Region:Global

Author(s):Dev

Product Code:KRAD0393

Pages:81

Published On:August 2025

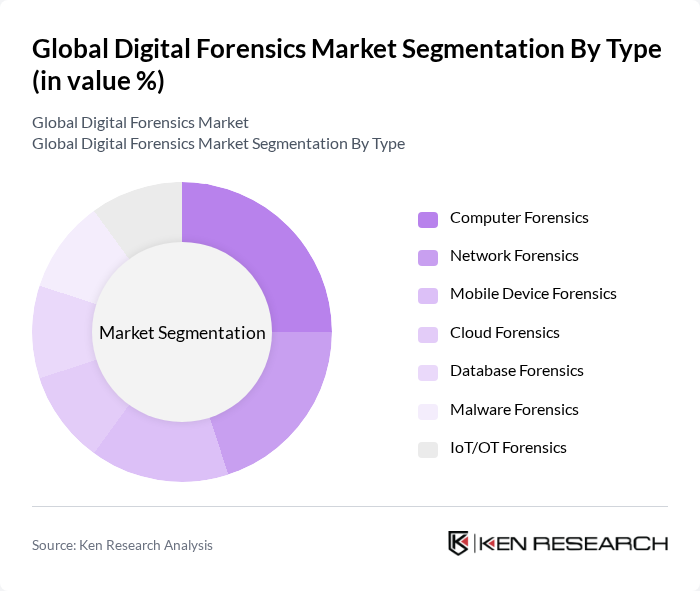

By Type:The digital forensics market can be segmented into various types, including Computer Forensics, Network Forensics, Mobile Device Forensics, Cloud Forensics, Database Forensics, Malware Forensics, and IoT/OT Forensics. Each of these sub-segments plays a crucial role in addressing specific forensic needs across different platforms and devices .

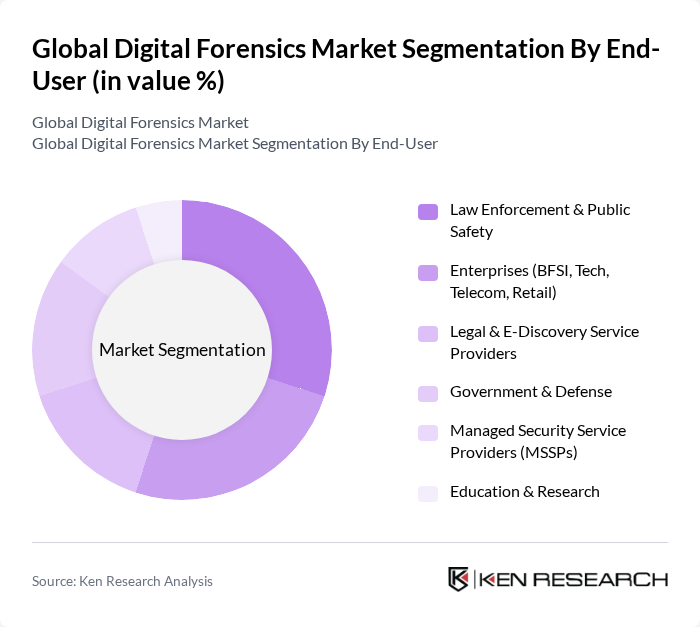

By End-User:The end-user segmentation of the digital forensics market includes Law Enforcement & Public Safety, Enterprises (BFSI, Tech, Telecom, Retail), Legal & E-Discovery Service Providers, Government & Defense, Managed Security Service Providers (MSSPs), and Education & Research. Each of these segments has unique requirements and applications for digital forensics. Law enforcement and government demand are sustained by criminal investigations and national security, while enterprises and service providers invest to support breach investigations, e-discovery, and regulatory compliance .

The Global Digital Forensics Market is characterized by a dynamic mix of regional and international players. Leading participants such as OpenText EnCase (formerly Guidance Software), Exterro FTK (formerly AccessData), Magnet Forensics, Cellebrite, X1 Discovery (X1 Social Discovery), ADF Solutions, Paraben Corporation, BlackBag Technologies (acquired by Cellebrite), Digital Detective Group, Oxygen Forensics, MSAB (Micro Systemation AB), Belkasoft, Kroll Digital Forensics, CrowdStrike (DFIR & forensics), Palo Alto Networks (Unit 42 DFIR) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the digital forensics market appears promising, driven by technological advancements and increasing awareness of cybersecurity. As organizations continue to prioritize data protection, the integration of artificial intelligence and machine learning into forensic tools is expected to enhance investigative capabilities. Additionally, the growing emphasis on cybersecurity training will equip professionals with the necessary skills to navigate complex digital environments. These trends indicate a robust demand for innovative digital forensics solutions, positioning the market for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Computer Forensics Network Forensics Mobile Device Forensics Cloud Forensics Database Forensics Malware Forensics IoT/OT Forensics |

| By End-User | Law Enforcement & Public Safety Enterprises (BFSI, Tech, Telecom, Retail) Legal & E-Discovery Service Providers Government & Defense Managed Security Service Providers (MSSPs) Education & Research |

| By Application | Cybercrime Investigation & Threat Attribution Incident Response & Breach Remediation E-Discovery & Litigation Support Fraud, AML, and Financial Crime Investigations Compliance Audits & Internal Investigations Blockchain/Cryptocurrency Forensics |

| By Component | Software (Acquisition, Analysis, Reporting) Hardware (Write Blockers, Forensic Imagers, Kits) Services (Consulting, DFIR, Expert Witness) Training & Certification Managed Forensics Services |

| By Deployment Mode | On-Premises Cloud/SaaS Hybrid |

| By Distribution Mode | Direct (Enterprise/Govt Procurement) Channel Partners/Resellers Online Marketplaces Systems Integrators |

| By Pricing Strategy | Perpetual License Subscription (User/Endpoint-Based) Usage-Based/Metered Managed Service Retainers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Law Enforcement Digital Forensics | 120 | Forensic Analysts, Cybercrime Investigators |

| Corporate Cybersecurity Investigations | 90 | IT Security Managers, Compliance Officers |

| Legal Sector Digital Evidence Handling | 70 | Legal Practitioners, Evidence Technicians |

| Data Recovery Services | 60 | Data Recovery Specialists, IT Support Managers |

| Digital Forensics Training Programs | 50 | Training Coordinators, Educational Program Directors |

The Global Digital Forensics Market is valued at approximately USD 12.0 billion, reflecting growth driven by increasing cybercrime incidents, expanding digital evidence volumes, and investments in incident response and compliance measures.