Region:North America

Author(s):Geetanshi

Product Code:KRAA1989

Pages:97

Published On:August 2025

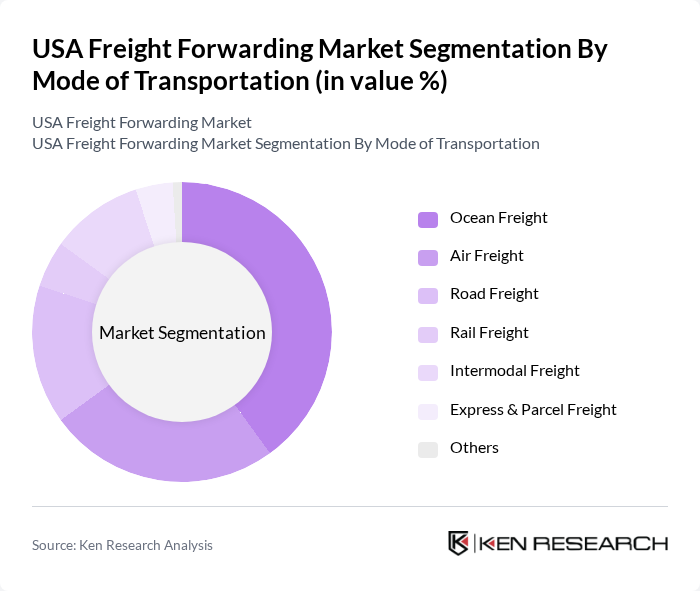

By Mode of Transportation:The freight forwarding market is segmented by mode of transportation, which includes ocean freight, air freight, road freight, rail freight, intermodal freight, express & parcel freight, and others. Each mode serves different logistical needs and customer preferences. Ocean freight is favored for bulk shipments due to cost-effectiveness and capacity, while air freight is preferred for time-sensitive and high-value deliveries. Road freight remains essential for domestic distribution, and intermodal solutions are increasingly adopted for efficiency and sustainability .

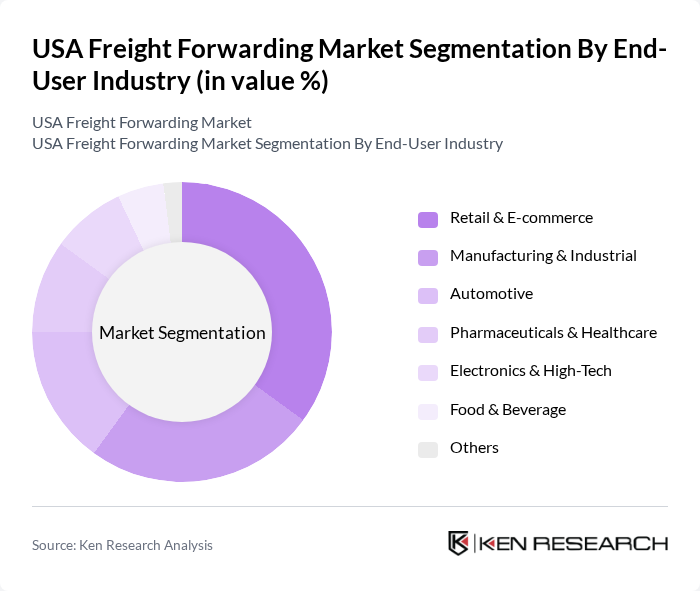

By End-User Industry:The freight forwarding market is also segmented by end-user industry, which includes retail & e-commerce, manufacturing & industrial, automotive, pharmaceuticals & healthcare, electronics & high-tech, food & beverage, and others. The retail & e-commerce sector is currently the dominant segment, driven by the surge in online shopping, omnichannel delivery models, and the need for rapid, flexible logistics solutions to meet evolving consumer demands .

The USA Freight Forwarding Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain & Global Forwarding, Kuehne + Nagel, DB Schenker, Expeditors International of Washington, Inc., C.H. Robinson Worldwide, Inc., XPO, Inc., UPS Supply Chain Solutions, FedEx Logistics, Maersk Logistics & Services, Geodis, DSV A/S, CEVA Logistics, Bolloré Logistics, Hellmann Worldwide Logistics, Nippon Express Holdings contribute to innovation, geographic expansion, and service delivery in this space.

The USA freight forwarding market is poised for significant transformation driven by technological advancements and evolving consumer expectations. As e-commerce continues to expand, logistics providers will increasingly leverage automation and AI to enhance operational efficiency. Additionally, sustainability initiatives will shape industry practices, with companies focusing on reducing carbon footprints. The integration of digital platforms will streamline processes, making freight forwarding more accessible and efficient, ultimately positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Mode of Transportation | Ocean Freight Air Freight Road Freight Rail Freight Intermodal Freight Express & Parcel Freight Others |

| By End-User Industry | Retail & E-commerce Manufacturing & Industrial Automotive Pharmaceuticals & Healthcare Electronics & High-Tech Food & Beverage Others |

| By Service Type | Transportation Warehousing & Distribution Customs Brokerage Freight Insurance Value-Added Logistics Services Supply Chain Management Others |

| By Shipment Size | Less than Container Load (LCL) Full Container Load (FCL) Bulk Shipments Parcel Shipments Others |

| By Geographic Coverage | Domestic International Cross-Border (Canada/Mexico) Others |

| By Delivery Speed | Standard Delivery Expedited Delivery Same-Day/Next-Day Delivery Others |

| By Customer Type | B2B (Business-to-Business) B2C (Business-to-Consumer) SMEs Large Enterprises & Government Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Air Freight Forwarding | 100 | Air Freight Managers, Operations Directors |

| Ocean Freight Services | 80 | Logistics Coordinators, Shipping Managers |

| Land Transportation Logistics | 60 | Fleet Managers, Supply Chain Analysts |

| Customs Brokerage Services | 50 | Customs Compliance Officers, Trade Specialists |

| Integrated Logistics Solutions | 70 | Business Development Managers, Account Executives |

The USA Freight Forwarding Market is valued at approximately USD 26 billion, reflecting significant growth driven by the demand for efficient logistics solutions, e-commerce expansion, and globalization, which necessitates the movement of goods across borders.