Clinics | 80 | Clinic Managers, Procurement Officers |

| Medical Device Manufacturers | 65 | Product Managers, Sales Directors |

| Healthcare Policy Makers | 45 | Health Economists, Policy Analysts |

| Research Institutions | 55 | Clinical Researchers, Academic Professors |

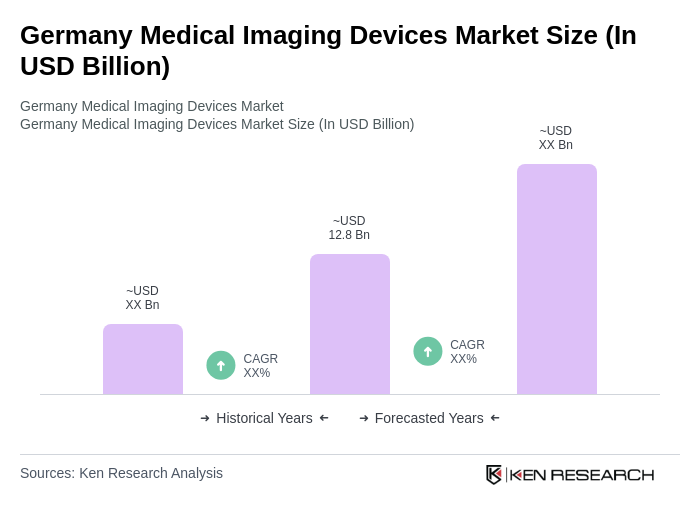

The Germany Medical Imaging Devices Market is valued at approximately USD 12.8 billion, driven by advancements in imaging technologies, the rising prevalence of chronic diseases, and an aging population, leading to increased demand for non-invasive imaging solutions.