Region:Middle East

Author(s):Rebecca

Product Code:KRAC9786

Pages:82

Published On:November 2025

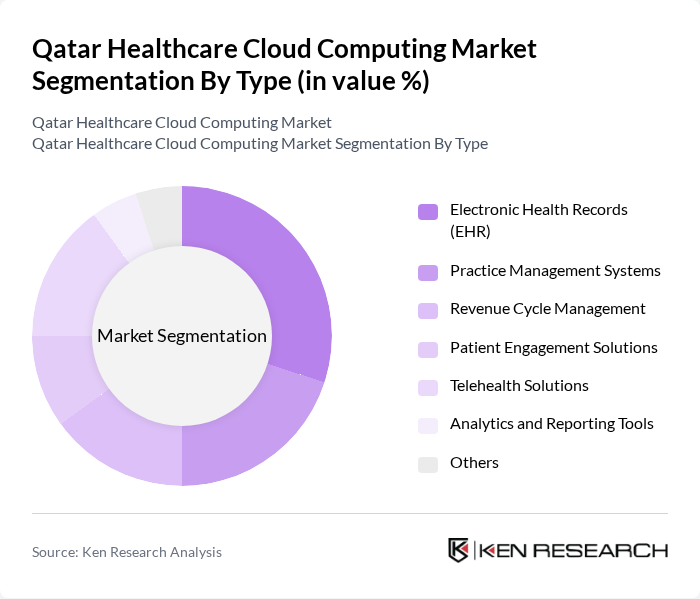

By Type:The market is segmented into various types, including Electronic Health Records (EHR), Practice Management Systems, Revenue Cycle Management, Patient Engagement Solutions, Telehealth Solutions, Analytics and Reporting Tools, and Others. Each of these sub-segments plays a crucial role in enhancing healthcare delivery and operational efficiency .

The Electronic Health Records (EHR) segment is currently dominating the market due to the increasing need for efficient patient data management and regulatory compliance. Healthcare providers are increasingly adopting EHR systems to streamline operations, improve patient care, and ensure data security. The growing emphasis on interoperability and data sharing among healthcare systems further drives the demand for EHR solutions. As a result, EHR systems are becoming essential for healthcare organizations aiming to enhance their service delivery and operational efficiency .

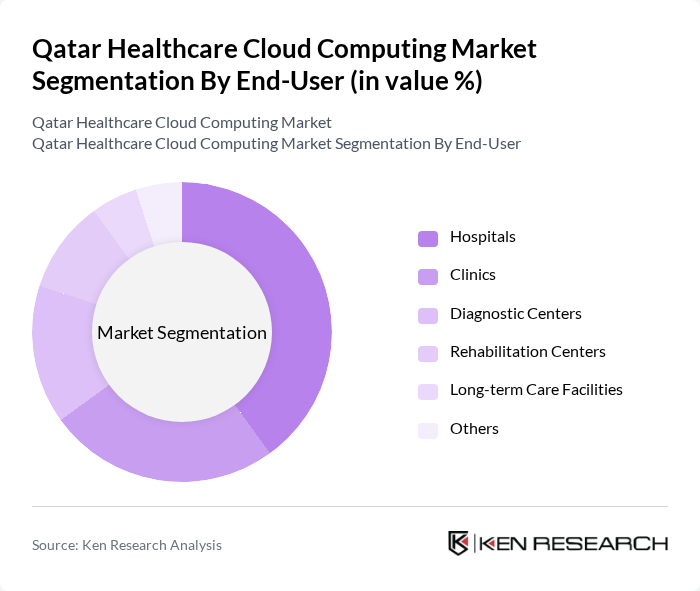

By End-User:The market is segmented by end-users, including Hospitals, Clinics, Diagnostic Centers, Rehabilitation Centers, Long-term Care Facilities, and Others. Each end-user category has unique requirements and preferences for cloud computing solutions .

Hospitals are the leading end-users of cloud computing solutions in the healthcare sector, primarily due to their large-scale operations and the need for comprehensive data management systems. The increasing patient volume and the complexity of healthcare services necessitate robust cloud solutions for efficient data storage, retrieval, and sharing. Additionally, hospitals are investing in advanced technologies to enhance patient care and operational efficiency, further solidifying their position as the dominant end-user in the market .

The Qatar Healthcare Cloud Computing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vodafone Qatar, Ooredoo, Microsoft Qatar, IBM Qatar, Oracle Qatar, SAP Qatar, Cisco Systems Qatar, Dell Technologies Qatar, Amazon Web Services (AWS) Qatar, Google Cloud Qatar, Infor Qatar, Cerner Corporation, Epic Systems Corporation, Allscripts Healthcare Solutions, Medtronic Qatar, Siemens Healthineers Qatar, Philips Healthcare Qatar, GE Healthcare Qatar, McKesson Corporation, Athenahealth, NextGen Healthcare, eClinicalWorks, DXC Technology, Meditech contribute to innovation, geographic expansion, and service delivery in this space.

The future of Qatar's healthcare cloud computing market appears promising, driven by technological advancements and increasing healthcare demands. The integration of artificial intelligence and machine learning into cloud solutions is expected to enhance patient care and operational efficiency. Additionally, the growing emphasis on cybersecurity will lead to more robust cloud infrastructures, ensuring data protection. As healthcare providers increasingly recognize the benefits of cloud technologies, the market is likely to witness accelerated adoption and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Electronic Health Records (EHR) Practice Management Systems Revenue Cycle Management Patient Engagement Solutions Telehealth Solutions Analytics and Reporting Tools Others |

| By End-User | Hospitals Clinics Diagnostic Centers Rehabilitation Centers Long-term Care Facilities Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Others |

| By Service Model | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) Others |

| By Application | Clinical Information Systems (CIS) Non-Clinical Information Systems (NCIS) Telehealth Solutions Billing and Revenue Cycle Management Data Storage and Backup Patient Management Others |

| By Security Model | Data Encryption Identity and Access Management Threat Intelligence Others |

| By Geographic Coverage | Ad Dawhah (Doha) Al Rayyan Al Wakrah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Hospitals Cloud Adoption | 100 | IT Directors, Chief Information Officers |

| Private Clinics IT Infrastructure | 70 | Practice Managers, IT Administrators |

| Telemedicine Service Providers | 50 | Product Managers, Technology Officers |

| Health Tech Startups | 40 | Founders, Business Development Managers |

| Healthcare IT Consultants | 60 | Consultants, Analysts |

The Qatar Healthcare Cloud Computing Market is valued at approximately USD 150 million, reflecting a significant growth trend driven by the adoption of digital health solutions and the increasing demand for telehealth services.