Region:Global

Author(s):Rebecca

Product Code:KRAD4334

Pages:96

Published On:December 2025

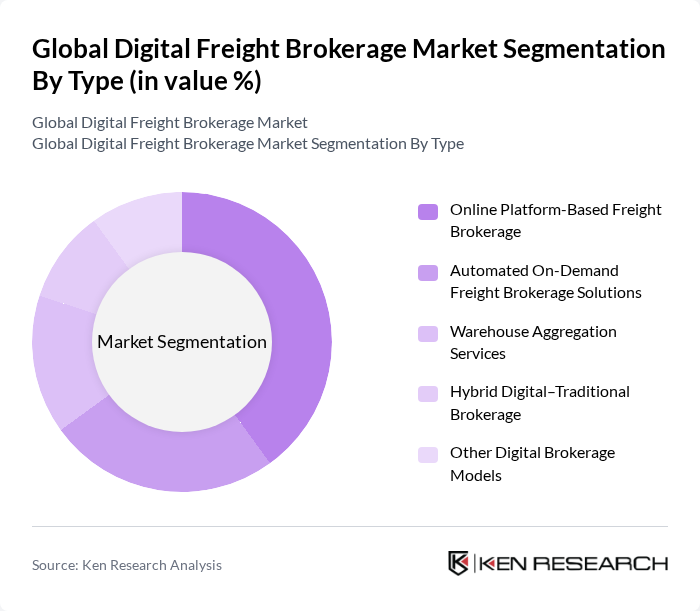

By Type:The market is segmented into various types, including Online Platform-Based Freight Brokerage, Automated On-Demand Freight Brokerage Solutions, Warehouse Aggregation Services, Hybrid Digital–Traditional Brokerage, and Other Digital Brokerage Models. Industry research consistently indicates that Online Platform-Based Freight Brokerage is the leading segment within digital brokerage and related categories, as most adopters first use web? and app?based marketplaces to match loads with carriers and access instant pricing. The convenience, scalability, and integration capabilities offered by these platforms have made them the preferred choice for many businesses seeking to digitize freight booking, with automated on?demand solutions gaining share as algorithmic pricing, dynamic capacity sourcing, and API connectivity with shippers’ systems mature.

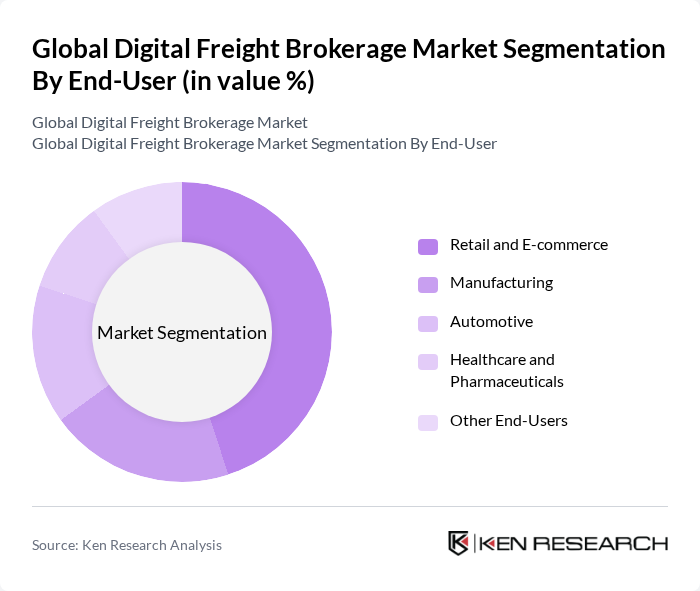

By End-User:The end-user segmentation includes Retail and E-commerce, Manufacturing, Automotive, Healthcare and Pharmaceuticals, and Other End-Users. Research across multiple firms confirms that Retail and E-commerce is one of the most dominant demand drivers for digital freight brokerage, as online sales expansion and tighter delivery windows increase the need for flexible capacity and real?time visibility. This segment’s demand for quick and reliable logistics services, including last?mile and cross?border parcel and freight flows, has significantly influenced overall market dynamics, followed by manufacturing and automotive shippers that use digital platforms to optimize lane performance, reduce empty miles, and gain better cost transparency.

The Global Digital Freight Brokerage Market is characterized by a dynamic mix of regional and international players. Leading participants such as C.H. Robinson (Navisphere), Uber Freight, Convoy, Loadsmart, Freightos, Flexport, Echo Global Logistics, DAT Freight & Analytics, project44, FourKites, Transporeon (Mercell Group), Zencargo, Sennder, Shipwell, J.B. Hunt 360 contribute to innovation, geographic expansion, and service delivery in this space. Many of these companies focus on expanding multimodal capabilities, deepening integrations with enterprise resource planning and transportation management systems, and offering value?added services such as predictive estimated time of arrival, emissions tracking, and automated tendering to differentiate in an increasingly competitive environment.

The future of the digital freight brokerage market appears promising, driven by ongoing technological advancements and the increasing demand for efficient logistics solutions. As companies continue to embrace digital transformation, the integration of AI and machine learning will enhance operational efficiencies and customer experiences. Additionally, the focus on sustainability will lead to the development of eco-friendly logistics solutions, positioning digital freight brokers as key players in the evolving supply chain landscape, ultimately shaping the future of global trade.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Platform-Based Freight Brokerage Automated On-Demand Freight Brokerage Solutions Warehouse Aggregation Services Hybrid Digital–Traditional Brokerage Other Digital Brokerage Models |

| By End-User | Retail and E-commerce Manufacturing Automotive Healthcare and Pharmaceuticals Other End-Users |

| By Service Type | Full-Truckload (FTL) Brokerage Less-Than-Truckload (LTL) Brokerage Intermodal and Cross-Border Brokerage Expedited and Temperature-Controlled Freight Other Digital Brokerage Services |

| By Mode of Transport | Road Freight Rail Freight Air Freight Ocean/Sea Freight Other Modes |

| By Technology | Cloud-Based Platforms Mobile-First Solutions AI, Analytics and IoT-Enabled Platforms API-Based Integration and Connectivity Other Enabling Technologies |

| By Customer Type | Business-to-Business (B2B) Business-to-Consumer (B2C) Small and Medium Enterprises (SMEs) Large Enterprises Digital-First Startups and Marketplaces |

| By Geographic Coverage | Domestic Freight Cross-Border Freight Regional and Intra-Regional Freight Global Multiregional Networks |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Freight Brokerage Adoption | 120 | Logistics Executives, IT Managers |

| Impact of AI on Freight Operations | 90 | Data Analysts, Operations Managers |

| Customer Satisfaction in Freight Services | 75 | Customer Service Managers, Sales Directors |

| Trends in Freight Pricing Models | 65 | Pricing Analysts, Financial Officers |

| Regulatory Compliance in Digital Freight | 55 | Compliance Officers, Legal Advisors |

The Global Digital Freight Brokerage Market is valued at approximately USD 6 billion, reflecting significant growth driven by digitization in freight forwarding and brokerage activities, as well as the increasing demand for efficient logistics solutions.