Region:Global

Author(s):Dev

Product Code:KRAA3015

Pages:85

Published On:August 2025

By Type:The duplex stainless steel market is segmented into four main types: Standard Duplex Stainless Steel, Super Duplex Stainless Steel, Lean Duplex Stainless Steel, and Hyper Duplex Stainless Steel. Among these, Super Duplex Stainless Steel is the most dominant due to its superior corrosion resistance and strength, making it ideal for high-pressure and aggressive environments, especially in the oil and gas sector. The increasing demand for high-performance alloys in offshore platforms, chemical processing, and desalination plants is driving the growth of this sub-segment .

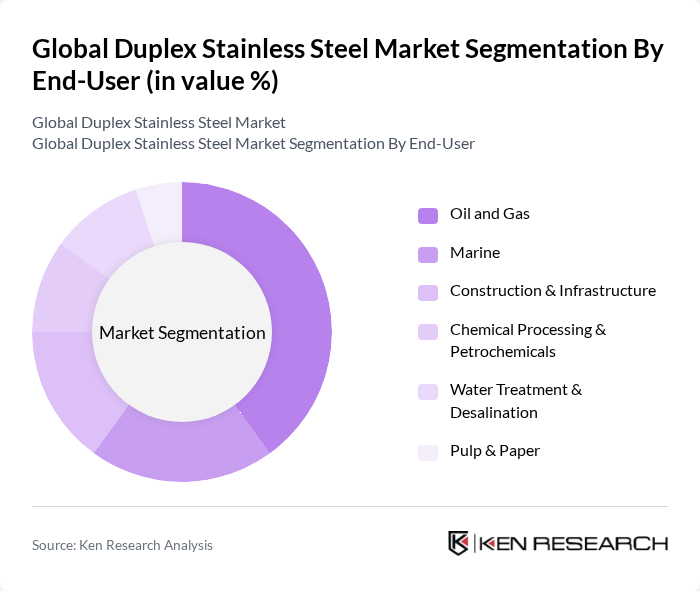

By End-User:The end-user segmentation includes Oil and Gas, Marine, Construction & Infrastructure, Chemical Processing & Petrochemicals, Water Treatment & Desalination, and Pulp & Paper. The Oil and Gas sector is the leading end-user, driven by the need for materials that can withstand harsh environments, high pressures, and corrosive substances. The expansion of offshore and onshore exploration, along with investments in energy infrastructure and desalination projects, continues to bolster demand for duplex stainless steel in this sector .

The Global Duplex Stainless Steel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Outokumpu Oyj, Aperam S.A., Thyssenkrupp AG, Sandvik AB, Allegheny Technologies Incorporated (ATI), Nippon Steel Stainless Steel Corporation, Jindal Stainless Limited, POSCO, ArcelorMittal, Valbruna Stainless Steel S.p.A., Daido Steel Co., Ltd., Carpenter Technology Corporation, Zapp Precision Metals GmbH, AK Steel (a Cleveland-Cliffs company), and Acerinox S.A. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the duplex stainless steel market appears promising, driven by increasing investments in infrastructure and a growing emphasis on sustainability. As industries seek to reduce their carbon footprint, the demand for eco-friendly materials is expected to rise. Additionally, advancements in manufacturing technologies will likely enhance production efficiency, allowing for cost-effective solutions. The market is poised for growth as companies adapt to these trends and capitalize on emerging opportunities in various sectors, including oil and gas, marine, and construction.

| Segment | Sub-Segments |

|---|---|

| By Type | Standard Duplex Stainless Steel Super Duplex Stainless Steel Lean Duplex Stainless Steel Hyper Duplex Stainless Steel |

| By End-User | Oil and Gas Marine Construction & Infrastructure Chemical Processing & Petrochemicals Water Treatment & Desalination Pulp & Paper |

| By Application | Piping Systems Heat Exchangers Pressure Vessels Storage Tanks Valves & Fittings Structural Components |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Industry Applications | 100 | Project Managers, Procurement Specialists |

| Chemical Processing Sector | 80 | Process Engineers, Operations Managers |

| Marine and Shipbuilding Applications | 60 | Naval Architects, Supply Chain Managers |

| Construction and Infrastructure Projects | 90 | Construction Managers, Materials Engineers |

| Automotive and Transportation Uses | 65 | Product Development Engineers, Quality Assurance Managers |

The Global Duplex Stainless Steel Market is valued at approximately USD 5.9 billion, driven by the increasing demand for corrosion-resistant materials across various industries, including oil and gas, marine, construction, and chemical processing.